Investing in Their Health Before It Became Expensive

This one surprises people, but many retirees say they regret not investing in their health earlier. Gym memberships, regular checkups, better food, and stress management would have paid off massively. It feels less like an investment when you are younger, but everything becomes a bigger deal in your sixties and seventies. Many wish they had treated their future body like an asset rather than an afterthought.

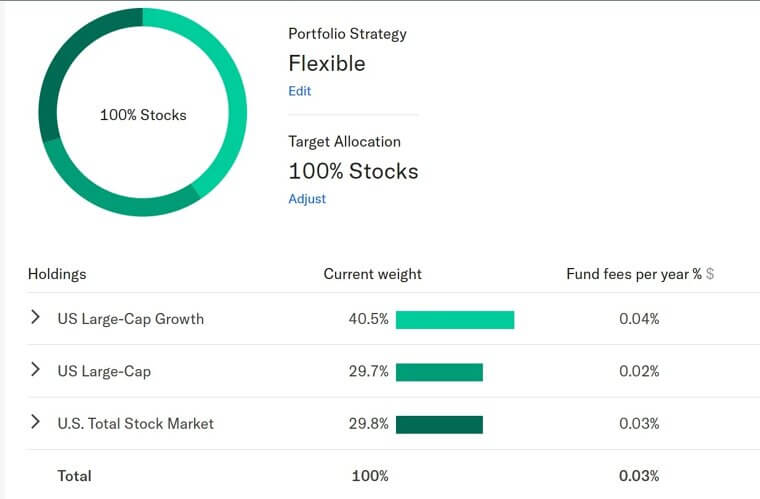

Starting a Simple Index Fund Early

Many retirees express regret about not investing in a simple index fund at an earlier age. They wish they had a little S&P 500 fund growing in the background. Many look back to the time when they could have taken advantage of compounding and wish they had invested a small amount monthly. Time is the moneymaker here, and many say they wish they had taken advantage of it much sooner than they did.

Buying a Modest Rental Property When Prices Were Low

Plenty of retirees admit they wish they had bought a rental property back when homes were cheaper and interest rates were predictable. Nothing extreme. Just a little house or duplex they could have rented out without too much trouble. Over two decades, that kind of property becomes a steady income source.

Now they look at rising rents and realize they could have been collecting that money instead of paying it. The opportunity feels even bigger in hindsight, especially when mortgage payments from the past look tiny compared to what renters pay today. It is one of the biggest financial regrets people share.

Now they look at rising rents and realize they could have been collecting that money instead of paying it. The opportunity feels even bigger in hindsight, especially when mortgage payments from the past look tiny compared to what renters pay today. It is one of the biggest financial regrets people share.

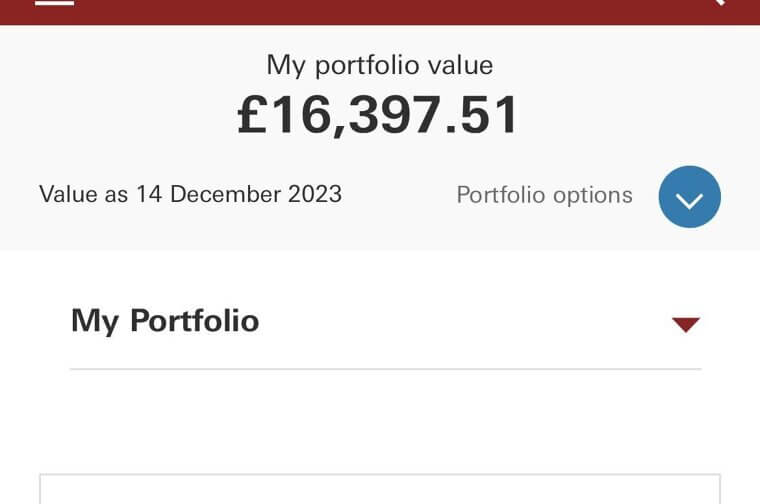

Putting Extra Money Toward Retirement Accounts

Many retirees regret not fully funding their retirement accounts sooner. They postponed full funding for “just another year” because they believed that they would always have the option to make up those contributions later on. They now realize how much these contributions would have grown had they been made when the opportunity presented itself.

Retirees also express regret concerning the tax benefits that they missed out on when they were younger. Receiving tax deductions earlier and letting the investments cook for decades would have been a huge help. This is a lesson that many do not learn until they reach retirement age.

Retirees also express regret concerning the tax benefits that they missed out on when they were younger. Receiving tax deductions earlier and letting the investments cook for decades would have been a huge help. This is a lesson that many do not learn until they reach retirement age.

Putting Money Into Skills That Boosted Their Career

Many retirees say they wish they had invested in skills back when they had more drive and time. Whether it was leadership training, coding, public speaking, or even a professional certification, those skills could have pushed them into higher-paying roles decades earlier. They look back and see how much income they left on the table simply by not leveling up sooner. They realize now that the right skills often pay off more than the right stocks.

