Financial Habits to Start Skipping Immediately

We all make money mistakes, but some have a sneaky way of catching up with us years down the line. Whether it’s overspending, under-saving, or trusting the wrong advice, these habits can quietly chip away at your financial future.

Not Saving for Retirement

Retirement is far away until it’s not. Skipping those early contributions is like saying no to free money (thanks, compound interest!). Future-you would love a comfy nest egg, not ramen for dinner at 70. Start now, even if it’s small. Your older self will high-five you in orthopedic shoes.

Underestimating the Cost of Kids

They’re adorable, they’re cuddly, and they’re expensive. Diapers become daycare, daycare becomes dance class, sports fees, and braces. Not accounting for all of it means you will be scrambling at every stage.

Not Automating Savings

Leaving your savings to "whenever I remember" is a good way to ensure that you save nothing. Automating transfers takes willpower out of the equation and makes building wealth feel effortless.

Living Paycheck to Paycheck

If your bank account flatlines the day before payday, you’re not alone, but it’s exhausting. No wiggle room means one surprise bill can wreck everything. Budgeting might sound boring, but so is calling your landlord about late rent.

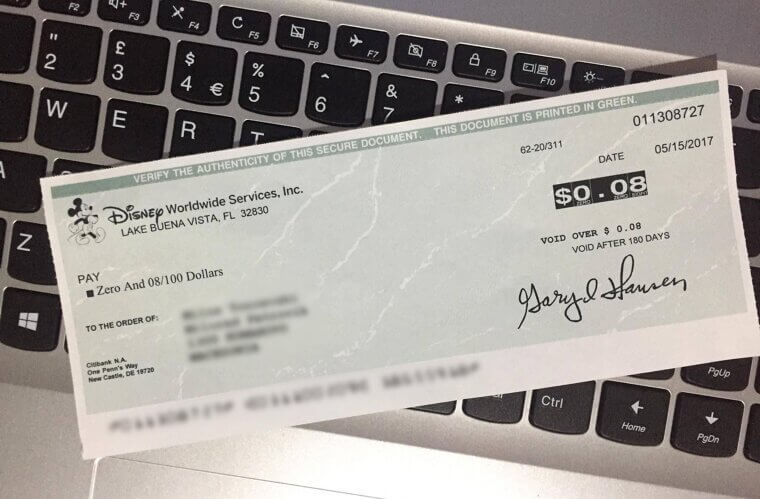

Carrying Credit Card Debt Forever

Swiping is exhilarating. Paying it off? Not so much. That $40 dinner just turned into $200 worth of regret, courtesy of interest rates that are ridiculously high. Revolving debt is the financial equivalent of dragging around a suitcase full of bricks. Start paying it down.

Financing Everything

New couch? Put it on the card. Birthday trip for the dog? Finance it. All those "easy" payments add up, and before you know it, you’re wondering how you spent your money. If you can’t pay cash, you probably can’t afford it.

Not Having an Emergency Fund

Life loves a good surprise, like flat tires, broken fridges, or dental drama. When you don’t have an emergency fund, you’ll be charging chaos at 20% APR. Put away a small amount every month. Think of it as financial bubble wrap; it’s unexciting, but it’ll cushion the blow when life decides to throw things.

Not Learning About Money Sooner

Some people avoid talking about money like it's a tax audit. But not knowing how interest, investing, or credit works can cost you big. You don’t need a PhD in finance. Simply understanding the basics can keep you away from mistakes that will haunt you for years.

Always Buying the Newest Thing

That new phone or shiny kitchen gadget? Super tempting. But chasing the latest trend is like running a marathon without a finish line. A year later, it’s outdated, and you’re stuck paying it off. Sometimes, “last year’s model” is a smarter move (and still takes selfies just fine).

