Private Clubs and Memberships

Private clubs often sell prestige more than practicality. Initiation fees can reach thousands, with monthly dues that add up quickly. The promise of exclusive networking rarely matches reality, as members often have similar social circles already. Many people join expecting opportunities and find mainly expenses. Amenities like dining or fitness facilities are luxurious but not unique enough to justify the price long-term. Even elite clubs experience turnover when members realize the novelty fades. Selling or transferring memberships is difficult, and benefits shrink if you relocate. What seemed like a worthwhile social investment becomes a steady drain on finances. Clubs thrive on the illusion of belonging, not measurable value. Before joining, calculate how often you’ll truly use it. Prestige doesn’t compound like interest, and access loses charm once the bills start arriving. True connections rarely require formal dues or dress codes.

Timeshares

Timeshares promise lifelong vacations and the illusion of ownership, but they rarely deliver on either. Buyers pay large upfront fees and then face annual maintenance costs that rise endlessly. The resale market is flooded, which makes them nearly impossible to sell. Many owners discover that using their “vacation weeks” means planning years in advance, only to find limited availability. Even renting similar properties often costs less per trip. The idea of guaranteed getaways quickly turns into a long-term financial headache. For most people, timeshares are less an investment and more a contract they can’t escape. Vacation flexibility and freedom always have higher value than a rigid payment plan for a destination you might stop loving. The smartest travelers use that money for trips on their own terms instead of tying their savings to a resort company’s fine print.

Luxury Watches

Luxury watches are marketed as timeless heirlooms, but most are just overpriced accessories. Only a handful of rare models ever increase in value. For the average buyer, the second that elegant box leaves the boutique, the watch loses thousands of dollars in resale potential. Repairs and insurance cost more than most realize, and style trends change faster than expected. Unless you truly understand vintage timepieces and collector demand, you’re gambling rather than investing. Many luxury watches are mass-produced yet priced as if they were rare works of art. They can certainly be beautiful and well made, but that doesn’t make them financially wise. The watch industry thrives on the illusion of exclusivity. Wearing one feels good, but believing it will appreciate is mostly wishful thinking. A good quartz watch keeps time just as well without draining your savings or requiring its own policy.

Vacation Homes

Owning a vacation home seems like a dream, but it rarely works out financially. Between property taxes, utilities, and upkeep, costs stack up faster than anyone expects. Renting the property to offset expenses sounds easy until repairs, management fees, and unpredictable seasons erase profits. Many owners visit less often than planned, turning their “escape” into an obligation. When life changes, selling can take years, especially in seasonal markets. The emotional connection makes it harder to face the math. A vacation home ties up money that could earn returns elsewhere or pay for dozens of carefree trips. Unless you genuinely live in it for much of the year, it’s usually a lifestyle luxury, not an investment. Travelers who crave flexibility often find renting far cheaper and far less stressful. The dream remains pleasant, but the financial reality often feels more like another mortgage.

Collectible Cars

Classic cars inspire passion, but very few produce real profit. The glamorous image of auctions and investment returns hides constant expenses. Insurance, maintenance, and proper storage easily eat up potential gains. Even well-kept vehicles lose value if trends shift. The market depends heavily on nostalgia, and not every “collectible” finds a buyer when it’s time to sell. A pristine restoration may look impressive, but it’s rarely cost-effective. Mechanics often warn that collectible cars are hobbies, not investments. Unless you’re a seasoned expert with deep connections, the odds of earning more than you spend are slim. For every car that triples in value, hundreds quietly depreciate in garages. The real reward lies in enjoying the drive, not chasing appreciation. Love it as a passion project, not a financial plan. Cars were made to move, not to sit around waiting to become profitable.

