Increased Life Expectancy

Whether it’s the latest new wonder drug or genuine innovations in healthcare, advancements in both medical services and living arrangements have increased the average life expectancy worldwide. In the US during the 70s, the average life expectancy was around 67 years; today, you can expect an additional ten years!

Delayed Retirement Age

Of course, the increase in life expectancy doesn’t necessarily mean you’ll get to enjoy another ten years of retirement. In fact, due to rising costs of living, many people are forced to work for much longer than they may have expected, leading to delayed retirement ages all around.

Defined Contribution Plans

Back in the 70s, you could reasonably rely on your employer to supply you with your pension. Nowadays, however, the burden of responsibility has been shifted from employer to employee thanks to schemes like 401k, which rely on individual contributions to fund a pension.

Gig Economy

Retirement used to mean getting to live out your twilight years in peace, or at the very least, doing what you want to do without having to worry too much. Nowadays, many retirees have taken up side hustles and gigs, either to stay financially independent without relying on their pension or to simply stay active.

Technological Integration

Back in the day, you’d have to guide your elders through every step of using their phones. These days though, many seniors have actively embraced technology, with digital tools like banking and shopping apps actively encouraging their independence. Of course, you may still have to guide your dear old grandad on how to use “the Net-Flicks”, but it’s a far cry from what it used to be.

Financial Planning

In the 70s, most retirees would have had a vague and general idea of when and how they planned to retire. Today, proper financial planning isn’t just smart, it’s necessary for survival. Many people will use retirement calculators or pursue financial advice before they even think about retiring.

Healthy Lives

With every medical advancement comes increased awareness surrounding certain health issues. While there’s a treatment for pretty much every condition you can think of nowadays, most people would rather avoid the costs such treatments will incur. This has emphasized the importance of personal wellness, and many people - both young and old - actively pursue healthier lifestyles.

Social Engagement

Retirement can be a good time, but most retirees will no doubt attest to just how lonely it can be as well. Fortunately, these days there are so many ways to connect with others that staying social has never been easier, and many retirees will pursue volunteer work or engage with their community just to maintain contact with others.

Unretirement

The world of today is a very different place from the one in the 70s. Changes in our culture have affected individuals across the age spectrum, and the very idea of retirement has evolved. Now, many retirees will continue to work in some capacity, giving rise to the terms “unretirement” or “rewirement”.

Global Mobility

Who says you need to stay at a retirement home in order to retire? Depending on where you’re from, it may actually be cheaper to go abroad and live out your retirement in some foreign locale, enjoying new experiences and adopting a completely different lifestyle. At the very least, retirement has never been more fun.

Financial Insecurity Concerns

Just having enough money to make it through the month isn’t enough nowadays, and most people will have less savings to spend on their retirement. This has caused many people to begin planning their retirement much, much earlier than they would have in the 70s.

Improved Education

In spite of the many financial setbacks young-to-middle-aged adults have had to face today, there’s no doubt that they are “better” educated than their forefathers, at least in terms of finances, which has led to somewhat higher lifetime earnings (even if the wages stay low and the cost of living grows ever higher).

Single-Person Households

The Nuclear Family was still common in the 70s. These days, however, there has been a significant increase in single-person households. This has greatly shifted certain social needs and dynamics, including among retirees.

Niche Retirement Communities

The very shape of retirement homes has changed significantly in the past few decades. Nowadays, there are hardly any “one size fits all” retirement homes, and many centers now cater to retirees with specific needs, interests, and backgrounds, allowing people to live more comfortably in an environment that suits them.

