Homeowners With Deep Financial Regrets

Buying a house is no small decision, and comes with a smorgasbord of risks that many homeowners fail to consider. These are 35 financial decisions that many homeowners end up regretting later on down the line.

Long-Term Maintenance Costs

We probably won’t be the first to make this analogy (and certainly won’t be the last), but buying a house is a lot like a marriage: it requires consistent work and effort in order to maintain, none of which is cheap. Unfortunately, many first-time homeowners underestimate the long-term costs involved in maintaining a house.

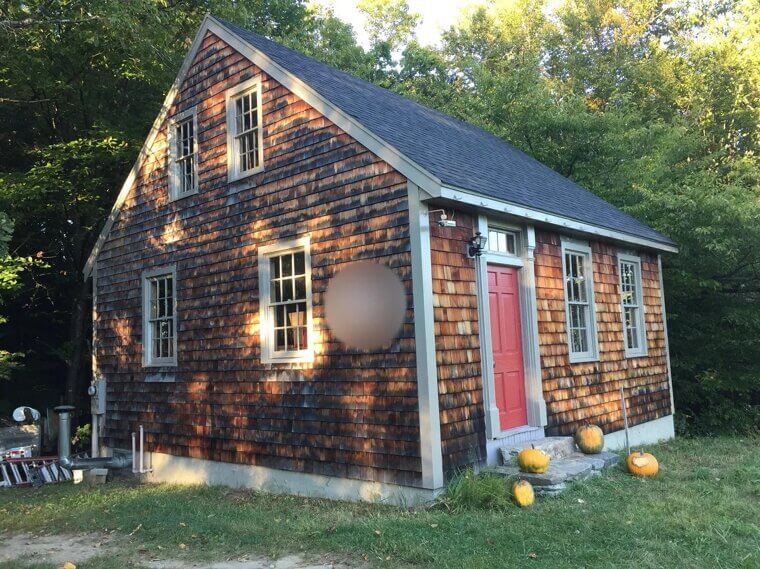

Small Houses

Some people will insist upon finding their “dream home”, one that is perfectly aligned with their personal tastes and style, and matches their needs. Many more people, however, will be more than willing to settle for a house that’s perhaps a little less than what they’d hoped. Unfortunately, those same people often regret buying a home that is much too small for them.

Big Houses

Of course, the opposite is true, too. If you’re a family of four, you could probably make do with an average suburban house that will accommodate every member of your family with some room to spare. You don’t want to move into a mansion, even if you do have the funds for it initially, since you’ll inevitably waste tons of space and be forced to deal with the higher maintenance costs that come with owning a larger property.

Budget Stretches

Before you commit to purchasing a property, you will want to ensure that you can comfortably pay for the mortgage while still having money left over for other essentials and luxuries. If you don’t, you run the risk of becoming “house poor”, that is, spending so much of your income on housing that you have no money left over for anything else.

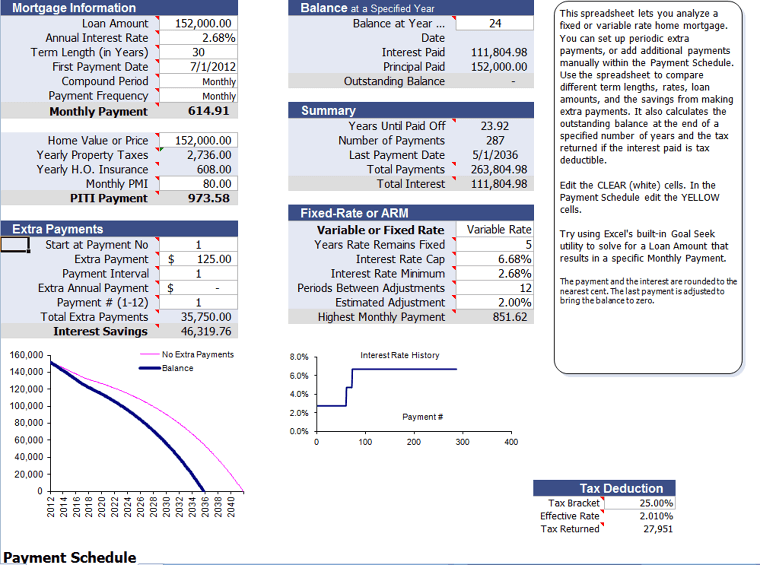

High Mortgage Rates

Nobody likes having to pay off their mortgage, but it’s one of the realities that come with buying a house. Be careful when discussing exactly how much you’ll be paying per month, however - a mortgage rate that is too high will affect all of your payments over the total lifespan of a loan.

