Biggest Regret Moments When Planning for Retirement

Retirement should be one of the best times of your life, but only if you plan for it properly! Many people make mistakes that they regret for years, and they’re always avoidable. To stay safe when planning for retirement, avoid making these 35 planning mistakes.

Not Paying Off Debts

This is one of the biggest mistakes you can make when planning for retirement. If you retire with debts, you’ll have less disposable income to spend on other things. Retirees have smaller budgets than working people, so you don’t want that money tied up in debt repayments.

Saving Too Late

Even when retirement is decades away, it’s a good idea to start saving. Various expenses pop up over the years, so you need a safety net to fall back on. If you start saving too late, you’ll have less money to live on when you retire.

Overestimating Social Security

Social security is a godsend, but don’t overestimate it! These payments only cover a portion of what you earn pre-retirement, and that won’t be enough to live on. That’s why you need to save money in other places and supplement your Social Security.

Forgetting About Healthcare

Healthcare is a massive expense, and that doesn’t go away with retirement. In fact, having the money to pay for healthcare is even more important once you retire because you’re more likely to need it as you age. Forgetting about it can lead to serious regret.

Ignoring Inflation

Unfortunately, inflation doesn’t go away with age, so all we can do is prepare for it. People who ignore the impact of inflation soon find that they have far fewer retirement funds than they thought, which greatly impacts their standard of living.

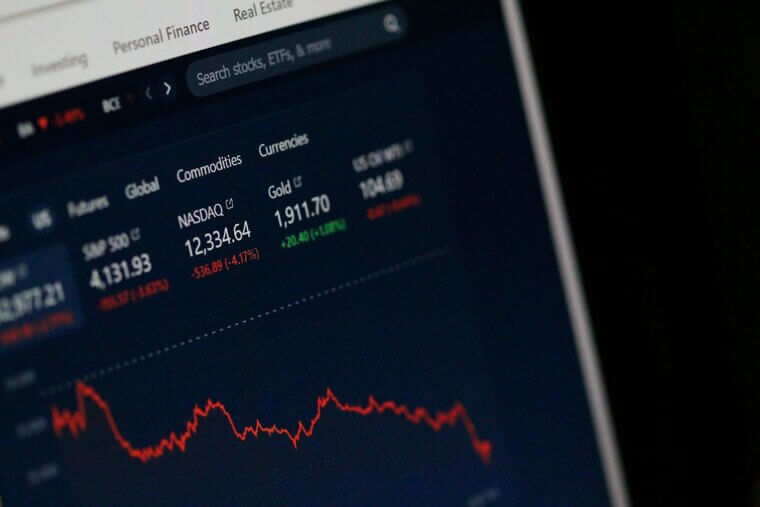

Making Bad Investments

Investing is a very good idea, but only if you know what you’re doing. Many people rush to invest money without monitoring the market or shopping around, which often leads to them losing money. This can be catastrophic for your retirement savings.

Forgetting Free Time

As important as planning all these important financial matters is, many people make the mistake of forgetting about free time. That causes them to become bored in retirement because there’s nothing to do. We recommend planning things like trips and activities to keep busy.

Borrowing From Retirement Funds

We know how tempting it can be to dip into your savings when you need some extra cash, but you’ll absolutely regret borrowing from retirement funds. That money should be built up over several decades, and taking from it, even only now and again, can devalue all that effort.

Paying Unnecessary Tax

Tax doesn’t go away when you retire, but each state has different retirement tax requirements. Pensions, social security, and IRAs are all taxed differently, with many states exempting retirees altogether. It’s crucial to factor this into your future retirement plan.

Putting Off Making a Will

It’s a sad fact of life, but we should never overestimate our life expectancies. Many people assume they won’t need to make a will until they’re elderly, but this is a huge mistake. Ideally, you should have one before you retire, just in case, especially if you own property.

Underestimating Necessities

Unfortunately, basic necessities, like food, clothing, and utility bills, are quickly becoming some of the most costly regular expenses. Retirees must not underestimate how much these will cost because it’s harder to expand a budget on a fixed income, especially when prices rise.

Overspending On Luxuries

While you shouldn’t deprive yourself of comforts, retirement funds should be spent carefully. Too many people see them as free money to spend on expensive, luxury goods, then later regret overspending. Once the funds are gone, you won’t get them back.

