Don’t Miss Out on What You’ve Earned

Many seniors are entitled to valuable benefits that often go unclaimed simply because they’re overlooked or misunderstood. From discounts on everyday expenses to government programs designed to ease financial strain, there are plenty of opportunities to save money and access helpful services. The challenge is knowing where to look and what to ask for. Taking a little time to explore what’s available can make a real difference in your budget and overall quality of life. These often-forgotten benefits are worth checking before you pay out of pocket.

Qualified Individual (QI) Program

QI covers the Part B premium for those with slightly higher incomes, between 120% and 135% of the Federal Poverty Level. This program has the lowest enrollment rate (only 15% of those eligible), meaning many people miss out on the monthly premium savings. Make sure you’re not one of them!

Senior Community Service Employment Program (SCSEP)

A Department of Labor program for adults 55+, SCSEP offers paid part-time work at local nonprofits and public agencies. It’s a way to stay active, learn new skills, and earn some extra income on the side.

Spousal Social Security Benefits (Maximization)

If your spouse worked and earned Social Security, you can collect up to half of their benefit amount even if you never worked yourself. Check with the SSA to ensure you aren't leaving money on the table.

Divorced Spousal Social Security Benefits

Yes, even having an ex can still pay off. If your marriage lasted 10 years or more and you haven’t remarried, you could qualify for benefits on your ex-spouse’s record. It is also important to note that receiving this benefit does not impact your ex-spouse or their current family's benefit amount in any way.

Social Security Survivor Benefits (Switching Records)

When a spouse dies, survivors may be able to claim benefits based on their earnings record. Widows and widowers can receive up to 100% of the deceased partner’s benefit. If you were already receiving Social Security, contact the SSA to apply and switch to the potentially higher survivor benefit.

The next one's worth knowing about, even if you hope you never need it.

The next one's worth knowing about, even if you hope you never need it.

One-Time Social Security Lump-Sum Death Payment

It's the ultimate consolation prize, but it’s easy to miss. The SSA provides a modest, one-time payment of $255 to eligible surviving spouses or children to help with immediate expenses after a death. It’s not much, but it’s something at a difficult time.

Supplemental Security Income (SSI) Enrollment

If your income is low, SSI provides a necessary income floor. This critical cash benefit helps low-income seniors, but there is some confusion around the application process, which results in eligible people never enrolling and missing out.

Supplemental Nutrition Assistance Program (SNAP) Enrollment

There is a little stigma around this that keeps nearly 60% of eligible seniors from claiming this free food assistance. If you are 60 or older, the resource limit is higher ($4,500), and the rules are generally simpler than for younger applicants.

This next one will put fresh, local food within your reach!

This next one will put fresh, local food within your reach!

Senior Farmers’ Market Nutrition Program (SFMNP)

Get your local produce for free! If you are a low-income senior, this program gives you checks or coupons to purchase fresh, locally grown fruits, vegetables, and herbs. Remember: this is a "use it or lose it" benefit that typically must be redeemed before the harvest season ends.

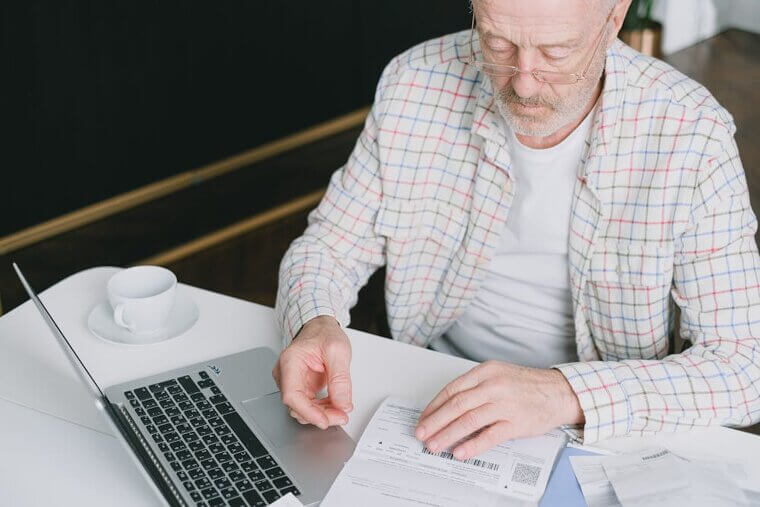

Locating State-Held Unclaimed Assets (Dormant Accounts)

Banks, employers, and insurers sometimes lose track of old accounts, refunds, or pension funds. States hold this “unclaimed property” until someone claims it. A quick online search on your state’s unclaimed property website could reveal forgotten money with your name on it.

