Apply for Senior Utility Discounts

For senior citizens, many utility companies offer discounted prices, but you frequently have to ask (and that can quickly become frustrating!). You might save money on gas, water, or electricity each month with a simple phone call or online form.

Use Public Transit or Senior Ride Programs

Seniors can ride for free or at a reduced cost in many places. You may go where you need to go without having to worry about parking or traffic by using buses, trains, and community shuttles. It's also a fantastic opportunity to meet new people and explore your neighborhood.

Downsize Your Home

There is less to clean, heat, and worry about in a smaller home. Whether you own a clean townhouse or a comfortable condo, downsizing can reduce monthly expenses and free up equity. Additionally, it's a fantastic reason to purge and save only the things that still work or actually provide delight.

Rent Out a Spare Room

That extra bedroom gathering dust? It could be earning you money. Hosting a tenant, student, or even a short-term guest can offset bills and add a little social buzz. Just be sure to screen carefully and set clear boundaries to keep things comfortable for everyone!

Switch to Energy-Efficient Appliances

Even though they may still function, old appliances can consume a lot of electricity. Making the switch to energy-efficient versions will lower your carbon footprint and power costs. Over time, both the environment and your wallet will appreciate you.

Use Smart Thermostats

Smart thermostats let you stay comfortable without wasting energy by learning your patterns and adjusting the temperature automatically. They frequently pay for themselves in less than a year and are simple to install.

Sell Your Second Car

If one vehicle sits idle most days, it might be time to let it go. You’ll save on insurance, registration, maintenance, and fuel. Plus, fewer cars mean fewer errands to juggle. Downsizing your driveway can be surprisingly liberating - and profitable, of course.

Bundle Auto and Home Insurance

Significant savings can result from combining your insurance products under a single provider. Additionally, it streamlines billing and paperwork. Though smarter bundling is frequently cheaper, it isn't always better. Just make sure the coverage still meets your needs.

Shop Around for Cheaper Car Insurance

Loyalty doesn’t always pay in the insurance world. It's worthwhile to compare quotations every year or two because rates have the potential to increase over time. By simply making a few phone calls or clicks, you could save hundreds of dollars a year without changing your driving habits.

Drive Less, Walk More

Cutting back on car use saves gas and wear and tear, and walking adds a healthy boost to your day. Whether it’s a stroll to the store or a lap around the block, every step counts. Bonus: you’ll notice things you’d miss behind the wheel, and appreciate the small things.

Use Senior Discount Days at Supermarkets

Older customers can take advantage of special discount days offered by many supermarket businesses. It's an easy method to reduce your weekly expenses by a few dollars. Make a note of the date, remember to bring your loyalty card, and experience the silent thrill of saving money simply by being on time.

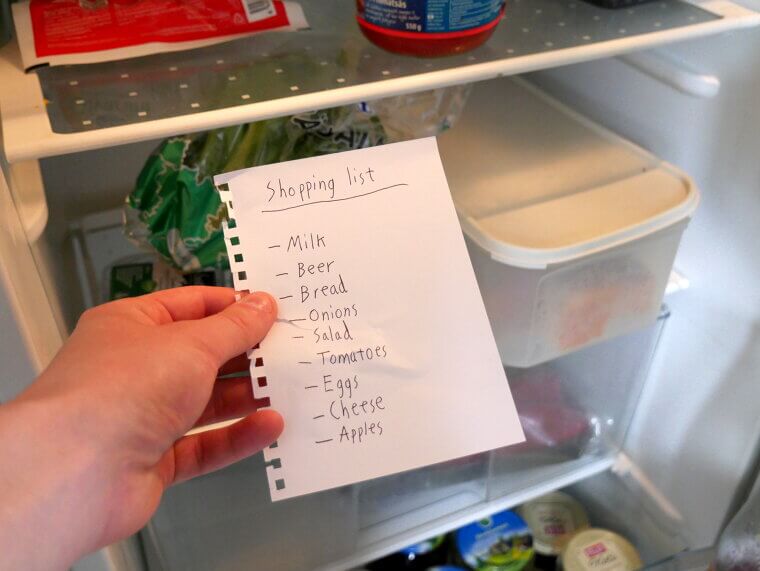

Plan Meals and Shop With a List

Wandering the aisles without a plan often leads to impulse buys and forgotten essentials. A simple list keeps you focused and helps avoid waste. Bonus points if you check your fridge first - there’s likely a lonely carrot or two waiting to be used.