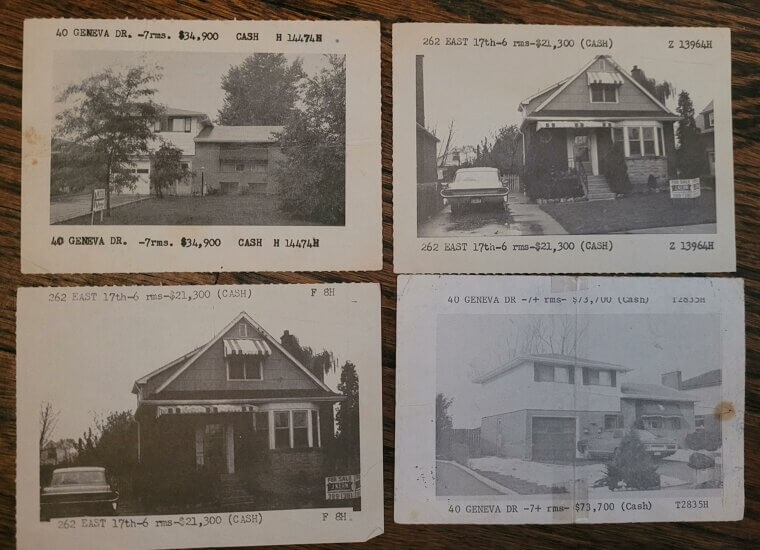

Increased Housing Costs

Whereas before you may have been able to live out your retirement in the very same home you raised your family in, it’s a much more difficult feat to pull off today. This has changed the way people approach retirement, often forcing many to relocate to dedicated retirement centers or go abroad just to afford personal housing.

Mental Health Concerns

Aging isn’t easy, and after a certain point in your life, your body starts to fail you. However, the effects of retirement aren’t only limited to the physical realm. Due to our society’s increased emphasis on mental health, retirees can now benefit from dedicated, round-the-clock support services specifically to deal with their mental health.

Flexible Work Arrangements

Some retirees don’t have the benefit of retiring completely. In fact, many will elect to remain with their current employer, albeit on a flexible work schedule which allows them to indulge in a bit of free time in exchange for increased financial security.

Encore Careers

In life, what you love to do won’t always be the thing you get to make money off of. Fortunately, many retirees these days have gone on to enjoy fulfilling second careers (in the arts, education, etc.) which are driven by their passion rather than financial worry.

Increased Workforce Participation

In order to get ahead in life, you need to make friends with the right people and play the long game. This is something many modern retirees understand, and remaining in contact with your former employers can sometimes yield great benefits, even if you elect to stay on in an advisory capacity.

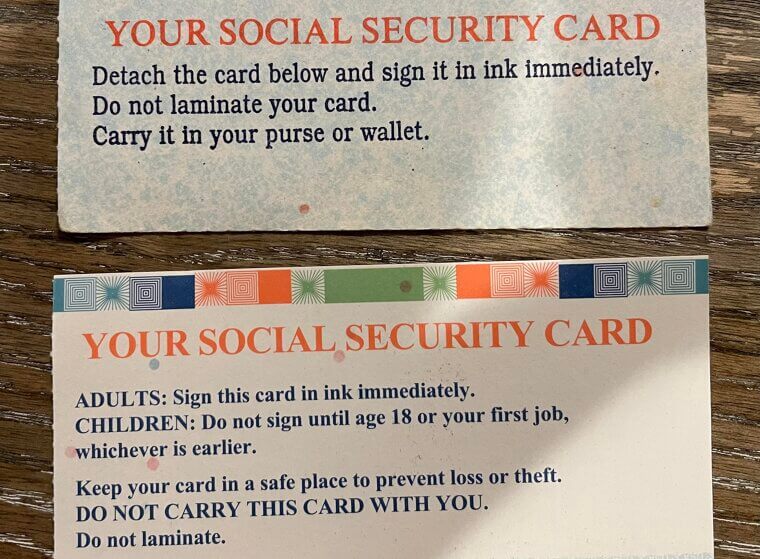

Social Security Dependency

While having a robust pool of savings to draw from is ideal, it’s not always feasible. These days, many retirees rely on social security schemes in order to survive, and knowledge of how to plan for and adapt to these schemes is more common nowadays.

Part-Time Employment

In between flexible work arrangements, encore careers, and side hustles, part-time employment rates for seniors have gone up as well. This could include seasonal work as well, allowing retirees to earn a few bucks for just a few weeks or months of work.

