Desire to Contribute

Ultimately, many retirees return to work for one simple reason: they still have more to give. Their expertise, passion, and work ethic don’t go away when they retire, and they want to keep contributing to the professional world and prove that age doesn’t diminish capabilities.

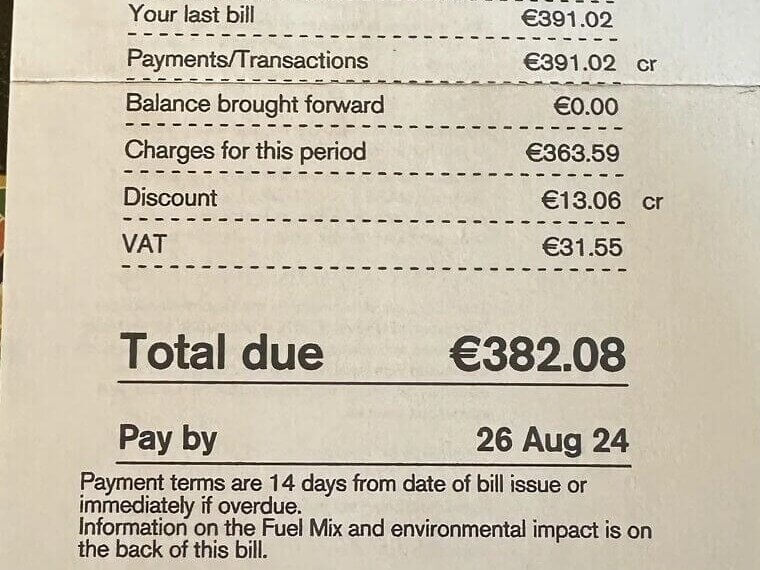

Increased Living Costs

Retirement is supposed to be a relaxing time where you enjoy the fruits of your life’s labor, but many retirees are going back to work due to the increased costs of living. With rising housing, food, and utility costs, most of them can’t live comfortably without additional income.

Boredom

After years of structured schedules and busy days, retirement can feel unexpectedly dull. Even retirees with hobbies find themselves missing daily challenges, so they return to work to give them something to do, help them set new goals, and help them feel productive again.

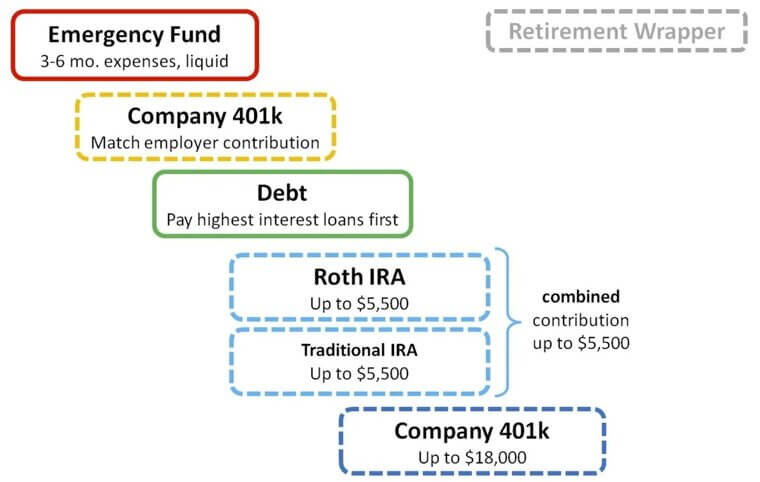

To Supplement Income

Social security and pension benefits should be enough to cover retirement, but that’s sadly not the case anymore. Many retirees need to work at least part-time to supplement their income and avoid overspending their savings. This also allows them to maintain their lifestyles.

Loneliness

Work can be stressful at times, but it’s also a way to stay in touch with other people. As soon as you retire, you don’t get to spend your days in the company of others anymore, and lots of people become lonely. Going back to work makes them happier.

