Step-By-Step Instructions to Retire Early

Want to retire early and live life on your terms? Early retirement isn’t just for lottery winners or tech geniuses; it’s totally possible if you have the right game plan. Whether you’re aiming for a beach chair at 50 or just want more freedom, these 9 smart strategies can help you fast-track your escape plan.

Contribute to Your Workplace Retirement Plan

Don’t leave free money on the table! If you have a 401(k), maximize it, especially if your company matches contributions. It's one of the easiest ways to supercharge your savings without impacting your cash flow. The earlier you start, the better your money can compound.

Don’t Touch Your Nest Egg (For Now)

Do you feel tempted to dip into that nest egg? Resist! Early withdrawals are often penalized heavily and will take away from your compound interest. Treat your retirement account like a "Do Not Touch" vault.

Figure Out What Really Matters to You

That daily latte or early freedom? Getting clear on what you value most helps cut the fluff and keep your goals on track. Early retirement is more than numbers; it is about what you are willing to give up in exchange for extra time.

Pay Off Debt and Don’t Take On More

Interest is the enemy of early retirement. Credit cards, car loans, and other high-interest debts drain your future funds. Pay them down aggressively and think twice before taking on new ones. The less debt you carry, the faster you can sprint toward your freedom date.

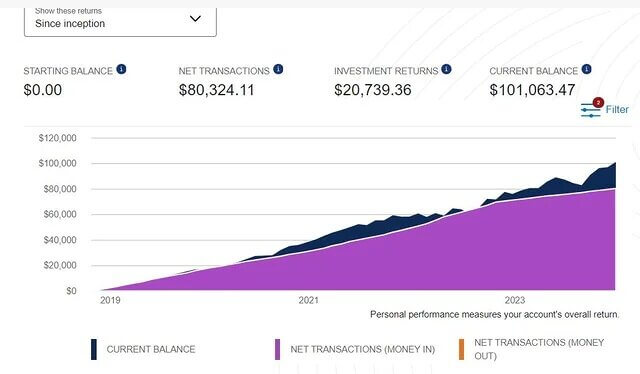

Start Investing

Time is your secret weapon. The sooner you invest, the more compound interest gets to show off. You don’t need to be a stock market wizard; just be consistent. Even small, regular contributions can snowball into serious savings over a couple of decades.

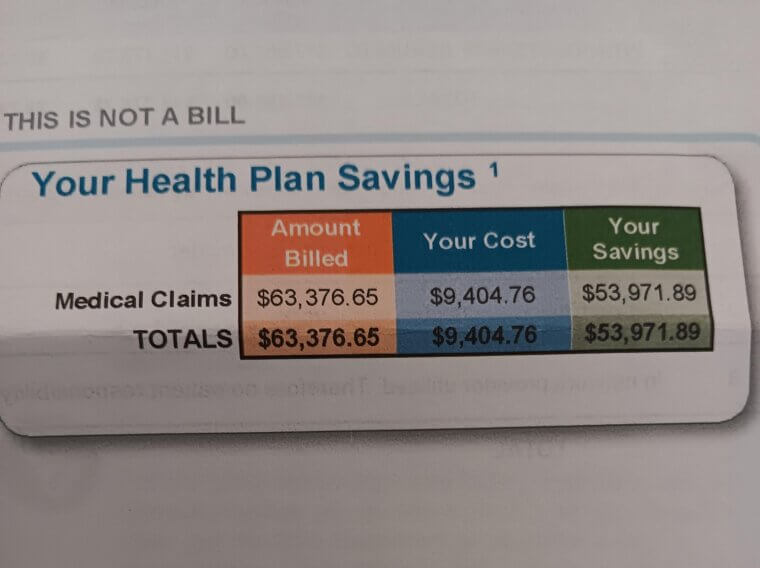

Use an HSA to Cover Future Health Costs

A Health Savings Account (HSA) is like a retirement plan for your future medical bills with triple tax perks. You contribute pre-tax, it grows tax-free, and you can use it tax-free for qualified expenses. Funds roll over annually and follow you if you change jobs. You can ask your advisor if it fits your plan.

Make the Most of Your Job’s Hidden Perks

Do you have an employee stock purchase plan or discounted health insurance? Use it! These are like hidden treasure; dig into them, make the most of what’s offered, and watch your plan roll.

Have Multiple Income Streams

Don’t put all your eggs in one basket. Start a side hustle, invest in real estate, or build dividend-paying portfolios. More income streams mean more cushion and the ability to walk away from your job without freaking out.

Track Your Progress and Adjust as Needed

Early retirement is a marathon, not a mystery. Keep track of your savings, expenses, and goals. Life changes, markets move, and dreams evolve. So should your plan. Regular check-ins will help you stay on course, pivot when needed, and stay motivated as you get closer to your vision.