Buy Generic Brands

Store-brand items often come from the same factories as name brands but cost far less. Using generics for everything from household products to cereal can rapidly add up. Try them out; aside from your bank balance, you might not even notice the difference.

Cook at Home More Often

Dining out is lovely, but restaurant meals can drain your budget faster than you can say “boo”. Home cooking lets you control ingredients, portions, and costs. Dust off those cookbooks or explore online recipes - it’s a chance to rediscover old favorites or try something new.

Join Warehouse Clubs

Buying in bulk isn't limited to large households. Warehouse clubs provide fantastic discounts on household products, prescription drugs, and other necessities. Just make sure to preserve everything correctly and refrain from purchasing too many perishables; a huge pack of toilet rolls is always useful, but twenty avocados might not be!

Review Medicare Plans Annually

Every year, as your needs vary, so do the plans and coverage. Examining your Medicare alternatives may reveal reduced rates or improved benefits. When a few hours of study could result in hundreds of savings over the course of the next year, it's worth the effort.

Use Mail-Order Prescriptions

Mail-order pharmacies often offer lower prices and longer supplies for routine medications. They’re convenient, reliable, and can help you avoid last-minute pharmacy runs. Just make sure to order ahead so you’re never caught short - especially before holidays or travel.

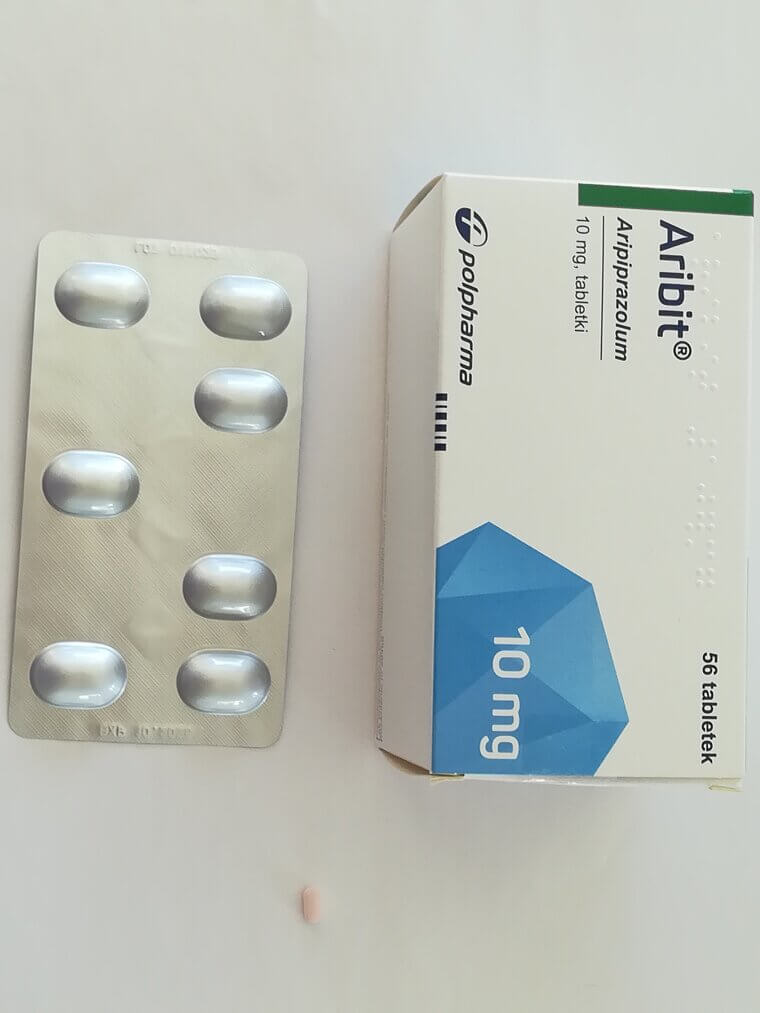

Ask for Generic Medications

Although they are substantially less expensive, generic medications have the same active components as name-brand ones. If a generic is available, ask your doctor or pharmacist about it. It's a straightforward switch that can result in significant savings over time.

Use Senior Fitness Programs

Staying active doesn’t have to cost a fortune. Certain programs offer free or discounted gym access, fitness classes, and wellness resources for older adults. It’s a great way to stay healthy, meet people, and keep moving - without stretching your budget.

Get Regular Checkups

