First-Year Retirement Regrets That Caught People by Surprise

Retirement sounds like an absolute paradise at first. You don’t have to wake up to an alarm every day! You can spend time with your grandkids! But for some people it turns into a nightmare as time goes on. Here’s 35 regrets people had during their first year of retirement – everything from money worries to healthcare problems.

Not Having a Daily Routine

At first, sleeping in and winging the day felt like a reward for a lifetime of service. But after a few months, many retirees say the lack of structure left them feeling aimless. Without a reason to get up and go, some ended up bored, restless, and even a bit unhappy.

Claiming Social Security Too Early

It’s tempting to start cashing in as soon as you can, but plenty of retirees wish they’d waited. Claiming benefits early reduced their monthly income for life. Several said they underestimated how long they'd live, because they simply (and understandably) didn’t want to think about it.

Underestimating Healthcare Costs

Medicare helps, but it doesn’t cover everything, and to put it bluntly you’re going to need more healthcare as you get older. Some people had to dip into savings just to stay afloat. Unfortunately, America is an expensive country to have healthcare issues.

Spending Too Much

Some retirees got all excited when they retired and spent a lot of money. Maybe they went on an around-the-world trip, or bought a shiny new sports car. They definitely regretted it later when the aforementioned healthcare costs rolled around.

Letting Friendships Slip Away

Without built-in interactions at work, many people didn’t realize how much their social life revolved around their job. Some retirees said they lost touch with colleagues they were close to and didn’t work hard enough to build new friendships.

Moving Too Quickly

Some retirees jumped into a big move - downsizing, relocating, or heading to a “dream” retirement town - only to realize they weren’t ready. Turns out, it’s hard to know what you’ll want before you settle into the lifestyle.

Not Talking About Money With Their Spouse

A few retirees assumed they were on the same page as their partner financially - until one wanted to travel and the other wanted to save. The first year of retirement brought some tension for couples, which was the last thing they wanted.

Losing Their Sense of Purpose

Without a job title, some retirees struggled with their identity. Who were they now? What were they “contributing”? Several people wished they’d planned for something meaningful, like volunteering at a place they loved, before stepping down from work.

Ignoring Health and Fitness

A lot of retirees thought they’d use their free time to finally get in shape, and… didn’t. In fact, many found themselves moving less, eating more, and gaining weight. The structure of a job had kept them active, and without it, they had no healthy habits anymore.

Not Having a Travel Budget

Traveling is a common retirement dream, but several retirees admitted they didn’t create a specific budget for it. So when they had a chance to go overseas, they found themselves unable to, because they didn’t plan ahead.

Waiting Too Long to Try New Things

Some retirees planned to ease into retirement slowly, only to realize their energy and health weren’t guaranteed. A few missed out on trips, hobbies, or volunteering opportunities because they waited too long and poor health ruined their plans.

Taking on Too Many Family Obligations

Retirees often stepped in to help with grandkids or aging parents, thinking they had endless time. But they found themselves overwhelmed, with no time left for themselves. It wasn’t that they regretted helping, but they wished they’d set a few more boundaries.

Not Downsizing

Some stayed in big houses out of habit or sentiment. But by the end of year one, the cleaning, yard work, and maintenance got on top of them. They realized they could’ve saved money and stress by downsizing sooner.

Failing to Revisit the Budget

Plenty of retirees kept spending like they were still working. Others underestimated how much things like groceries and (here it is again) healthcare would cost. That first year brought some reality checks for many retirees.

Putting Off Estate Planning

A few retirees admitted they didn’t want to think about wills, power of attorney, or healthcare directives - so they didn’t. But that left their families unprepared and anxious. Some even ran into legal issues when a health scare hit.

Not Trying Part-Time Work

Many retirees missed the structure and social interaction that came with having a job. Several said if they could do it again, they’d ease out of their career with part-time gigs or seasonal work. It could’ve made the transition smoother.

Neglecting Their Mental Health

Without the daily rhythm of work and the friendship of coworkers, some retirees found themselves feeling depressed. A few said they were surprised by how emotionally hard retirement hit them. They now wish they’d talked to a therapist or joined a support group early on.

Overcommitting to Volunteer Work

Helping out felt good, until it started to feel like a job again. Some retirees jumped into volunteer roles too quickly and found themselves drained or overwhelmed by all the work. This is another area where it helps to set strong boundaries straight away.

Not Taking Enough Time to Rest

A few retirees tried to stay super busy, fearing they’d be bored if they didn’t fill every hour. But constantly running from one activity to the next left them exhausted. They now say it’s okay to slow down and enjoy the quiet.

Thinking Hobbies Would Fill the Time

Retirees said they had hobbies - gardening, golfing, crafting - but they didn’t realize how much free time they'd actually have. After a few months, the novelty wore off, and they still had hours to fill. Plenty wished they’d signed up for free classes, for example, in the first year.