Home Renovations Without ROI

Not every renovation boosts your home’s value. Over-the-top kitchens, spa bathrooms, or extravagant additions often cost more than buyers will pay. While upgrades feel satisfying, the resale market values practicality over personality. A marble countertop won’t impress someone planning to replace it anyway. Neighborhood standards also matter—if nearby homes are modest, expensive remodels rarely return what you invest. Even energy-efficient improvements can take years to pay off. The smartest homeowners consult appraisers before spending heavily. Cosmetic updates, like new paint or modern lighting, usually offer a better return. Major makeovers are best done for personal enjoyment, not profit. Turning your home into your dream space is perfectly valid, but calling it an investment often leads to disappointment. When selling time comes, simplicity almost always sells faster and smarter than any luxurious renovation designed for yourself rather than the next owner.

Boat Ownership

Boats symbolize freedom, but financially they’re anchors. Maintenance, fuel, and storage add thousands each year. Engines break down, hulls need cleaning, and insurance never gets cheaper. The resale market is soft because boats age fast, especially in saltwater. Many owners use them only a few weekends a year, realizing too late that rentals offer the same thrill for a fraction of the cost. There’s an old saying: the two happiest days in a boat owner’s life are the day they buy it and the day they sell it. Even small boats create big bills, and the joy often fades once those invoices start arriving. Unless boating is your lifestyle, it’s not an investment but an indulgence. Owning one can be rewarding emotionally, but financially, it almost never floats. The water sparkles, but so does the money slipping away quietly beneath it.

Wine Collections

Fine wine sounds like a sophisticated investment, but it’s incredibly fragile. Storage must be temperature controlled, humidity monitored, and bottles handled precisely. Labels fade, corks dry, and conditions fluctuate. One small mistake can ruin an entire collection’s value. The market is unpredictable and crowded with counterfeits, and genuine buyers are hard to find. Appreciation happens for only a few rare vintages tied to famous vineyards. Most wines simply peak, decline, and lose worth. Collecting for pleasure is wonderful; collecting for profit is risky and slow. Transporting bottles is expensive, and auction fees eat into returns. The truth is that wine is best enjoyed, not hoarded for speculation. For most enthusiasts, the “investment” delivers more satisfaction poured into a glass than sealed in a cellar. The richest return often comes not in dollars, but in a shared bottle among friends.

Art for Profit

Buying art as an investment feels refined, but the numbers rarely justify the romance. The market depends on reputation, trends, and timing—all things nearly impossible to predict. Most artworks gain sentimental rather than financial value. Galleries and auction houses take large cuts from any sale, and storage or insurance adds hidden expenses. Only established names appreciate reliably, and even then, not always quickly. For every collector who makes money, hundreds break even or lose it. Art should first appeal to emotion, not the balance sheet. If you wouldn’t hang it proudly in your home, it’s probably not worth buying. Treating art as a speculative asset turns creativity into accounting. The wiser approach is to buy what moves you. Beauty and inspiration pay dividends no market fluctuation can erase. Appreciation in value should be a pleasant surprise, never the goal.

High-End Home Gyms

A private gym seems efficient and healthy, but most end up collecting dust. Expensive equipment feels motivating at first, until schedules tighten and enthusiasm fades. Repairs and maintenance are costly, especially for smart machines or treadmills with screens. Few homeowners use them often enough to justify the investment. Secondhand values are dismal, and moving heavy machines becomes a nightmare during relocation. Meanwhile, gyms keep upgrading faster than you can. For real results, consistency matters more than hardware quality. A modest setup of free weights, resistance bands, and dedication yields the same physical benefits for a fraction of the cost. Many people regret turning a spare room into a monument to early ambition. When fitness becomes another financial burden, the workout stops feeling rewarding. The healthiest investment is always discipline, not expensive machinery that eventually turns into modern furniture.

Smart Home Systems

Fully integrated smart home systems promise futuristic convenience but often deliver ongoing frustration. The technology evolves faster than most homes can keep up. Devices become obsolete within a few years, software stops updating, and replacement parts are expensive. When something fails, you can’t fix it yourself. Compatibility issues also pile up as brands release new versions. While some features are genuinely useful, most homeowners never use half of what they install. The real investment ends up being time spent troubleshooting. Buyers rarely pay more for homes with outdated automation because they know upgrades will be needed. A few smart plugs or thermostats can offer the same convenience without the huge bill. The idea of a home that runs itself sounds great in ads but often feels more like a subscription service with wires. Convenience shouldn’t cost constant maintenance or endless app updates.