Shopping Around

Speaking of loans, you’ll likely have to borrow some money for your house (unless you’re filthy, stinking rich, of course). Many people make the mistake of accepting the first offer that comes their way when they may have been able to secure a more favourable loan had they shopped around first.

Adjustable-Rate Mortgages

Adjustable-rate mortgages (or ARMs) allow your mortgage rates to change periodically, either increasing or decreasing, depending on certain variables. Unfortunately, for many, they often don’t fluctuate in their favor, forcing many homeowners to pay much more than they initially bargained for.

Down Payments

Down payments are essentially the deposit you pay for the opportunity to own a house. They’re often flexible, so long as they represent a percentage of the house’s total value. Some homeowners make the mistake of paying too little on their initial deposit, leading to higher interest rates.

Borrowing

Loans are often necessary for many would-be homeowners, but there is always the risk of borrowing too much upfront. This leads to a much heavier debt burden, and can potentially exacerbate any “running costs” you may have already.

Home Inspections

You wouldn’t buy a car without thoroughly inspecting it for any issues (at least, we hope you wouldn’t). Similarly, you shouldn’t commit to the purchase of a property without first ensuring that everything is “up to scratch”, lest you end up having to pay for some incredibly pricey repairs.

Invisible Costs

Hopefully, this won’t be too much of a surprise for any prospective homeowners reading this, but there are many “additional” costs that come with owning a home beyond the obvious. These include everything from utilities to lawn care to HOA fees, all of which should be considered and budgeted for beforehand.

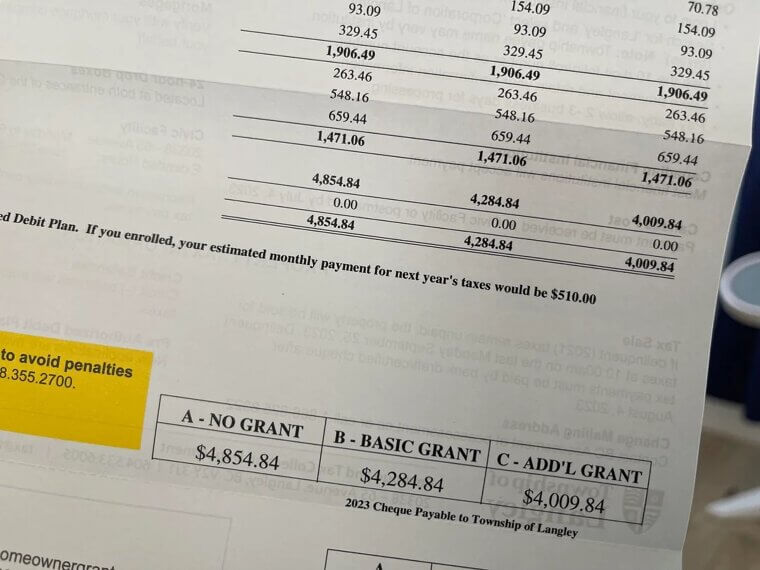

Property Tax Increases

Did you know that even after you’ve successfully completed the purchase of a house, you’ll still need to pay a monthly fee just for the right to exist in that space? Indeed, property taxes are what is known as a pain in the butt (to put it nicely), and they’re something that can easily sneak up on you if not accounted for when buying.

HOA Fees & Restrictions

Homeowners associations are something of a scourge upon many suburban landscapes. Unfortunately, they’re also sometimes unavoidable, and you may have to pay HOA fees every month. Again, this is something that you will want to factor into your budget before you commit to the purchase of a property.

Fixer-Uppers

Many people make a living off of buying shoddy, run-down houses before transforming them and reselling them at a profit. If you think the property you’ve been eyeing has “potential”, make sure that you properly budget everything beforehand lest your project runs over budget.

Bad Locations

When you purchase a property, you’re also committing to making that neighborhood - that entire part of the world, really - your home. It’s therefore worth doing a little research on the neighborhood you’re moving into to get a good sense of crime rates in the area, schools in the district, and how long your commute will be.

Neighborhood Prospects

While the development of your neighborhood isn’t really something you can predict, paying close attention to any potential changes can help you make the right choice as to whether you should purchase a specific property.

Schools and Commute

As mentioned already, you’ll want to pay close attention to what your options for schooling are and what shape your daily commute could take. Having to travel far just to drop the kids off or go to the office will likely drive up your monthly expenses.

Early Remodeling

Once you’ve bought a house, you likely won’t have much spending money left over to dedicate to remodeling. However, it’s worth it to at least make a few initial alterations as soon as possible, or else be left with a bevy of costs way later down the line.