Buying Long-Term Care Insurance Before It Got Expensive

Many retirees regret not purchasing long-term care insurance when they were able to get coverage at a lower cost. They saw it as optional back then and thought they could think about it “someday.” However, the cost of health care is rising quickly, and they can see how comforting it would have been to have coverage locked in early.

They talk about how the peace of mind alone would have been worth it. Instead of having to drain their own savings later, they could have relied on their insurance policy to provide them with the necessary coverage. This is one of those decisions that only feels urgent after it is too late.

They talk about how the peace of mind alone would have been worth it. Instead of having to drain their own savings later, they could have relied on their insurance policy to provide them with the necessary coverage. This is one of those decisions that only feels urgent after it is too late.

Paying Off Their Mortgage Earlier

Retirees have often said that they regret not making partial monthly payments to reduce their mortgage. Even a small additional amount per month would have saved them many years on their mortgage debt. At the time, paying the mortgage was just another bill. Today, they see how freeing it would be to enter retirement without a housing payment hanging over them.

Starting a Small Side Business Sooner

A surprising number of retirees say they regret not starting a small side business when they had the energy for it. It did not need to be a big deal. Just something they enjoyed that could grow slowly over the years. That income could have snowballed into a much larger opportunity.

Now they look back and realize how low the risk actually was. Even a weekend hobby could have turned into a reliable source of passive or part-time income today. They wish they had played around with ideas instead of assuming side businesses were only for entrepreneurs.

Now they look back and realize how low the risk actually was. Even a weekend hobby could have turned into a reliable source of passive or part-time income today. They wish they had played around with ideas instead of assuming side businesses were only for entrepreneurs.

Putting Money Into Dividend Stocks Earlier

Many retirees say they wish they had learned about dividend investing sooner, so they could have built their portfolios way before they retired. The idea of collecting little payments without doing anything never felt urgent. However, they now understand how great these dividends can become after 20 years of compounding and reinvesting.

Saving for Emergencies Before Life Got Chaotic

Retirees often regret not building a solid emergency fund much earlier. Back then, it didn’t seem too important, and they figured they’d just juggle things as they came. However, life is full of unexpected surprises, and it is easier to deal with issues if you have a safety net.

While in retirement, they appreciate the benefits of being able to take care of unexpected bills without having to scramble to figure out how to make ends meet. They wish they had treated an emergency fund like a non-negotiable earlier in life.

While in retirement, they appreciate the benefits of being able to take care of unexpected bills without having to scramble to figure out how to make ends meet. They wish they had treated an emergency fund like a non-negotiable earlier in life.

Setting Up Automatic Savings Earlier

Retirees often say they wish they had implemented automated savings at an earlier point in their lives. Manually transferring money felt easy to skip, especially in busy or expensive months. Having funds automatically deposited each month would have steadily created a solid financial cushion without requiring constant discipline or reminders.

Putting Money Into a Reliable Used Car Instead of New Ones

Many retirees admit they burned through too much money buying new cars. At the time, driving something shiny felt important. But depreciation hit fast, and they ended up losing money that could have gone toward savings or investments. They wish they had chosen reliable used cars instead.

They watch younger people doing exactly that and building stronger financial foundations. They realize the freedom that comes from lower payments, cheaper insurance, and slower depreciation. They say they could have invested the difference and been in a much better place today.

They watch younger people doing exactly that and building stronger financial foundations. They realize the freedom that comes from lower payments, cheaper insurance, and slower depreciation. They say they could have invested the difference and been in a much better place today.

Starting an HSA While They Still Qualified

Retirees often talk about how powerful a health savings account would have been if they had opened one early. They did not realize it was one of the few accounts that lets your money go in tax-free, grow tax-free, and then come out tax-free for medical expenses. It is basically a hidden gem people overlook.

With how much they spend on healthcare in retirement, they wish they had twenty years of savings built up. Even small contributions would have grown into a huge safety net. They say it is one of those financial tools you only appreciate once you no longer qualify for it.

With how much they spend on healthcare in retirement, they wish they had twenty years of savings built up. Even small contributions would have grown into a huge safety net. They say it is one of those financial tools you only appreciate once you no longer qualify for it.

Investing in Their Physical Health Sooner

A lot of retirees admit they wish they had taken their health more seriously when they were younger. Not in a dramatic way, but simple things like walking daily, stretching, or eating a bit cleaner. They spent years thinking they were too busy, and now they see how those little habits could have made a huge difference.

They talk about how much harder it is to fix things later in life. Stronger joints, better stamina, and lower health costs would have been priceless today. They regret waiting until their body forced them to pay attention instead of building those habits earlier.

They talk about how much harder it is to fix things later in life. Stronger joints, better stamina, and lower health costs would have been priceless today. They regret waiting until their body forced them to pay attention instead of building those habits earlier.

Buying a Small Piece of Land Before Prices Exploded

Many retirees say they overlooked land as an investment when it was affordable. It felt like something only farmers or developers needed. They never imagined that even a tiny parcel outside town could double or triple in value over a couple of decades.