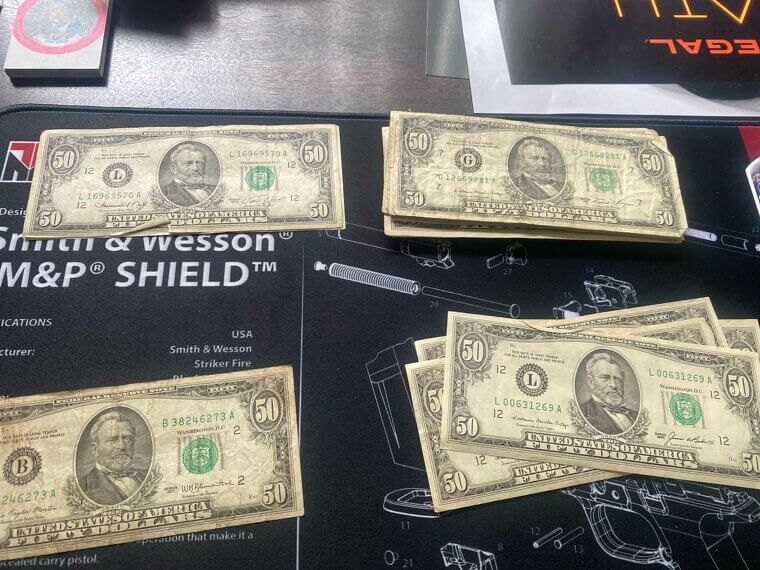

Lack of Retirement Funds

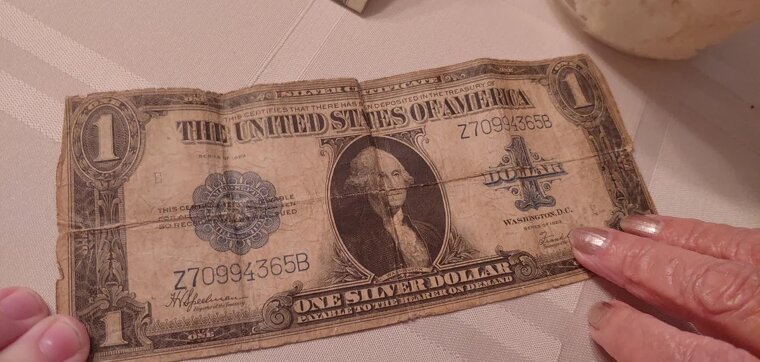

Some people overestimate their retirement funds and end up retiring too soon, which is a huge mistake. Without the money to live, there’s no safety net, especially if unexpected expenses crop up. As a result, they have no choice but to start working again.

No Sense of Purpose

We should work to live, not live to work, but that doesn’t stop our jobs from becoming important focal points in our lives. Retirees often feel useless because they’re no longer working towards goals, so they return to work to rediscover their identities.

Employer Demand

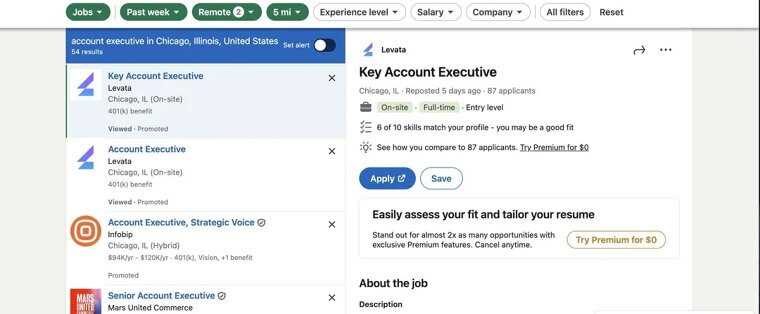

Labor shortages in many industries often create opportunities for retirees to re-enter the workforce. Their experience and strong work ethics make them attractive hires, so those who do want to go back to work don’t mind giving in to employer demand.