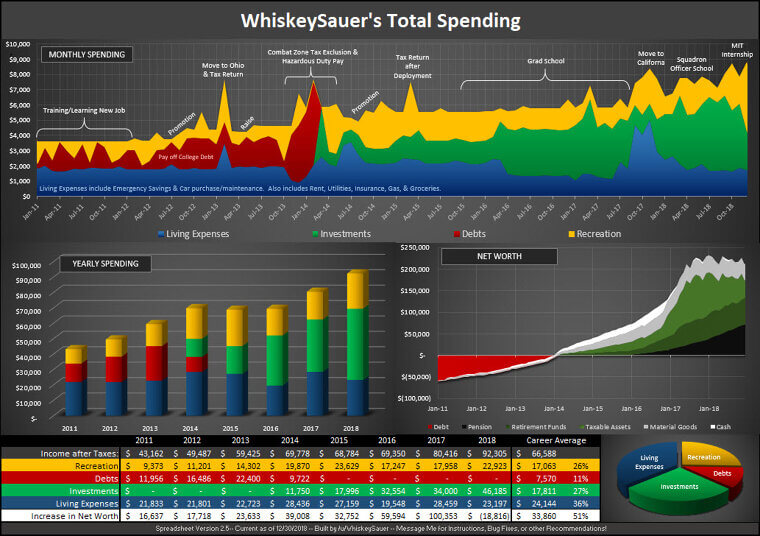

Not Tracking Your Spending

If you don’t know where your money goes, it’s probably going somewhere weird. Tracking spending isn’t just for finance nerds; it’s how you find the leaks. Like that $60-a-month subscription you forgot you set up. Knowledge is power, and sometimes, it’s also pizza money.

Buying a House You Can’t Afford

That “dream house” can quickly become a nightmare if the mortgage eats up your whole budget. Granite countertops won’t make you feel better when you can’t afford to furnish the living room. Buy what you can afford, not what the bank says you can afford. There’s a difference.

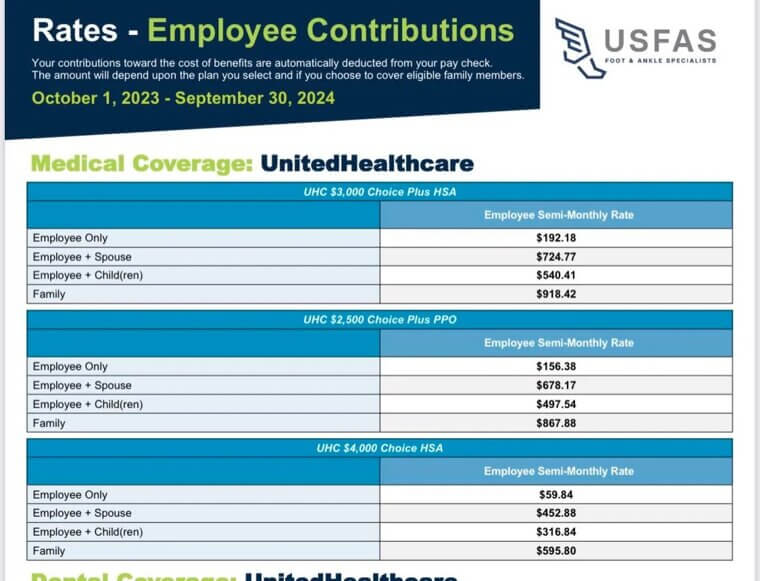

Putting Off Health Insurance

Skipping insurance to “save money” works great until a surprise trip to the ER eats your life savings. One bad break (literally) can cost thousands. Health insurance might feel expensive, but medical debt? That’s the real financial horror story. Protect yourself like the squishy, vulnerable human you are.

Lending Money to Everyone

Helping friends is noble, but lending money can turn your relationships into awkward group projects. Unless you’re prepared to consider that money a gift, think twice. Because “I’ll pay you back next week” often turns into “Did I say that?”

Using Your Savings for Non-Emergencies

Your emergency fund is not for concert tickets or kitchen gadgets shaped like cats. It’s for actual chaos: car repairs, vet bills, and life going sideways. Touch it only when necessary and not because your favorite store is having a sale.