Financial Advisors

These days, anything and everything you can own is locked behind some inscrutable contract or another. These can be particularly difficult for seniors to navigate, which has necessitated an increased use of financial advisory services to help manage these complex schemes.

Savings Options

Although saving money has arguably never been more difficult due to increased costs of living all around, these days, people at least have more options when it comes to planning for their retirement, including 401k’s and IRA’s.

Lifelong Learning

One thing many prospective retirees worry about is the possibility of stagnating completely. Fortunately, thanks to an abundance of online workshops and learning programs, many retirees can now engage in lifelong learning, acquiring new skills and knowledge at an age that used to be considered “past their prime”.

Health and Wellness Industry

Things like pilates, yoga, and meditation were once thought of as fads that would fade away as quickly as they came. However, these activities - part of the health and wellness industry - have only continued to grow in popularity, and many people now acknowledge their positive effects and benefits, leading to many retirees partaking in them too.

Family Dynamics

Due to shifts in our culture’s attitudes towards family dynamics, the burden of responsibility has shifted drastically. These days, it’s not uncommon for retirees to become caretakers for their grandchildren, which allows them to remain close to their families while still keeping on their toes.

Mandatory Retirement

As you’ve no doubt gleaned from many of the items on this list already, retirement is a lot more flexible today than it was in the 70s. In fact, mandatory retirement used to be much more common back then, with workers being penalized for every month worked over the retirement age.

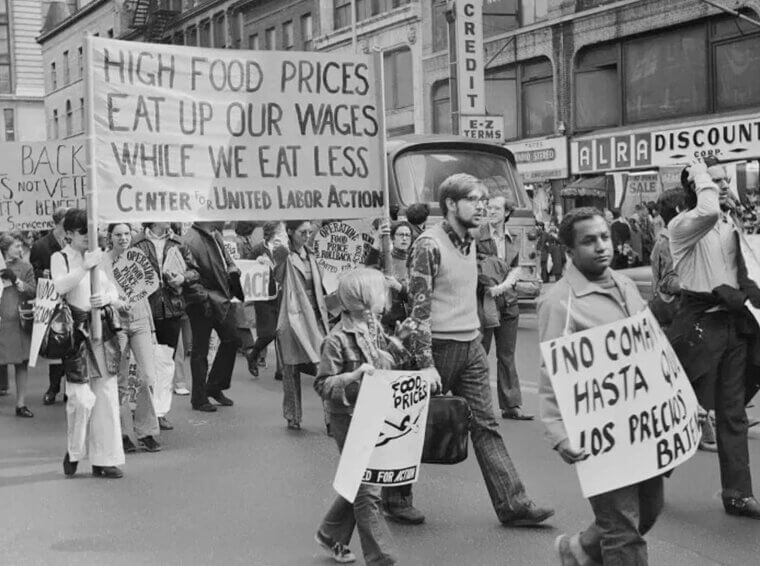

Inflation

Inflation is that inscrutable, esoteric term that you’ll often hear being tossed around in financial discussions. But the 70s is where inflation really began to take hold, leaving many Americans in the dust and decreasing the availability of actual retirement benefits.

Increase in Assisted Living

Assisted living has been around, in one form or another, for centuries, but it was during the 70s that the concept was officially recognized and made an institution. These days, assisted care is more common - and popular - than it has ever been before.

More Comfort

Despite the many difficulties, both financial and physical, that retirees face, we can say for certain that comfort has improved from what it was in the 70s. It comes down to even the smallest things, like indoor AC and heating appliances that keep retirees warm during the cold months of the year.

Loneliness Epidemic

We’ve already discussed the prevalence of single-person households. Called the “Loneliness Epidemic”, this phenomenon has forced more and more retirees to live in complete isolation.

Telephones

It’s true that we have grown lonelier the more time has gone on, but it’s also true that there are more ways than ever to stay in contact with loved ones. Indeed, it comes down to something as simple and innocuous as the presence of telephones, which are much more prevalent today than they were in the 70s.