Structure and Routine

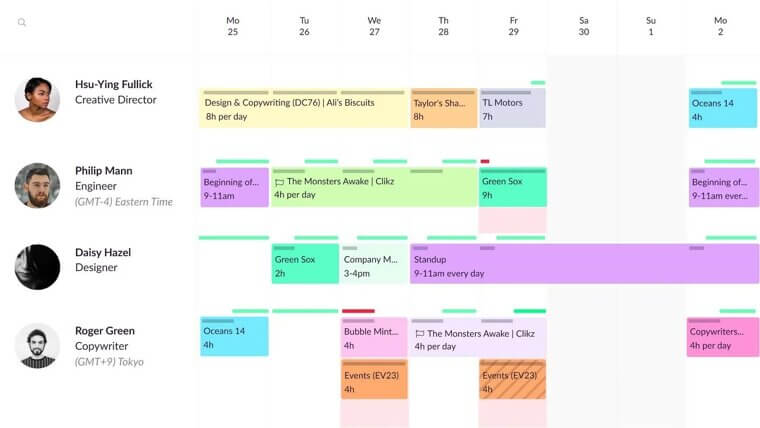

Retirement is what you make it, and many people love having an open schedule. However, others find it disorienting, so they return to their old jobs to regain that structure. Lots of retirees enjoy routine, and there’s no routine quite like work!

Flexible Working

Flexible working isn’t for everyone, but it’s making it easier than ever for people to do jobs they wouldn’t have had access to before. If retirees are comfortable working remotely, they can earn money from the comfort of their own homes, enjoying personal freedom.

Decreased Living Standards

The whole point of saving for retirement is to have a good lifestyle, so many retirees find it jarring when they can no longer afford their typical living costs. To maintain travel, leisure, hobbies, and housing, they need more money, which is why going back to work is the answer.

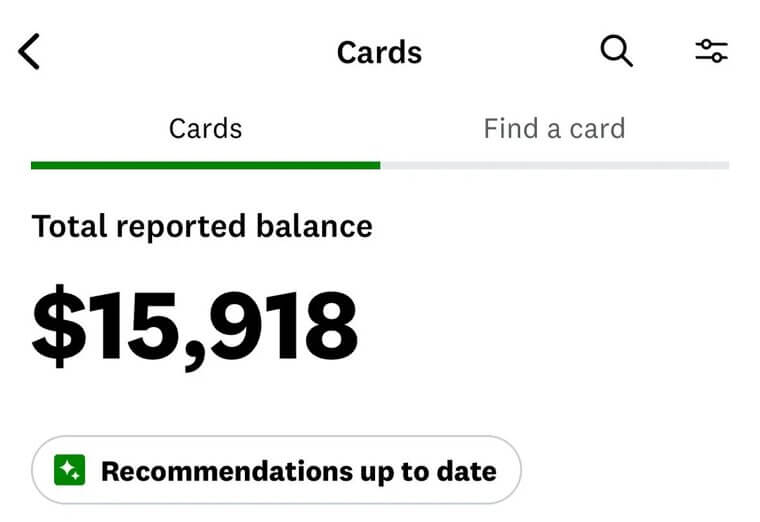

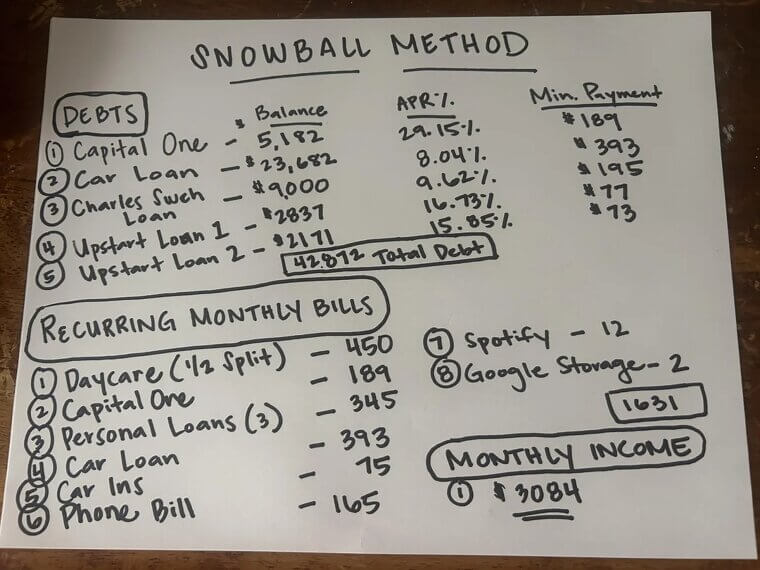

Debt Obligations

Unfortunately, mortgages, loans, and credit card balances don’t disappear with retirement, and many retirees underestimate how much their debt costs. They cannot afford to pay them back without a steady income, so they have no choice but to pick up a new job.