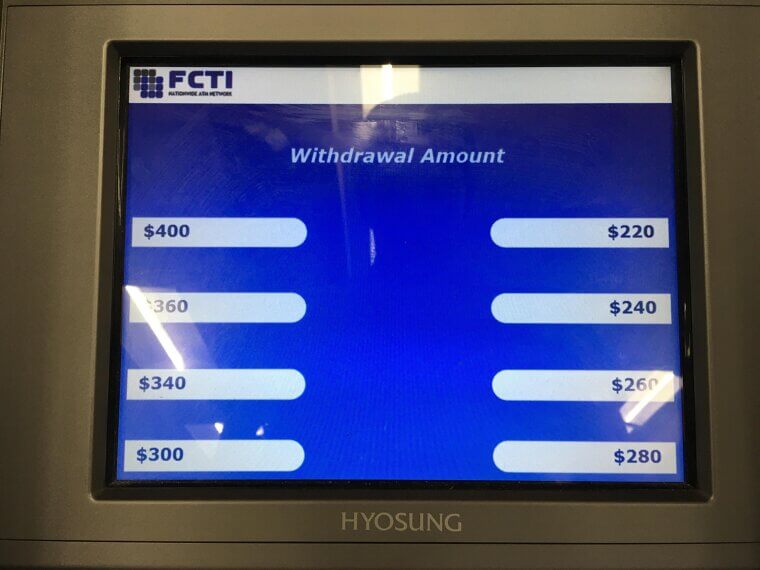

Raiding Pension Funds

American workers can take some funds from their pensions at age 55, but this isn’t always a good thing. This can prompt some people to raid their pension funds and not have enough left for later, which could cause them to put off retirement for longer.

Not Prioritizing Health

Everybody should prioritize their health, but it’s something that prospective retirees must plan for. Even budgeting for things like exercise classes and healthy grocery orders can make a huge difference to your health and quality of life once you retire.

Not Updating Calculations

It’s a good idea to calculate a rough retirement budget years in advance, but those calculations may not be relevant after a few years. Not updating your calculations can leave you with less money than you expected to have when you retire.

Forgetting About Pets

One of the best things about retirement is getting to spend more time with our furry friends. However, they must also be carefully budgeted for. Vet bills, medication, and pet food all become more expensive when you have less disposable income.

Planning to Work Forever

While it isn’t a bad thing to love your job, remember that we work to live, not live to work! Planning to work for the rest of their lives is something many people later regret when they realize that they could have spent that time with loved ones.

Letting Money Stagnate

You wouldn’t just leave cash sitting in a jar untouched for years, would you? Your retirement savings are exactly the same. If you invest them carefully over time, you can increase their value. While over-investing isn’t a wise idea, making guided investments can really pay off.

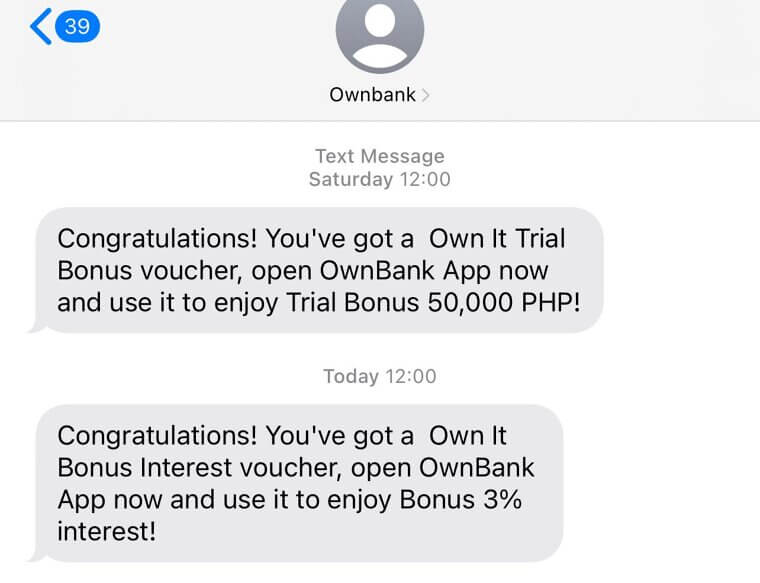

Falling For Scams

Scams are everywhere, and people with savings are very vulnerable to them. There are brazen fraudsters who prey on retirees in order to steal their pensions, and, though it isn’t their fault, these people deeply regret not taking precautionary measures in their planning.

Neglecting the Social Side

Another reason why many people get bored in retirement is a lack of social planning. You should allocate some ‘fun money’ into your retirement budget to keep you busy and ensure you still get to spend time with other people once you finish working.