The Retirement Savings Contributions Credit (Saver’s Credit)

Are you still working and saving for retirement? This is a tax break you should claim. This credit is designed for low-to-moderate-income workers, providing a non-refundable tax credit of up to $1,000 for individuals contributing to an IRA or 401(k).

Your state might have some free money for you!

Your state might have some free money for you!

Claiming State Tax Exemptions for Retirement Income

Don't let your state double-dip. Many states give seniors a tax break by excluding part or all of their retirement income from state taxes. That includes Social Security, pensions, or IRAs, depending on where you live.

Qualified Medicare Beneficiary (QMB) Program

This is the big one for low-income seniors. QMB pays for all Medicare premiums (Parts A and B), deductibles, and copayments. This will help eliminate almost all of your out-of-pocket medical costs. Yet somehow, nearly half of eligible beneficiaries miss out on this massive financial relief.

Specified Low-Income Medicare Beneficiary (SLMB) Program

If your income is too high for QMB, SLMB is your next best bet. This program covers your entire Medicare Part B monthly premium. It is valued at over $2,000 annually and grants automatic enrollment in the Extra Help prescription program.

Didn't qualify for the previous one? This one might be your ticket!

Didn't qualify for the previous one? This one might be your ticket!

Low-Income Subsidy (LIS) / Extra Help for Part D

This subsidy, sometimes called "Extra Help," can significantly reduce your prescription costs, covering your Part D drug premiums, deductibles, and copayments. You are automatically eligible if you qualify for any Medicare Savings Program (QMB/SLMB/QI).

Medicare Advantage Over-The-Counter (OTC) Benefits

If you have a Medicare Advantage plan, you might want to check your mailbox for some free goodies! Many plans give a quarterly allowance for essential health items like vitamins, pain relievers, and first-aid supplies.

Here's a free checkup most people don't even know about…

Here's a free checkup most people don't even know about…

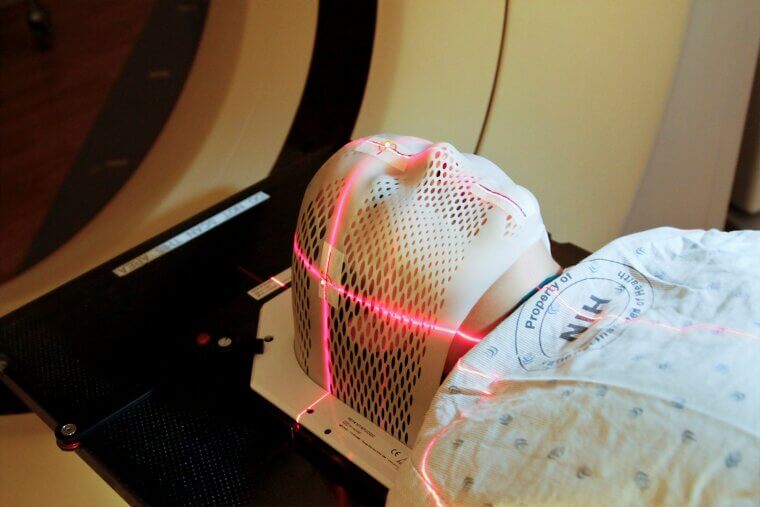

Medicare Annual Wellness Visit (AWV)

This is a free, annual, zero-copay session to create a preventative health plan. It is often confused with a physical exam, which usually costs money. The AWV includes medication reviews and a cognitive assessment, which is great for catching problems early on.

Therapeutic Shoe Allowance for Diabetics

If you have diabetes, Medicare Part B provides coverage for one pair of therapeutic depth or custom-molded shoes, plus multiple pairs of inserts, per calendar year. It can help avoid serious health issues, and believe it or not, the shoes are a lot more stylish than the name suggests.

Free Preventive Screenings (Zero Cost)

Why would you want to risk it when it's free? Medicare covers several crucial preventive screenings at zero cost, including cancer, diabetes, and heart screenings. Skipping them doesn’t save you anything, but getting them could save your life.

Worried about transportation? There's a benefit for that as well!

Worried about transportation? There's a benefit for that as well!