Now they see younger investors benefiting from land they bought almost as an afterthought. Retirees say they wish they had purchased just one lot and held onto it. Land does not break, rust, or wear out. It just sits quietly and becomes more valuable over time. They see now how simple and smart that move would have been.

Now they see younger investors benefiting from land they bought almost as an afterthought. Retirees say they wish they had purchased just one lot and held onto it. Land does not break, rust, or wear out. It just sits quietly and becomes more valuable over time. They see now how simple and smart that move would have been.

Starting a College Fund for Their Kids Earlier

A lot of retirees say they wish they had opened a college fund the moment their kids were born. Back then, tuition prices didn’t feel as scary, and it was easy to think there was plenty of time. But years pass fast, and small contributions early on would have grown into something meaningful.

College education is so expensive now and they realize how much pressure could have been lifted if they'd started a college fund earlier. Even a modest fund would have reduced loans and stress for everyone. They say they underestimated how powerful early compounding can be when you have eighteen years on your side.

College education is so expensive now and they realize how much pressure could have been lifted if they'd started a college fund earlier. Even a modest fund would have reduced loans and stress for everyone. They say they underestimated how powerful early compounding can be when you have eighteen years on your side.

Investing in a High-Quality Mattress Sooner

Many retirees laugh when they say this, but they wish they had splurged on a great mattress earlier in life. Back then, it felt silly to spend real money on something so simple. Today, they understand that good sleep affects health, stress, and energy more than almost anything else.

They talk about how aches, back pain, and restless nights started long before retirement. A better mattress would have supported their bodies and probably saved money on massages, chiropractors, and sleep aids. It sounds small, but they insist it would have paid off in ways they never imagined.

They talk about how aches, back pain, and restless nights started long before retirement. A better mattress would have supported their bodies and probably saved money on massages, chiropractors, and sleep aids. It sounds small, but they insist it would have paid off in ways they never imagined.

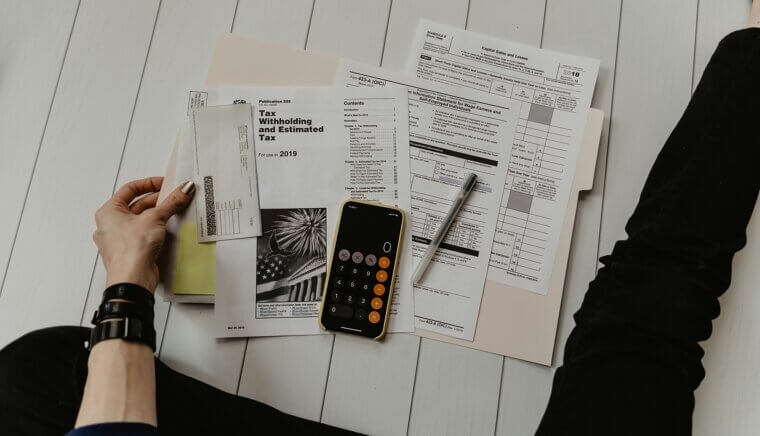

Learning About Taxes Instead of Ignoring Them

Retirees often say they regret not understanding how heavily taxes can impact their investments. They focused on earning and saving but didn’t think about strategy. Twenty years earlier, they could have placed money in smarter accounts, avoided penalties, and kept more of what they earned.

Now they see how tax planning makes a massive difference in retirement income. They wish they had learned the basics instead of assuming it was all too complicated. A little knowledge back then would have made their savings stretch much further today.

Now they see how tax planning makes a massive difference in retirement income. They wish they had learned the basics instead of assuming it was all too complicated. A little knowledge back then would have made their savings stretch much further today.

Putting More Money Into Roth Accounts

A lot of retirees kick themselves for not contributing to a Roth when they had the chance. They were so focused on traditional retirement accounts that they missed the beauty of tax-free withdrawals later. They admit they did not fully understand how valuable that flexibility would feel.

When they see friends enjoying tax-free income in retirement, they realize they could have built the same thing. Even a small Roth started early would have grown quietly in the background. They wish they had balanced their contributions instead of going all in on one type of account.

When they see friends enjoying tax-free income in retirement, they realize they could have built the same thing. Even a small Roth started early would have grown quietly in the background. They wish they had balanced their contributions instead of going all in on one type of account.

Investing in Friendships and Community Early in Life

Retirees often say they didn’t realize how important friendships would become later in life. Work, kids, and responsibilities took over, and before they knew it, time had slipped away. They wish they had stayed in touch, reached out more, and invested in the people who mattered.

They now see how community affects happiness, purpose, and even longevity. Social support becomes priceless as you age. They say the emotional return on investing in relationships is bigger than anything money can buy. It is the one investment they truly wish they had started decades earlier.

They now see how community affects happiness, purpose, and even longevity. Social support becomes priceless as you age. They say the emotional return on investing in relationships is bigger than anything money can buy. It is the one investment they truly wish they had started decades earlier.