Not Planning for Taxes

Taxes are the adulting surprise no one really prepares you for. Freelancers, side hustlers, or even big bonuses can come with a tax hangover. Always set aside a chunk for Uncle Sam. Because nothing ruins a windfall like realizing it’s not actually yours.

Not Negotiating Anything

Whether it’s a salary, car price, or cable bill, never negotiating means you’re probably overpaying. A simple “Is that the best you can do?” works wonders. Don’t let politeness rob your paycheck; speak up! The worst they can say is no.

Falling for Get-Rich-Quick Schemes

If it promises easy money, it’s usually just a fancier way to lose it. Crypto bros, sketchy “investments,” and pyramid-adjacent side hustles all have one thing in common: they sound better than they end. If someone says you’ll be rich overnight, hold your wallet and run.

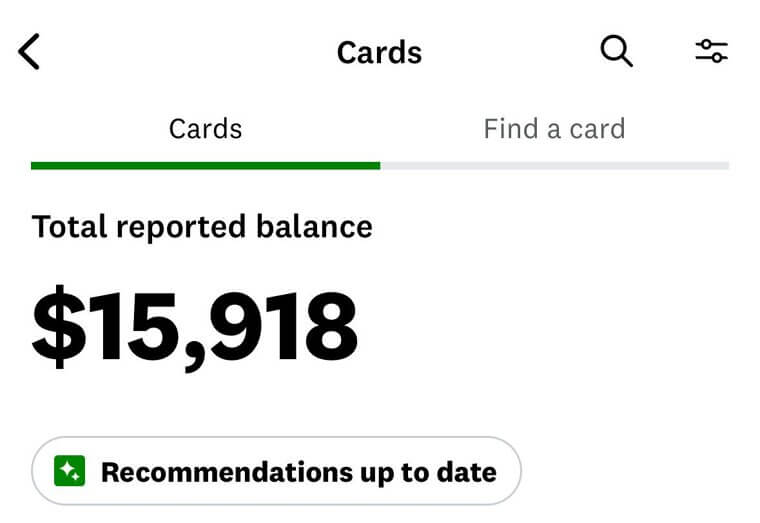

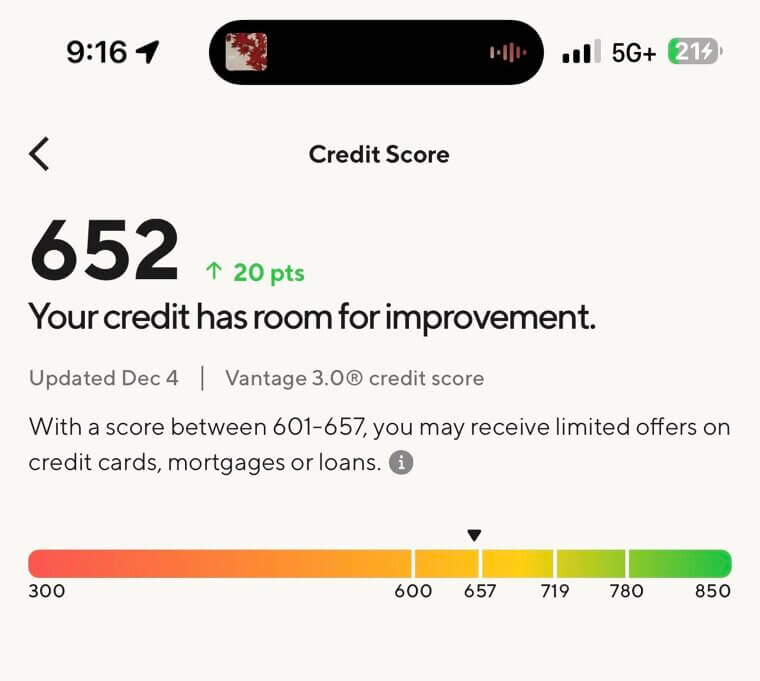

Ignoring Your Credit Score

Your credit score is like a financial GPA, and ignoring it doesn’t make the grades better. Check it regularly, keep your utilization low, and treat your credit card like a tool, not a temptation.