Non-Emergency Medical Transportation (NEMT)

If getting to the doctor is hard, let Medicaid or your Medicare Advantage plan drive you. NEMT provides free rides to and from covered medical appointments. Even though this is such a crucial accessibility tool, utilization remains low, suggesting many don't know it exists.

Free or Low-Cost Dental Care (Donated Dental Services - DDS)

Since Medicare usually doesn't cover your teeth, programs like Donated Dental Services (DDS) can come in handy. DDS provides free, comprehensive dental care for low-income seniors over age 65, the disabled, and the medically fragile.

Low Income Home Energy Assistance Program (LIHEAP)

Still paying the "heat or eat" tax? Worry no more. LIHEAP helps low-income households, including seniors, manage high utility bills for heating and cooling. The program can cover part of your utility bills or provide direct assistance.

Tired of paying costly bills? Here's how you can make them smaller!

Tired of paying costly bills? Here's how you can make them smaller!

Weatherization Assistance Program (WAP)

Don't just pay your high energy bills; fix the cause. WAP provides free, permanent home efficiency improvements like insulation, air sealing, and furnace repair. You may also automatically qualify for these repairs if you receive federal aid, such as SSI.

Lifeline Program for Phone Service

The Lifeline program offers discounted or free traditional phone service, including landline or mobile options for qualified low-income households. Eligibility is often linked to participation in other federal programs like SNAP or SSI, so make sure to get those in order.

Affordable Connectivity Program (ACP)

If you need internet access, the ACP provides a $30 monthly discount on broadband service for eligible households. You qualify if your income is below 200% of the poverty line or if you receive SNAP or SSI.

This next local benefit is huge but usually flies under the radar!

This next local benefit is huge but usually flies under the radar!

State / Local Property Tax Freeze / Exemptions

Many states give seniors a tax break by excluding part or all of their retirement income from state taxes. That includes Social Security, pensions, or IRAs, depending on where you live. Always check your state’s rules; you might be paying more than you need to.

Senior Property Tax Deferral Programs

Some states let seniors delay paying all or part of their property taxes until the home is sold or passed to heirs. For example, Minnesota allows seniors to pay just 3% of their household income toward taxes, with the state covering the rest as a secured loan that is repaid later.

Senior Property Tax Work-Off Programs

If you’ve got some time on your hands, you could trade some of that in for a tax reduction. Many municipalities offer programs where seniors (typically 60+) can volunteer service hours in exchange for a direct reduction in their property tax bill.

Don’t miss this if you're a veteran or caring for one…

Don’t miss this if you're a veteran or caring for one…

VA Aid and Attendance (A&A) Pension

This needs-based pension is for wartime veterans or survivors who require assistance with daily living activities, like bathing, dressing, or medication. It's designed to help offset the high costs of in-home care or long-term custodial care expenses.

VA Housebound Benefits

If your permanent disability confines you to your home for most of the day, you could qualify for this supplemental income. However, you must choose between this and the A&A Pension; you cannot receive both simultaneously.

VA Home Modification and Housing Adaptations

The VA can help make your home safe and accessible through financial assistance for necessary modifications to a veteran’s or caregiver’s home. This can help cover costs like installing ramps, grab bars, widening doorways, or making bathroom modifications to accommodate a disability.

Elderly Legal Assistance Programs (ELAP)

ELAP is designed to offer free or low-cost legal help for seniors (typically age 60 and older). These programs cover crucial issues, including appealing benefits denials, resolving housing disputes, and drafting basic estate planning documents.

Need help? You don’t have to keep up with household tasks alone…

Need help? You don’t have to keep up with household tasks alone…

Chore and Errand Assistance Programs

If you need help with heavy lifting, this non-medical assistance can be a huge help. These local programs provide supportive services like light home maintenance, heavy household chores, or running essential errands for seniors who struggle with physical mobility.

America the Beautiful – National Park Senior Lifetime Pass

Think of this as a retirement gift from the federal government. For a one-time payment of $80, seniors (62 and older) get lifetime access to all federal sites, including National Parks, forests, trails, and historic sites. It also provides discounts on amenities like camping and guided tours.

Commodity Supplemental Food Program (CSFP)

Every month, this federal program provides low-income seniors with a monthly box of nutritious food, including canned fruits, vegetables, grains, and milk. It’s like a surprise care package from the government (minus the confetti, but still much appreciated at dinner time).