Excessive Remodeling

On the other hand, you’ll also want to curb some of your more ambitious ideas until you’re fully ready to commit to them. Too much remodeling early on and without sufficient planning often leads to many homeowners going way over budget.

Renovation Time

One last consideration to make before you commit to any renovations is the time they take to complete. The longer a project goes on, the more likely it is that you’ll spend more money than you intended to; additionally, depending on what you do, you may have to live with a huge mess for a while.

Overpaying

Houses are essentially products at the end of the day. Like all products, they’re often marketed and sold quite aggressively, leaving many homeowners feeling that they may have been ripped off or overcharged.

Rushing

Remember the marriage metaphor? You shouldn’t marry anyone unless you’re absolutely sure that you want to spend the rest of your life with them. Similarly, you shouldn’t rush into purchasing a house until you’re committed to owning, maintaining, and paying for it.

Saving

In today’s economy, you’re lucky if you’re even able to save 5% of your monthly income. Savings are crucial to ensuring long-term survivability, so it’s best to start as early as possible.

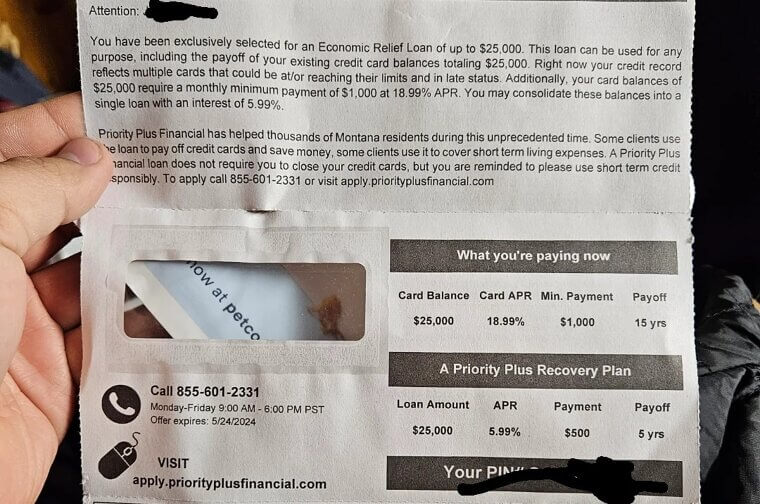

Debt Accumulation

Managing a household means being realistic about what you can and can’t spend. You don’t want to make the mistake of living beyond your means, which will only lead to more debt.

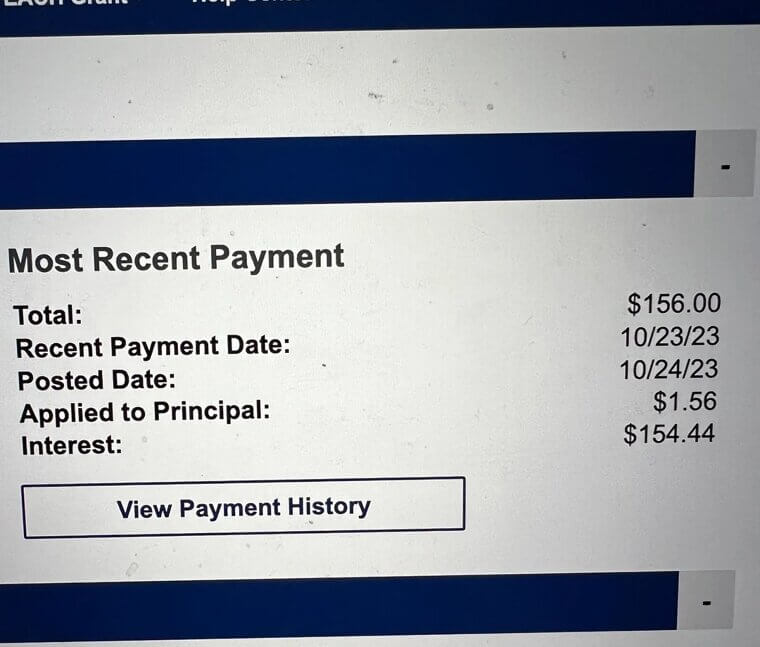

Early Debt

Most people are likely to come into debt at some point in their lives. This is often necessary for short-term survival, and - fortunately - can be paid off over a certain period of time. However, you will want to avoid coming into debt too young lest your future prospects become bleak.

Retirement Investments

If you purchase a house young, retirement will likely be quite far from your mind. However, it’s best to get started with your 401(k) investments sooner rather than later.

