Expenses That Boomers Forgot to Include

Retirement is meant to be a time to unwind, not be blindsided by unexpected bills. But, for many boomers, a few hidden costs slipped through the cracks of their planning. Here are five common retirement costs many boomers didn't plan for, but they should have.

Inflation

Inflation might seem like background noise until it begins to crunch your retirement budget. What felt like a comfortable nest egg during year one could end up feeling tight by year ten. The rising costs of food, gasoline, and healthcare can shrink fixed incomes rapidly. Regular reviews of your plan are essential.

Long Term Care Planning

Many retirees underestimate the cost of long-term care. Assisted living, in-home help, and nursing facilities can all be expensive and drain your savings quickly. Medicare does not cover every aspect of care, and getting private insurance can be costly.

Social Security and Pension Tax Burden

This might come as a surprise, but your benefits might be taxed. A lot of retirees are not aware that income from Social Security and pensions is subject to federal taxes, and in some cases, state taxes. A little tax planning can do wonders!

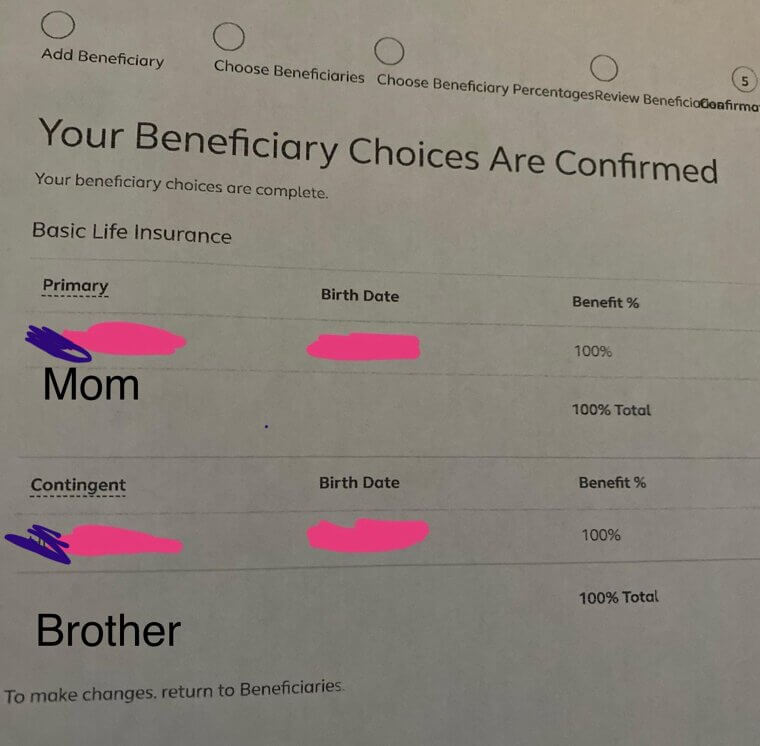

Overlooked Estate Plan Revisions

An estate plan that’s outdated can leave your loved ones with a financial nightmare. Wills, trusts, and beneficiary designations should be reviewed regularly, especially after life changes. Legal fees to update documents can be considerable, but are necessary to keep your assets safe and avoid probate headaches.

Healthcare Beyond Insurance

Retirees often assume Medicare covers all healthcare expenses, but it doesn’t. Copays, dental, vision, hearing aids, and prescriptions can add up fast. Many also forget to budget for supplemental insurance plans. Staying healthy isn’t cheap; even the most cautious retiree can be blindsided by the unexpected costs.