Preventive treatment helps identify problems early, often before they become costly. Despite their seemingly routine nature, yearly examinations, screenings, and dental appointments are effective means of maintaining good health and preventing costly medical complications. Consider it upkeep for your most valuable possession: yourself!

Cancel Unused Subscriptions

Streaming services, magazines, and memberships can quietly pile up. If you’re not using them regularly, it’s time to cut the cord. Review your monthly statements and cancel anything that’s gathering digital dust - you’ll barely miss them, and your wallet will breathe a sigh of relief.

Use Your Library

Libraries are treasure troves of free entertainment. Beyond books, many offer movies, audiobooks, classes, and events. It’s a brilliant way to stay engaged without spending a penny. Plus, there’s something comforting about browsing shelves and discovering unexpected gems.

Take Advantage of Senior Discounts

From travel to dining, senior discounts are everywhere - you just have to ask. Keep your ID handy and don’t be shy. Whether it’s a reduced museum ticket or a cheaper hotel rate, these perks are designed to help you enjoy more for less.

Attend Free Community Events

Local councils, libraries, and community centers often host free concerts, lectures, and workshops. These events offer entertainment, education, and social connection without the price tag. Check bulletin boards or websites regularly - you might find your new favorite activity just around the corner.

Cut Cable and Switch to Streaming

Cable bills can be surprisingly steep. Switching to streaming services can offer plenty of entertainment at a fraction of the cost. Choose a few favorites and skip the rest. Your remote control and your budget will thank you.

Refinance or Pay off High-Interest Debt

Interest charges can quietly eat away at your income. Refinancing or paying off high-interest debt reduces monthly expenses and frees up cash for more enjoyable things. Talk to a financial advisor or your bank; there may be better options than you think.

Use Cash-Back or Rewards Credit Cards Wisely

If you’re already spending, you might as well earn something back. Cash-back and rewards cards offer perks like travel points or statement credits. Just be sure to pay off balances monthly - interest charges can quickly undo the benefits.