Emotional Judgements

Purchasing a house is a big decision, one that nobody should take lightly. That said, it’s best to keep yourself in check and be realistic about every possible outcome - don’t let emotions cloud your judgment.

Non-Professional Advice

With the weight of such huge decisions like purchasing property, there’s no shame in seeking counsel and advice before committing. That said, it’s always better to trust the judgment of professionals over personal acquaintances like friends and family members.

Resale Value

Although you may have every intention of making this your “forever home”, resale value is an important thing to consider up-front should the worst come to pass and you are forced to resell.

Buying Over Renting

Although you may think you’re fully prepared to handle the responsibility of purchasing a house, it’s sometimes better to rent your home instead, especially if you’re young.

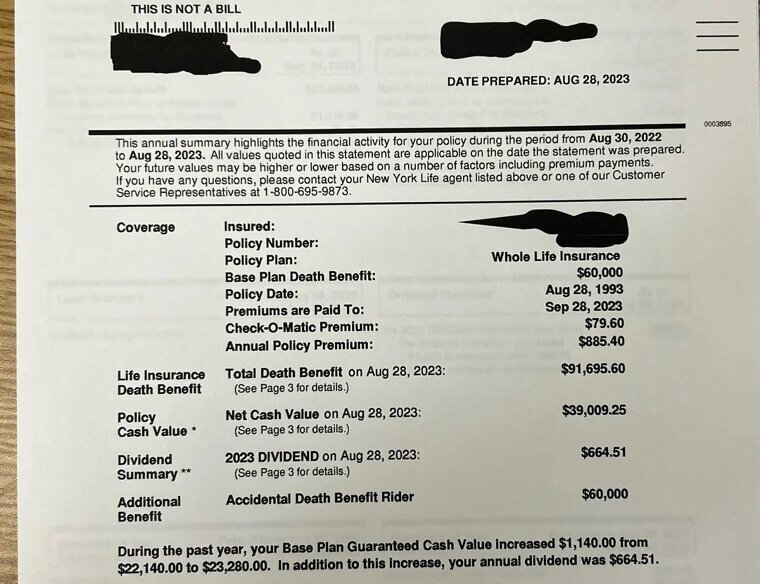

Poor Investments

Look, every decision that you make regarding how you spend your money is going to come with certain risks. That said, when it comes to investments like life insurance policies, it’s best to consider them fully before committing.

Bling Houses

If you have the means to buy a house for posterity’s sake, none of the advice on this list will probably apply to you. For everyone else, however, remember this: homes bought to impress led to regrets.

Co-Signing

Before co-signing a house with a spouse or family member, be realistic about whether you can count on them to manage their finances properly.

Flooring

House flooring can be expensive to change, but if you have the money - and time - it can be worth it. That said, it’s not a task that should be taken lightly, and many homeowners regret changing their floors to something that is even more expensive to maintain, like marble.

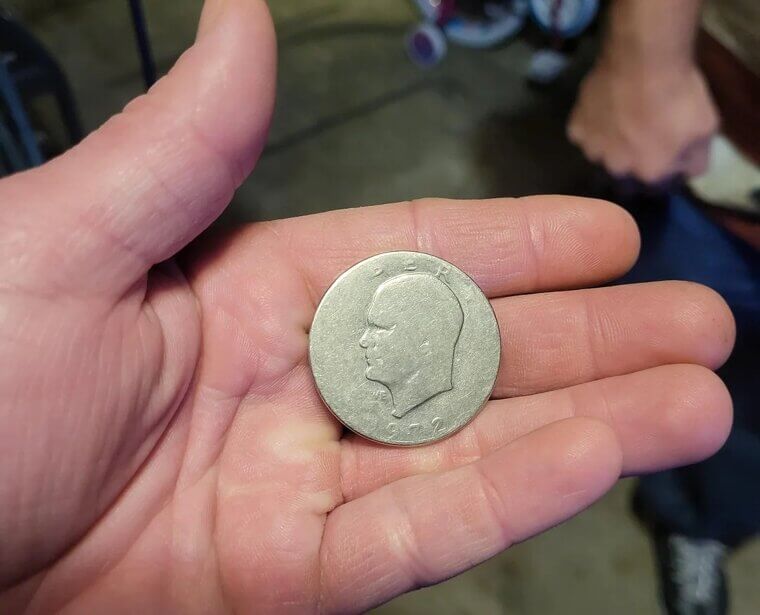

Big Investments

Over the course of your life, you may have the opportunity to invest your money into something that could have a big pay-off (Amazon, Bitcoin, even some parcels of land). While you shouldn’t commit your whole life savings to one investment, small investments could potentially lead to big wealth in the future, and are something that you don’t want to miss out on.