Loss of Spouse’s Income

Sometimes, only one half of a couple retires, so there's still an additional income to live on. But if the working spouse loses their job, their partner may be forced to come out of retirement to bring some money into the household.

Mundanity

After working for so many decades, our identities become attached to our jobs. When we retire, we abruptly lose that identity, and every day becomes mundane and uneventful. Simply being in the workplace and surrounded by people can be enough to convince some individuals to return to work.

Mentorship Opportunities

Sometimes, working full-time after retirement isn't the answer. But many retirees find it really rewarding to mentor younger employees, pass on their knowledge, and contribute without the stress and responsibility they used to have. They get to dip back in on their own terms.

Familiarity

Just like we crave routine, we also crave familiarity. For lots of retirees, the workplace is all they've known for so long, and they feel lost without their jobs. Many of them cave to internal pressure and go back to work just to have something familiar in their lives.

Unexpected Expenses

When things are good, they’re great, but just one unexpected expense can drain your savings, especially if you have no income. Retirees are often forced to return to work at least temporarily to cover sudden costs without jeopardizing their long-term financial security.

Personal Growth

Who said personal growth is just for the young? Many people only truly find themselves through their work, so retirement robs them of that sense of growth and purpose. Returning to work allows them to continue personally developing and finding themselves.

Career-Focused Identities

For lifelong professionals, their careers define their self-image. Without them, retirement feels empty and a bit pointless, even if it’s a long-awaited reward. Some retirees feel more at home returning to work, and they don’t see it as a burden, but as a source of pride.

Lack of Physical Activity

Not every job is super active, but getting out of the house and walking around each day is good for your body, especially as it ages. Some retirees become sedentary, so they return to work at least part-time to stay active and keep their bodies healthy.

More Senior-Friendly Jobs

Unlike in the past, modern companies are continuously designing roles to suit workers of all ages. Nowadays, many seniors don’t “age out” of their jobs, so they can keep working as long as they want, or make a confident career change post-retirement.

Employer Loyalty

Ask any boomer and they’ll tell you about how well their employer looked after them, so it’s no wonder that many retirees are still so loyal to their previous workplaces. It’s also one of the reasons why they choose to go back to a good job and boss.

Workaholism

You've probably heard the “workaholic boomers” stereotype, and for many people, it's true! Too many people struggle to switch off from work when they retire, and their workaholism encourages them to return to the workplace even when it's time to relax and recuperate.

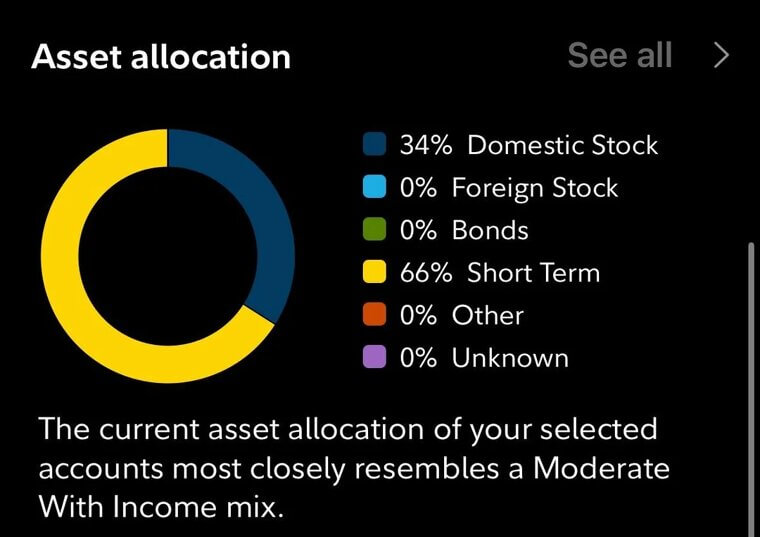

Declining Investments

Investments are key when it comes to building retirement finances, but one big downturn can shrink your entire account. In these cases, retirees go back to work because it provides income stability, which allows them to rebuild portfolios without withdrawing from investments prematurely.

