Retirees' Worst Financial Moves

When you think of retirement, you most likely anticipate carefree, enjoyable days. Too frequently, our golden years are sadly short on gold. Want to avoid this? Continue reading to unearth 20 financial moves retirees most often regret.

Not Optimizing Taxes

Missed chances to lower tax obligations and increase retirement savings are a huge “oops” for retirees who fail to optimize tax tactics. Many retirees lament not using tax-advantaged retirement accounts and investment vehicles or getting expert tax guidance. So don’t make the same mistake!

Collecting Social Security Before Age 70

Believe it or not, but you’d receive noticeably larger monthly Social Security benefits if you wait until you turn 70. Some people, however, start withdrawing a little too early and live to regret it, as they’d receive significantly less!

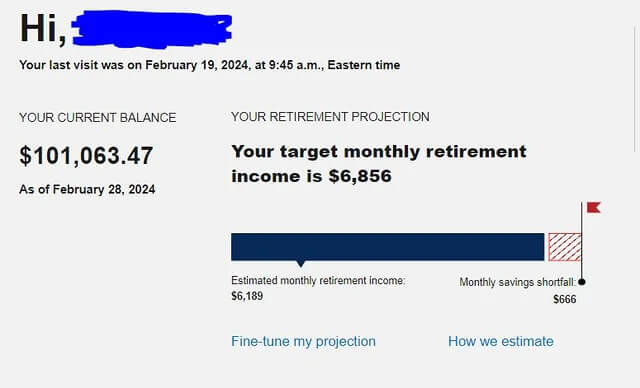

Not Saving Enough Retirement Money

Many retirees experience financial stress throughout their golden years due to a lack of retirement money. Insufficient retirement money can make it more difficult for you, as a retiree, to live comfortably, whether as a result of poor savings or unanticipated events.

Not Being Financially Educated

If you’re too lazy to do a little research on retirement finances, then you’re likely to feel unable to make wise financial decisions in your golden years. If you lack a firm grasp of personal finance, you’ll make frequent mistakes and pass up chances to maximize your retirement funds.

Having No Balance Between Saving And Enjoying

Many retirees struggle to strike the correct balance between living in the moment and saving for the future. Some people wish they had invested more carefully for their retirement years, while others regret not putting experiences and quality of life first sooner.

Not Being Financially Responsible Throughout Life

Some retirees grow to regret the “you only live once” axiom and wish that they'd been more responsible with money in their younger years. Try not to make the same mistake! Prioritizing financial discipline and knowledge is the key to avoiding bank-breaking errors.

Starting Retirement Savings Too Late

People can take advantage of compound interest and increase their nest egg over time by beginning their retirement savings early. Given the substantial impact this quick and easy top tip has, retirees frequently regret not seizing this chance.

Overworking

Quite a few retirees resent working too long and giving up valuable time for hobbies or spending with loved ones. Overall well-being depends on striking a balance between job and personal life, and retirees suggest determining the ideal retirement age depending on personal interests and circumstances.

Retiring Too Early

Premature retirees frequently look back on - and regret - not accounting for the long-term financial effects of their choice and wish they had stayed in the workforce for a few more years. Remember to be certain that you have enough saved to live lavishly in your golden years!

Overthinking Finances

Despite the importance of financial planning, some retirees acknowledge that they overthink their money and lose out on life's little pleasures. To find contentment in retirement, all you need to do is master your personal finances while embracing spontaneity. Easy peasy!

Spending Too Much On Housing

Retirees' finances are heavily impacted by housing costs, particularly if they own a large or expensive home. Those who overspend on housing as retirees frequently lament not finding cheaper home options or downsizing to free up money for other, more exciting needs.

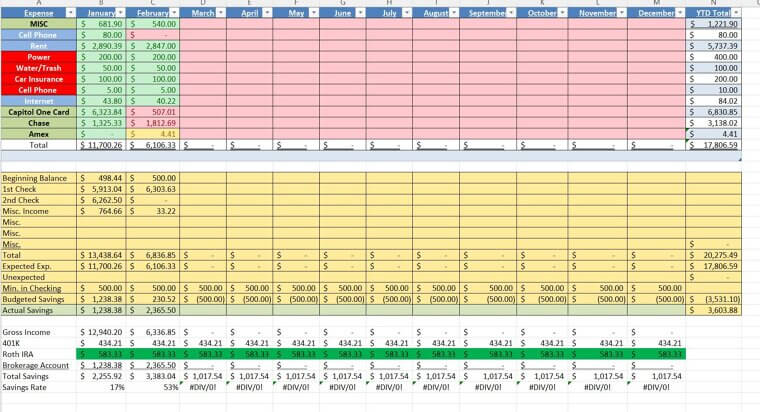

Not Sticking To A Budget

Budgeting is essential for controlling spending and preserving retirement financial security. It’s impossible to overstate how crucial it is to create a budget and keep track of expenditures in order to prevent overspending and guarantee that retirement funds last a lifetime.

Eating Out Too Often

Retirees' finances are easily knocked down by frequent dining out. In order to free up their retirement funds for other uses, retirees frequently regret not cooking more meals at home or finding ways to enjoy eating out without spending an arm and a leg.

Getting Into Debt

Overspending on credit cards, loans, or mortgages can have a significant negative impact on retirees' financial situation. Remorse over previous borrowing choices can result from high-interest debt, which can also reduce financial flexibility. And that’s not what you want!

Overlooking Tax Consequences

Nobody enjoys paying taxes, particularly when they suddenly deplete your retirement funds. Therefore, one of the top priorities on your retirement checklist should be tax planning and mitigation. Don’t leave it to the last minute!

Underestimating Healthcare Costs

Unfortunately, healthcare expenditures tend to increase with age as people do not normally get healthier as they age. With this, healthcare costs can be a major financial hardship in retirement, and many retirees regret not budgeting for them sufficiently.

Disregarding Investment Fees

Fees are frequently an unstated expense of investing that is simple to overlook while you are preoccupied with your job and family. Such fees can eat away at your savings, making retirees regret not paying more attention to the investment fees.

Panicking When The Market Drops

Panic does not lead to intelligent choices in many areas of life, and the same is true for investing in retirement. Some retirees regret selling their investments because they were afraid during a market downturn. Looking back, they realize that it would have been wiser to remain invested.

Putting Children’s Needs First

Raising a child can be very costly. It's hard not to put your children's needs ahead of your own, as you want the best for them. However, many retirees regret not doing a better job of balancing their finances.

Borrowing From 401(k) or IRA Accounts

Borrowing from a 401(k) or IRA account can appear like a necessary decision at the moment. However, retirees often learn to regret not making a greater effort to come up with an alternative.