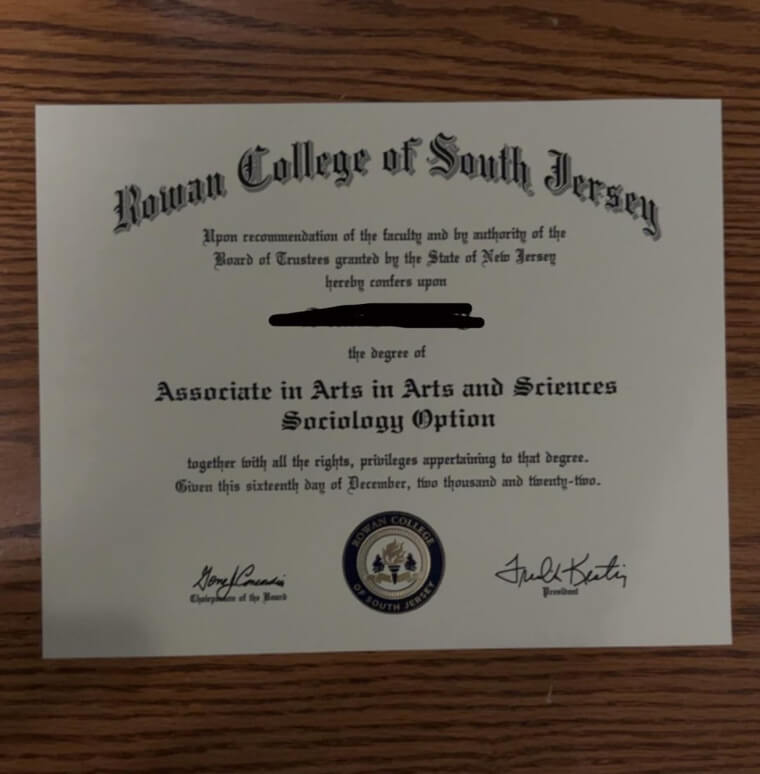

College Degrees for Prestige Alone

A college degree is valuable, but paying premium tuition solely for prestige can backfire. Elite universities may open doors, but debt can close them just as fast. Employers increasingly prioritize skills and experience over school names. Students often discover that smaller or public institutions provide the same education for far less money. When repayments stretch for decades, any advantage quickly fades. Prestige fades faster in industries that value results over pedigree. Many successful professionals came from modest schools without crushing debt. The smart investment lies in networking, internships, and applicable skills, not brand labels. Education should empower, not weigh you down. Choosing an affordable path to meaningful work is more sustainable than chasing bragging rights. In the long run, knowledge and ambition earn better returns than fancy tuition bills. A diploma’s worth lies in how it’s used, not where it’s framed.

Luxury Kitchens

Luxury kitchens may look stunning in magazines, but they rarely deliver a financial return. Custom cabinetry, imported countertops, and professional-grade appliances can cost as much as a small home addition. Appraisers and buyers usually won’t pay extra for such extravagance. Even subtle wear quickly dulls the shine. Trends change, and what feels high-end today can look outdated within a decade. Repairs and replacements are also more expensive when materials are specialized. For most homeowners, a practical, well-designed kitchen makes far more sense. It functions just as well and often attracts more buyers. Spending thousands on gadgets and finishes adds personal satisfaction but not real equity. Cooking in a beautiful space feels great, but calling it an investment is misleading. A kitchen should suit your lifestyle, not drain your savings. Meals taste the same whether cooked on marble or laminate if you love making them.