Selling Everything

It may be tempting to change things up as you approach retirement, but hold off on selling belongings until later. If you rush to get rid of things as soon as possible, you may not get a fair price for them.

Never Spending Any Money

This may seem like it goes against the rest of our list, but being too stingy is also a mistake. Saving for retirement all your life means nothing if you don’t also use that money to enjoy yourself. Emotional well-being is also important.

No Longer Upskilling

The workplace isn’t the only place that calls for skills! Upskilling is also something that you should plan to do throughout retirement because it will help you to keep up with technology, pick up new hobbies or classes, and maintain cognitive health.

Giving Everything to the Kids

Of course, you’ll want to leave assets and money to your children in your will, but beware of giving them everything while you’re still alive. When you retire, you’ll need plentiful funds to live on, as well as assets to invest in for extra cash flow.

Planning Too Late

There’s nothing as stressful as realizing you’ve got nothing but blank notes for the future. We seriously advise making a plan for your estate, other assets, and potential future care before retiring; otherwise, you’ll be left scrambling and might make mistakes in the process.

Moving House

It’s common to downsize when you retire; however, moving house can often cause regrets. On top of sentimental attachments, it also causes unnecessary expenses, such as estate agent fees, and may threaten your retirement savings if the new property loses value.

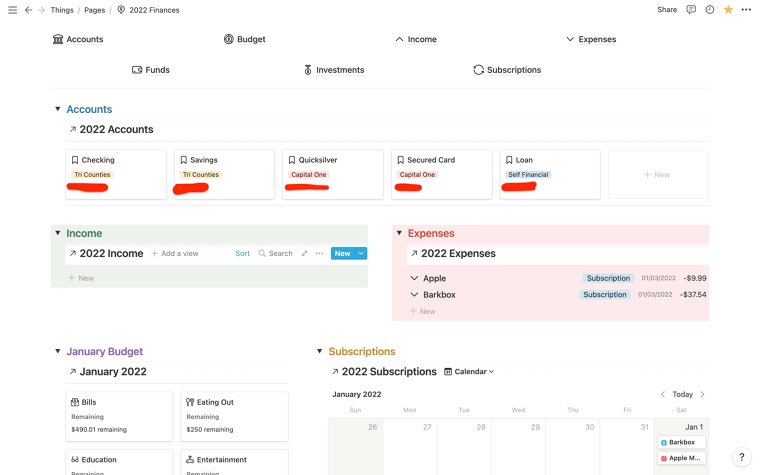

Not Making a Budget

Not making a retirement budget at all may seem like an obvious mistake, but many people assume they’ll be able to do it as they go along. They soon find out that that isn’t the case. Having a pre-prepared budget gives you far more control over your finances.

Remortgaging Property

People remortgage their property all the time, but it’s really not advisable as part of your retirement plan. At best, you’ll get a quick cash injection, but the long-term financial burden of that extended debt will put a huge strain on your retirement budget.

Taking a Lump Sum

Lump sum pensions have their benefits, but many people wind up regretting taking them. This is because you won’t have a regular monthly income, so you’ll have to be stricter with your finances to stop the money from running out straightaway.

Relying on the Government

While we strongly recommend taking advantage of every government benefit for retirees, you can’t rely solely on the government to keep you afloat. A good retirement plan should blend government benefits with personal savings and investments to make money go as far as possible.

Forgetting Self-Care

With so much complicated financial planning required before retirement, many people forget about self-care. That’s why it’s necessary to budget for personal comforts, including things that will help with mobility in later life. Planning ahead is vital to protecting your future.

Not Planning For the Worst

Speaking of planning for every eventuality, it’s a massive mistake to only plan for the good times in retirement. Unfortunately, emergencies happen all the time, and if you don’t have a plan in place for them, you could be left physically, financially, and emotionally bereft.

Taking Too Many Vacations

Unlimited free time is one of the best things about retirement. However, many people are quick to spend more than they can afford on vacations, only to find themselves struggling to afford necessities. Like every other expense, vacations should be outlined in your plan.

Not Prioritizing Happiness

While strict financial planning is very important, it means nothing if you don’t also prioritize your happiness. Retirement can be the best time to find a new life’s purpose, so why not plan for it? From education to volunteering, there are plenty of ways to find happiness.

Retiring Too Early

One of the most tempting mistakes that many people make when planning for retirement is trying to retire too early. Sadly, most of us simply can’t afford it, so we need to work until retirement age in order to gather the necessary funds to live comfortably.