Healthcare Costs

It’s a sad fact of life, but medical expenses often rise faster than pensions or savings, and some cost tens of thousands. Retirees may return to work primarily for employer-sponsored health insurance, or just to make some cash back to offset out-of-pocket medical bills.

Pursuing New Avenues

Just as retirement can get boring, it can also be demotivating. Many retirees feel a strong desire to pursue new avenues after leaving their lifelong careers, so they might start new jobs or pursue other professional opportunities that they couldn't before.

Community Involvement

Retirees often become lonely and bored because they don’t know how to fill their time, so working locally allows them to connect with their communities. Whether in schools, non-profits, or small businesses, employment becomes a way to give back and stay socially active.

Seasonal Work

The best thing about being retired is the freedom to choose. For some people, that means going back to work on a more temporary basis, so seasonal work is perfect. There's less commitment, but still plenty of responsibility, plus the chance of festive fun!

Economic Uncertainty

Unfortunately, the future is never certain, and many retirees no longer feel safe putting all their faith in their existing savings and pensions. Many are going back to work to ensure their futures, even if that means less free time.

Entrepreneurship

With age comes wisdom, and with retirement comes more free time, so when better to start your own business? Entrepreneurship provides retirees with a focus and a means to earn extra money, offering total autonomy, creative control, and flexibility.

Divorce

Later-in-life divorces can quickly cut retirement assets in half. They may not want to, but some newly-divorced retirees have to start working again to support themselves solo and supplement any costs incurred during the process. Sometimes, this actually improves emotional stability.

Mental Stimulation

Our jobs mentally stimulate us more than we think, but we typically don't realize until we leave them. Many retirees struggle to keep their minds active, so returning to work provides them with something to focus on and an opportunity to exercise their brains daily.

Volunteer Opportunities

Sometimes, the answer to retirement woes is to “work” without pay. That gives them more freedom, less pressure, and a greater wealth of opportunities to choose from. Giving time to good causes gives many retirees structure, meaning, and better self-confidence.

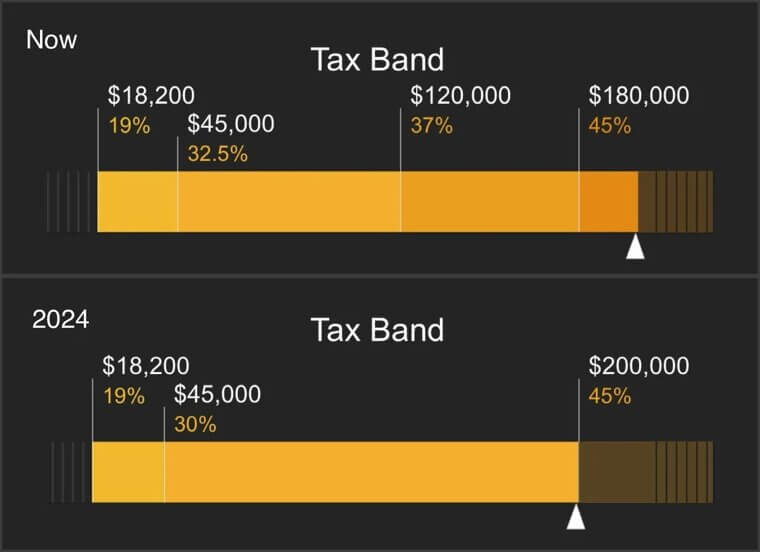

Tax Incentives

Certain programs encourage older adults to rejoin the workforce by promising tax breaks or earnings credits. These appeal to many retirees who weren’t opposed to going back to work, and sometimes help to convince them that post-retirement employment is actually worthwhile.