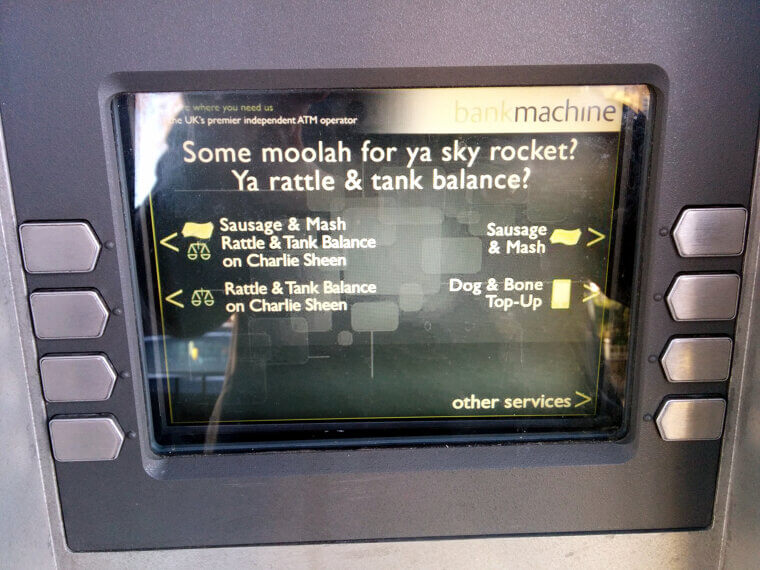

Avoid ATM Fees

ATM fees are small but sneaky. Use in-network machines or get cash back at the till when shopping. Over time, avoiding those $2 or $3 charges can add up, especially if you’re withdrawing regularly.

Review Life Insurance Needs

Life insurance is important, but coverage that made sense years ago might be excessive now. Review your policies and consider adjusting them to better fit your current situation. You could reduce premiums or redirect funds to more immediate needs.

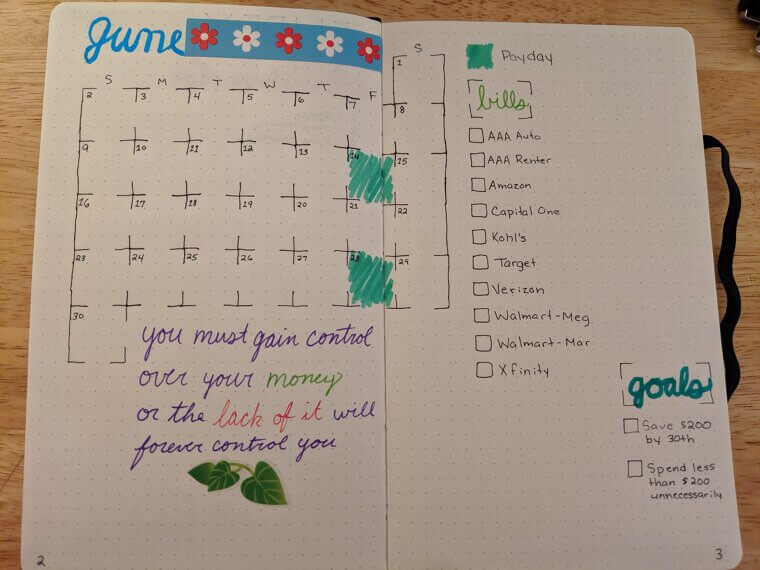

Set a Monthly Budget and Track Spending

Budgeting doesn’t mean deprivation; it’s about awareness. Tracking your spending helps identify leaks and set priorities. Use a notebook, spreadsheet, or app - whatever works for you. The goal is clarity, not perfection, and even small adjustments can lead to big savings.

DIY Home Maintenance When Possible

YouTube tutorials and a bit of elbow grease can save you hundreds on basic repairs. Whether it’s fixing a leaky tap or painting a room, doing it yourself builds confidence and keeps costs down. Just know your limits - some jobs are best left to the pros.

Cut Back on Professional Cleaning Services

Hiring cleaners is convenient, but doing it yourself or reducing the frequency can save a bundle. Break tasks into manageable chunks or enlist help from family. A tidy home feels just as satisfying when you’ve earned it with your own two hands.

Buy Secondhand or Refurbished Items

Thrift shops, online marketplaces, and refurbished retailers offer great deals on furniture, electronics, and more. Many items are gently used or professionally restored. It’s a smart way to stretch your budget and reduce waste - plus, you might score something truly unique.

Use Coupons and Cashback Apps

Digital tools like Rakuten and Ibotta make saving effortless. They apply discounts automatically or offer cashback on everyday purchases. It’s like finding money you didn’t know you had, just for shopping as usual.

Declutter and Sell Unused Items

Your home might be hiding a small fortune in unused gadgets, clothes, or collectibles. Selling them online or at a car boot sale clears space and puts cash in your pocket. It’s a win-win; less clutter, more breathing room, and a little extra income.