Cutting Ties With Their Industry Too Soon

Some retirees walked away completely - gave up their credentials, stopped reading industry news, and said goodbye to the networks they’d built up over the years. But later, they wished they’d kept a foot in the door so they could come back as a consultant.

Not Creating a 'Fun Fund'

Many retirees focused so much on essentials - bills, healthcare, food - that they forgot to carve out money for fun. When opportunities came up for doing something that would’ve been a great experience, they hesitated or passed.

Assuming Their Marriage Would Stay the Same

Retirement changed the dynamic for a lot of couples. They were suddenly together all the time, with different ideas about what to do. Some retirees admitted they argued more, embarked on different routines, or got on each other’s nerves.

Overplanning Every Day

Some retirees make detailed schedules and long to-do lists every day, only to realize that the joy of retirement is having flexibility. A few said they missed the freedom they’d hoped for because they conducted themselves like they were still working.

Not Learning a New Skill

Several retirees expected time alone to bring joy, but got bored instead. They wished they’d challenged themselves early with something new and exciting, like learning an instrument, a new language, or even how to use that new tech their grandchildren were always going on about.

Letting the House Take Over

Without work, many retirees turned their full attention to the house… and that wasn’t always good. They became obsessed with renovating, spending tons of money, or they began to obsessively keep the place clean.

Assuming the Kids Would Visit More

Some thought retirement would bring more family time - but their adult kids were still busy working, parenting, and managing life. A few retirees said they felt disappointed or even a little hurt. It’s a cliché, but it still happens.

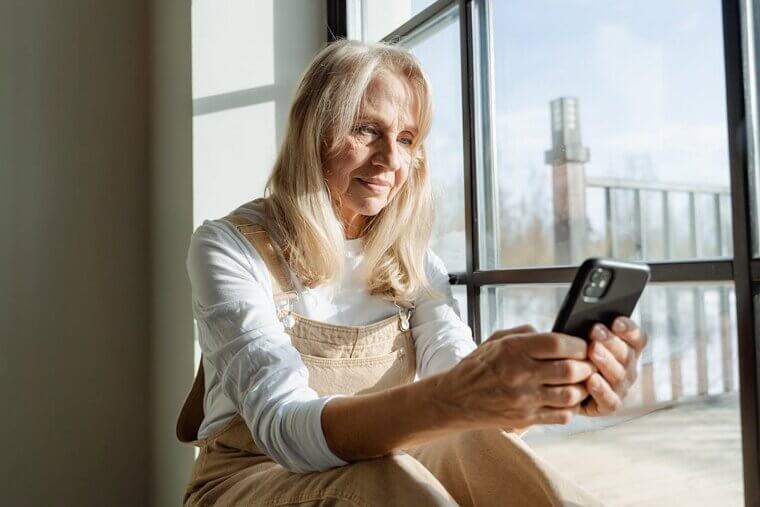

Avoiding Technology

A handful of retirees resisted all tech – smartphones, social media, Zoom, even email. But they soon found themselves missing out on conversations with their family. The fact of the matter is, a lot of life is lived online these days.

Not Talking to a Financial Advisor

Several retirees avoided meeting with a professional, thinking their finances were simple enough. But mistakes crept in and money was lost. And as a lot of people will tell you, there’s no regret like financial regret.

Forgetting to Celebrate the Milestone

Oddly enough, some retirees said they barely celebrated their retirement. They wrapped up work, walked out the door, and just... kept going. Looking back, they wish they’d marked the moment with a party or something similar.

Thinking Retirement Would Solve All Their Problems

Several people admitted they thought retiring would “fix” things - stress, relationships, health, happiness. But retirement isn’t magic. Problems don’t just vanish with your job. For some, that first year was a wake-up call: you still have to work on yourself, even when you’re not working anymore.

Not Asking Other Retirees for Advice

They didn’t know what they didn’t know. Many retirees said they wished they’d talked to others who had already retired, especially about money and important admin tasks like will-writing. It could’ve saved them a few headaches.

Assuming They’d Never Want to Work Again

A surprising number of retirees said they missed working - not necessarily full time, but in some capacity. A few even went back to work just to feel productive. They now recommend keeping an open mind about what you can and can’t do in retirement.

Comparing Their Retirement to Others

FOMO is considered a young person’s problem, but retired adults get it too. Many people have reported seeing Facebook photos of other people’s perfect retirements online and feeling jealous. Honestly, it might be best to ditch Facebook altogether if you’re comparing yourself to others.

Thinking They Had to Have It All Figured Out

The biggest regret, shared by many? Expecting to have all the answers on day one. Retirement is a major life change, and it takes time to adjust. That first year is full of trial and error, and that’s okay. It’s not about doing everything right… it’s about learning what works for you.