Designer Furniture

Designer furniture promises craftsmanship and prestige, but the return on investment is mostly emotional. Famous names inflate prices, while construction quality often matches midrange pieces. Trends move quickly, and styles that once screamed sophistication soon look dated. Resale markets are niche, and few buyers pay anywhere near the original price. Even slight damage or fading can halve the value instantly. Many people discover that their “collectible” chair or sofa depreciates faster than their car. It’s fine to splurge on comfort or aesthetics, but expecting profit later is unrealistic. Buy furniture you love for its design or function, not its potential appreciation. True heirlooms are rare and usually accidental. If you want furniture that lasts, focus on solid construction rather than brand reputation. A comfortable seat and a sturdy frame offer more lasting satisfaction than any designer label ever could.

Exotic Pets

Exotic pets attract curiosity, but they’re costly commitments disguised as novelty. Specialized diets, enclosures, and climate control systems add thousands to ownership costs. Finding veterinarians qualified to treat them can be difficult and expensive. Regulations often restrict resale or rehoming, meaning you’re responsible for life. Many animals live longer than expected, creating decades of ongoing expenses. Some owners underestimate the time and expertise required, leaving pets stressed or unhealthy. These creatures belong in ecosystems, not living rooms. The “unique investment” rarely holds financial or emotional value once reality sets in. Feeding, housing, and maintaining them drains both wallets and patience. Resale is nearly impossible, and sanctuaries are overwhelmed. True animal lovers support conservation, not captivity. If you want companionship without the complications, traditional pets provide endless reward without requiring a trust fund or a miniature rainforest inside your home.

Solar Panels on the Wrong Roof

Solar panels can save money, but only in the right conditions. Shaded roofs, poor orientation, and low electricity costs make it hard to break even. Homeowners often overlook installation expenses, permits, and inverter replacements over time. Leasing programs sound attractive but can limit resale value since new buyers may reject the contract. Energy credits vary by state, making payback timelines unpredictable. A poorly planned system may take decades to pay off, and some never do. The smartest solar investments start with professional assessments, not enthusiasm alone. When done right, solar can work wonders. When done poorly, it’s just an expensive rooftop decoration. Maintenance also adds hidden costs that eat away at savings. Renewable energy is worthwhile, but only after careful calculation. The sun is free; converting its power efficiently is not. Doing the math before installation ensures your bright idea actually shines.

Cryptocurrency for Beginners

Cryptocurrency promises big rewards but demands deep understanding. New investors often chase trends without grasping volatility or security risks. Values can soar overnight and crash just as quickly. Scams, hacking, and forgotten passwords wipe out fortunes. Regulations shift constantly, leaving even cautious buyers exposed. Without experience or long-term strategy, most newcomers lose money rather than earn it. Success stories fuel the illusion that crypto is easy profit. In reality, it behaves more like gambling than investing for beginners. Mechanics and fees vary between platforms, making mistakes common and costly. For professionals, crypto can diversify a portfolio; for casual investors, it’s usually an expensive lesson. The best approach is caution, not enthusiasm. Investing should feel stable, not thrilling. If your heart races watching market graphs, it’s probably not an investment suited for your comfort zone or long-term peace of mind.

Landscaping Overhauls

Elaborate landscaping transforms curb appeal, but it rarely transforms your finances. Custom stonework, ponds, and exotic plants add beauty, not equity. Homebuyers appreciate tidy yards, not expensive maintenance. Water features leak, trees overgrow, and seasonal care costs pile up year after year. The more impressive the design, the more upkeep it demands. Landscapers often underestimate labor, and repairs double the budget quickly. While the yard may look magazine-ready, few buyers will pay extra for it later. Simpler designs age better and cost less. Practical touches like new grass, fencing, or lighting provide similar satisfaction for minimal investment. Landscaping should enhance your enjoyment, not your credit card balance. Unless you plan to stay for decades, those perfect flower beds become expensive souvenirs. Nature doesn’t care about design trends, and neither will your home’s next owner once maintenance season begins again.

