Worried About Money?

Retirement should be about enjoying your time, not stressing over money. But the truth is, some of the biggest drains on your budget aren’t the obvious ones like healthcare - they’re the sneaky little costs you don’t even think about. Take a look at this list and see if any of these 20 things have become a problem for you.

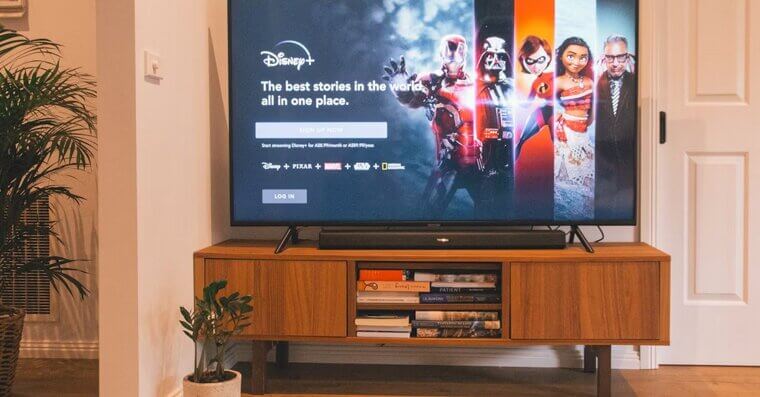

Subscription Creep

If you love your entertainment, charges add up fast. Streaming services, apps, magazines - you might not even use half of them, but they’re there. A couple of forgotten subscriptions could quietly eat $50–$100 every month. Review your bank statements constantly and cut out everything you don’t need.

Plugged-In Electronics

These are nicknamed “energy vampires” and it’s not hard to see why. TVs, coffee makers, chargers, and other things you don’t think about all drain electricity around the clock. Over the year, that adds up to a surprisingly big bill. Go round and turn everything off!

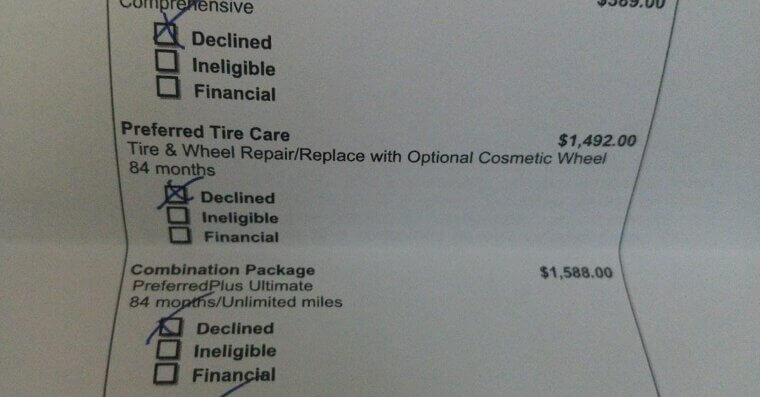

Extended Warranties

Stores love to upsell these, but most extended warranties go unused. By the time you’d need the coverage, the item is outdated or replaced anyway. The money is usually better in your own pocket. Skip them at the store (but be polite about it.)

Cable and Internet Bundles

That “intro rate” always looks good, but when the promotion ends, your bill quietly doubles. Providers bank on you not noticing. If you’re paying for channels you don’t watch or internet speed you don’t use, it’s time to renegotiate – or just ditch the service.

Overpaying for Insurance

Car, home, even pet insurance - it all sneaks up if you’re not shopping around every year or two. Rates creep higher, and suddenly you’re paying hundreds more than necessary. Call around and don’t be afraid to take your custom elsewhere.

Unused Gym Memberships

Plenty of people join a gym with good intentions, then stop going but keep paying. Even if it’s only $30 a month, that’s $360 a year you’re throwing away. The gym wants you to forget you’re paying them! Make sure you cancel as soon as you realize.

Bottled Water

Honestly, you should never buy bottled water. It tastes no different to tap water, all that plastic is terrible for the environment, and it’s expensive. Just get yourself a refillable bottle and carry that with you when you’re out and about in hot weather.

Lawn and Garden Services

If you can handle a little yard work yourself, you’ll save big. Even hiring help monthly instead of weekly makes a huge difference. Bear in mind that doing your own mowing, trimming etc is good exercise that can keep you active in old age.

Property Taxes

This one stings because you can’t eliminate it, but you can manage it. Taxes often creep up each year, and many retirees don’t realize they may qualify for senior exemptions or freezes. Consulting with a financial advisor could knock hundreds off your bill annually.

Home Maintenance Delays

Putting off small fixes – a leaky faucet for example - can turn into big, expensive repairs later on. And in retirement, those bills hit even harder. A little preventive maintenance keeps your house in good shape and it’s easier than ever to find good workmen these days.

Bank Fees

Overdrafts, ATM fees, and minimum balance penalties feel tiny, but they add up over a year. Banks count on retirees not noticing what’s going on. Switching to a credit union or no-fee account could save you hundreds in your golden years.

Pest Control Plans

Maybe you hate bugs and have hired a monthly service to make sure you never see one… but that could be costing you way more money than you should spare. Simply buying good sprays and setting traps in your house should be enough. And don’t forget, some bugs are actually beneficial to the environment.

Fancy Cleaning Supplies

Every shelf in the store has a different spray or wipe for the same job, and they’re expensive. A few basics - vinegar, baking soda, dish soap - handle almost everything for a low price. The cleaning aisle is designed to make you overbuy and lots of people fall for it.

Name-Brand Groceries

Buying the label over the store brand costs more without delivering much difference. Grocery bills are one of the sneakiest drains on a retirement budget. Swapping just a few items each trip can save serious money over the year while tasting exactly the same.

Outdated Appliances

That old fridge or dryer may still function okay, but it’s guzzling energy. Newer models on the other hand often cut electricity use in half, which shows up on the utility bill. Sometimes replacing something before it dies is the smarter financial decision.

Daily Coffee Runs

Even if it’s just $3 a day, that’s nearly $1,000 a year spent on coffee! Brewing at home is pennies per cup, and you can still make it taste café-quality with a French press. And if you used the coffee shop for socializing, there are other ways to do that, too.

Streaming Add-Ons

Beyond the main subscriptions, it’s the little add-ons - premium channels, movie rentals, special packages - that really sneak up. They feel harmless in the moment but pile onto the bill. Maybe make a list of the channels you can’t live without and cancel everything else.

Convenience Foods

Pre-chopped veggies, single-serve snacks, or frozen meals seem easier but cost far more than cooking. Retirement gives you the time to learn to cook from scratch, and it saves hundreds each month. Plus, think of all the new flavors you could unlock.

Overwatering the Lawn

Water bills can double in summer, because you’ve got your sprinklers running all day. But do you really need that? Rain will water your lawn just as well, and having sprinklers on is thought to contribute to climate change anyway.

Credit Card Interest

Even small balances left unpaid rack up interest quickly. That $1,000 you meant to pay off next month turns into $1,200 or more before you know it. Paying cards in full each month saves you from feeding the banks extra cash that could be used to help you and your family instead.