Not Setting Financial Goals

Without goals, your money just kind of wanders off. Want a house? A vacation? To stop crying at your bank statement? Set clear goals. Give your money a mission. Otherwise, it’ll just slip through your fingers.

Eating Out Too Much

Restaurants are great until your bank account starts looking like it’s on a diet. Dining out adds up fast. Those “cheap” lunches and “casual” dinners could fund a weekend getaway. Cook at home a few times a week. Trust us, it’ll make a difference.

Ignoring Your Retirement Accounts

Your 401(k) isn’t just a mysterious deduction; it’s your future. Not maxing out contributions or ignoring your company match is basically leaving free money on the table. Check in on it occasionally. You deserve more than stale crackers and a wobbly lawn chair when you retire.

Buying a Car You Can’t Afford

That shiny new ride makes you feel like a boss until the payment eats your budget alive. Add insurance, gas, and repairs, and it’s less “dream car” and more “nightmare loan.” A used car with low miles and no drama? That’s the real flex.

Using Retail Therapy as Actual Therapy

Bad day? New shoes! Bored? Online cart time! Emotions make terrible financial advisors. Shopping to soothe your soul only works until the bill arrives. Try journaling, walking, or cleaning your kitchen. Still cheaper than another pair of boots you don’t need.

Putting Kids’ Needs Before Retirement

We know you love your kids. But draining your retirement to fund their college, hobbies, or frequent snack runs will only leave you dependent on them later. There are loans for education, not for aging gracefully.

No Budget

Budgeting isn’t glamorous, but it’s better than wondering where your money went every month, like it ghosted you. Think of a budget as a permission slip for your money: “Yes, you may buy coffee. No, you may not impulsively buy a kayak on Amazon at 2 a.m.”

Not Reading the Fine Print

Those tiny letters are boring, but they’re hiding all the good stuff (or bad stuff, really). Whether it’s a loan, lease, or “free trial,” the fine print is where your future regrets live. Read it. Twice. Maybe three times. Or at least scroll to the end once.

Co-Signing a Loan You Shouldn’t

Co-signing seems nice until they stop paying. Now, it’s your credit on the line and your bank account on the hook. Unless you’re prepared to take over the loan entirely, just say no. You can love someone deeply without sharing their debt.

Avoiding Talk About Money in Relationships

Nothing kills romance like secret credit card debt. If you’re building a life together, you have to talk dollars and sense. Being open about money can prevent future fights, therapy bills, and “I didn’t know we were broke!” meltdowns.

Thinking You’ll “Figure It Out Later”

Waiting to deal with debt, savings, or investing only makes the hill steeper. Start small. Start now. Future-you will write you a thank-you note on personalized stationery because you’ll be that level of put-together.

Relying on One Income Stream

Putting all your eggs in one paycheck basket is risky business. Side gigs, passive income, or even a hobby that makes a little cash can add security and make your finances better.

Keeping Up With the Joneses

The Joneses are probably in debt. Their shiny new SUV and backyard pool look nice, but comparing yourself to others is a fast track to financial stress. Live within your means, not your Instagram feed. The real flex is not needing to impress anyone.

Falling for Lifestyle Creep

You get a raise, you upgrade your life. You get another raise, upgrade again. All of a sudden, you are making more money but are still broke. That’s lifestyle creep. The key is to keep living life like you are just a bit poorer than you really are.

Skipping a Will or Estate Plan

Nobody wants to think about it, but if you’ve got stuff, people, or even a beloved dog, make a plan. If you don't, your family will just be left to sort everything out, and that could include court dates.

Believing “More Money Means No Problems”

Turns out more money just means different problems. Overspending, bad investments, tax issues, the fun never ends! Financial peace doesn’t come from making millions; it comes from managing what you have wisely.

Not Asking for Help Sooner

Pride is expensive. There is no shame in asking for help, whether it is with a financial advisor, a mentor, or even a friend who has a good handle on spreadsheets. Asking for help doesn’t mean you’ve failed; it simply means you’re smart enough to learn before it’s too late. And trust us, everyone’s winging it more than they will admit.