Vacation Clubs

Vacation clubs promise flexibility and exclusive destinations, but most members soon discover they’re paying premium prices for limited freedom. Upfront fees and annual dues add up fast, and booking popular dates often feels impossible. Some clubs restrict destinations or impose blackout periods, forcing members into less desirable travel times. The value shrinks further when you realize how many comparable options exist online for lower prices. Selling or transferring membership is nearly impossible, leaving owners stuck with ongoing costs. While the idea of guaranteed luxury getaways sounds appealing, the reality is more paperwork and fewer choices. Independent travelers who shop around almost always find better deals without commitment. A vacation club may sound like an investment in experiences, but it functions more like an expensive subscription with too many rules. Travel should feel liberating, not like another financial contract that follows you everywhere.

Luxury SUVs

Luxury SUVs blend comfort and performance, but financially they make little sense. Their value plummets the moment they leave the dealership, and maintenance costs quickly multiply. Complex electronics and high-end materials are expensive to repair, while insurance premiums climb with each feature added. Fuel efficiency is rarely impressive, and depreciation outpaces that of smaller vehicles. For most buyers, the “luxury” part is mostly branding. A well-equipped midrange SUV delivers nearly the same comfort for a fraction of the long-term cost. Mechanics often note that luxury models require specialized parts and service, meaning repairs take longer and cost more. While they offer prestige and plush interiors, they rarely hold their worth. The smarter investment lies in practicality, not excess. A comfortable, reliable vehicle that doesn’t punish your wallet every year offers far better satisfaction than any badge promising status but delivering bills.

Swimming Pools

A backyard pool looks like the ultimate upgrade, but financially it’s almost always a losing game. Installation costs can exceed expectations, and maintenance never ends. Chemicals, filters, and heating bills accumulate month after month. Most homeowners underestimate the time and effort required to keep a pool clean and safe. When it’s time to sell, buyers often see pools as liabilities, not luxuries. They worry about repairs, insurance, and safety concerns. Unless you live in a region with year-round heat, a pool sits unused for much of the year while still costing money. For families who truly love swimming, it can bring joy, but calling it an investment stretches the truth. A pool adds enjoyment, not equity. The best financial decision is often joining a community pool instead of building one. Cool water is refreshing, but unexpected expenses have a habit of drowning budgets.

Home Theaters

Installing a home theater feels glamorous until the receipts start stacking up. Custom seating, acoustic panels, and high-end projectors can cost as much as a small car. Technology evolves so quickly that equipment becomes outdated within a few years. Repairs and replacements are constant, and resale buyers rarely pay extra for an elaborate setup. Most people eventually watch movies in the living room anyway. Streaming services have made entertainment so accessible that large-scale theaters feel unnecessary. Unless you’re a true film enthusiast with money to spare, it’s a vanity project more than a wise investment. The comfort of a simple flat-screen TV and soundbar offers nearly the same experience for a fraction of the cost. It’s fun to build a private cinema, but the financial payoff never arrives. The applause ends after opening night, leaving only dust and ongoing maintenance costs.

Luxury Bedding and Mattresses

Luxury mattresses and bedding promise life-changing rest, but few deliver more comfort than well-made midrange options. Many high-end brands charge extra for exotic materials and technology that add little real benefit. Some promote features like cooling gels or custom zones that sound impressive but feel similar after a few nights. Warranty claims are often tricky, and replacements can take months. A quality mattress doesn’t have to cost thousands. Proper support and consistent care matter more than fancy labels. As for designer sheets and duvets, their lifespan matches that of cheaper alternatives when washed regularly. Sleep improves through habits, not just products. Spending heavily for marginal gains rarely makes financial sense. Comfort is subjective, but depreciation isn’t. The satisfaction of a full night’s rest comes from relaxation, not brand reputation. A good mattress supports your back, not your debt balance or pride.

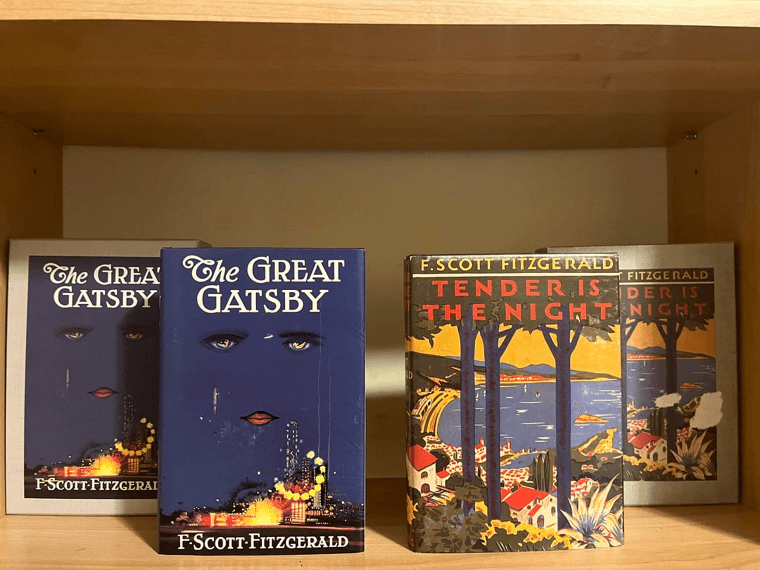

Rare Books and Memorabilia

Collecting rare books or memorabilia feels cultural and nostalgic, but it’s rarely profitable. Values depend on demand, which fluctuates with trends. Condition, authenticity, and provenance all determine worth, and maintaining them takes effort. Preservation requires specific environments, and restoration can erase value instead of adding it. The internet has also changed everything: once-scarce items appear online daily, reducing rarity. Counterfeits complicate resale, and genuine buyers are limited. Collectors often invest emotionally rather than logically, spending thousands for personal satisfaction rather than financial return. While owning history can be rewarding, it’s rarely lucrative. Most items never appreciate beyond inflation. Museums and serious investors dominate the top market tiers, leaving casual buyers in a sentimental niche. The safest return is enjoyment. History feels richer when shared, not sealed in climate-controlled storage waiting for a profit that never arrives.

Backyard Additions

Outdoor kitchens, fireplaces, and built-in bars elevate curb appeal but rarely investment value. Installation costs soar while practical use stays limited to fair weather. Harsh climates shorten lifespans, and repairs require specialists. Appraisers seldom assign extra value because future buyers may not share the same tastes. Outdoor features also demand maintenance—sealing stone, cleaning grills, and replacing fixtures yearly. Utility costs rise as well, especially for lighting or gas lines. Many homeowners love the space for gatherings but later admit it didn’t justify the expense. Simpler upgrades like patios or decks offer better returns and easier upkeep. Backyard additions should serve enjoyment, not financial goals. They’re luxuries meant for lifestyle, not ledgers. Creating outdoor comfort is worthwhile, but calling it an investment misleads. The best backyard feature is affordability, not extravagance that slowly fades under rain and sunlight.

Luxury Electronics

Top-of-the-line electronics impress for a season, but their value collapses once newer models arrive. Ultra-premium TVs, speakers, or appliances lose half their worth in months. Manufacturers release constant upgrades, making last year’s innovations feel outdated fast. Repairs are pricey, parts become unavailable, and warranties rarely cover advanced components. Many buyers mistake novelty for progress, forgetting that image quality and sound reach a point of diminishing returns. Midrange options now offer nearly identical performance for much less money. Technology that costs thousands today becomes bargain-bin material tomorrow. The smarter move is moderation—upgrade when necessary, not annually. True innovation should simplify life, not complicate finances. A home filled with “cutting-edge” gadgets often turns into a museum of obsolescence. The thrill of unboxing fades quickly, leaving only receipts. Investing in technology for bragging rights rarely pays off once the future inevitably arrives.