Shocking Post-Retirement Expenses

Retirement used to be a time to look forward to. But it’s becoming more and more expensive to retire now than ever before. Many people are shocked at all these sudden costs. Out of all the common expenses incurred by retirees, these are the costs that most surprised people after they retired.

Utilities

Utilities can be a pain to pay for at the best of times, but many retirees underestimate how much more expensive they can become. When you retire, you spend more time at home, which means you’re using (and paying for) more water, central heating, AC, and gas.

Leisure Activities

One of the best things about retiring is having endless time for leisure activities. Sadly, many leisure activities, especially things like sports that usually require specific gear, classes, and memberships, are unreasonably pricey. Unfortunately, this causes many retirees to give their activities up.

Dental Work

Dental work is essential for everyone, but it’s particularly important for retirees with older teeth. Basic care can cost up to $100 if you have X-rays, and if more extensive work is needed, the expense soon racks up. This can quickly eat up much of a retiree’s monthly budget.

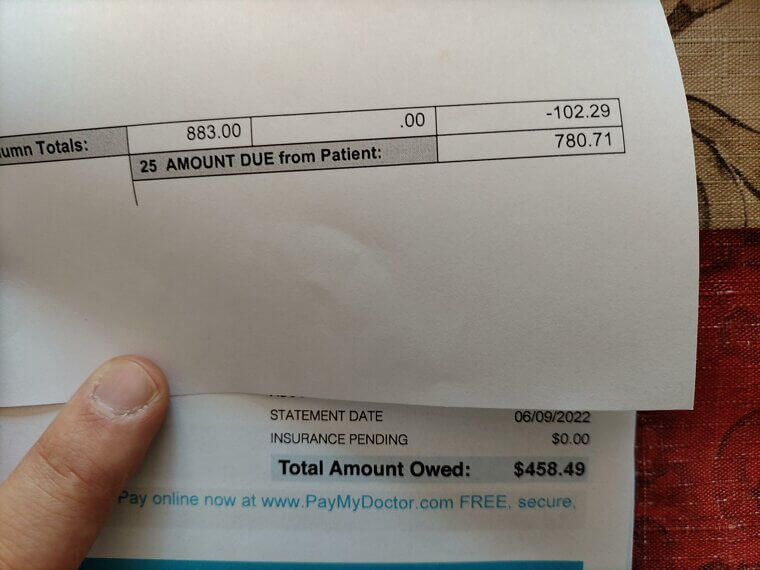

Healthcare

We’ve all heard the nightmare stories about high healthcare costs, and these only rise with age. When planning for retirement, most people don’t set aside enough potential funds to cover a medical emergency, and this can be disastrous if they need sudden healthcare. The future of healthcare expenses still seems uncertain.

Home Maintenance

Plenty of retirees enjoy having more time to spend working on their homes, but that doesn’t come for free either! From things as simple as tools and cleaning products to the cost of hiring a professional laborer, home maintenance can quickly become more expensive than you’d expect.

Groceries

Retirees live on fixed monthly budgets, so it’s essential to make that money go as far as possible. Sadly, groceries are heavily affected by inflation, and many retirees are having to sacrifice certain products to keep their grocery costs down. Even cheaper store brands have inflated their prices.

Public Transport

Many older retirees give up driving in favor of taking public transport. And while this is a more cost-effective travel option, it’s still an unexpected expense if used regularly. Bus fares are now around $2.50 each way, proving that even the most basic expenses can snowball.

Supporting Family Members

Family doesn’t end when your kids turn 18! Retirees have more free time to enjoy with their family members, but this also means freeing up some funds to support them when they need help. Sadly, inflation in all sectors has made it more difficult to extend these kind gestures to family.

Vacations

Who wouldn’t want to spend their retirement living it up abroad? But everything about vacations, from the cost of travel to accommodation to food and drink, has become ridiculously expensive. If you can’t comfortably cover regular expenses, retirement vacations are, sadly, off the table.

Medical Prescriptions

It’s important to keep up with your prescriptions as you age. But what many retirees forget is that current American prescription drug prices are some of the highest in the world! Medical prescriptions are vital to maintaining good health, but they’re also painfully expensive at times.

Caring For Pets

Most retirees adopt pets once they’ve ceased working, and it’s a great way to get company and regular exercise. And while it’s easy to add pet food to your weekly budget, a sudden trip to the vet can end up costing thousands! But this is an essential expense for our furry friends.

Insurance

It seems like everything needs insurance. Your home, car, health, and pets all need separate policies in case anything happens, but that doesn’t make them any easier to pay for. Retirees end up spending thousands on each, and these policies can also increase in price.

Vehicle Upkeep

While it’s true that older people, like retirees, pay less for things like vehicle insurance than younger generations, taking care of a car is still no cheap task. Fuel, repairs, and regular check-ups all eat into your budget, and serious maintenance jobs can cost hundreds or even thousands.

Accessibility Upgrades

Sometimes, we have to admit that we aren’t as young or able as we used to be. Older retirees are one of the main demographics who need accessibility upgrades made to their homes, but they often don’t expect to be forced to pay so much just to get around their own houses.

Entertainment

Many retirees don’t like having empty free time when they leave their jobs, so they find ways to entertain themselves. But even at-home entertainment, such as streaming platforms, can take a large bite out of the fixed budget, and more people are having to choose boredom.

Future Planning

Nobody wants to think about a future where they’re ill or dying, but it’s crucial to plan for all eventualities once you get older. Retirees have lots of time to assess their finances, but they often don’t expect to have to put so much aside for things that haven’t happened yet.

Technology

Almost everybody is complaining about how ridiculously overpriced technology has become, and it’s starting to hit retirees, too. Most retired people have been paying for technology for years, but when they have more time to enjoy it, they realize how much it costs them.

Gifts

Everybody gives gifts, but most working people are always rushing to buy them around their busy schedules. Retirees, on the other hand, have more time to shop and browse, and then it hits them that many gifts, especially around Christmastime, are priced up past what they’re worth.

Emergency Funds

If there’s one thing you can do after you retire, it’s set aside funds for emergencies! However, this is easier said than done. Some emergencies may require hundreds of dollars, and it’s hard to save that on a fixed pension when you also have endless, more immediate financial obligations.

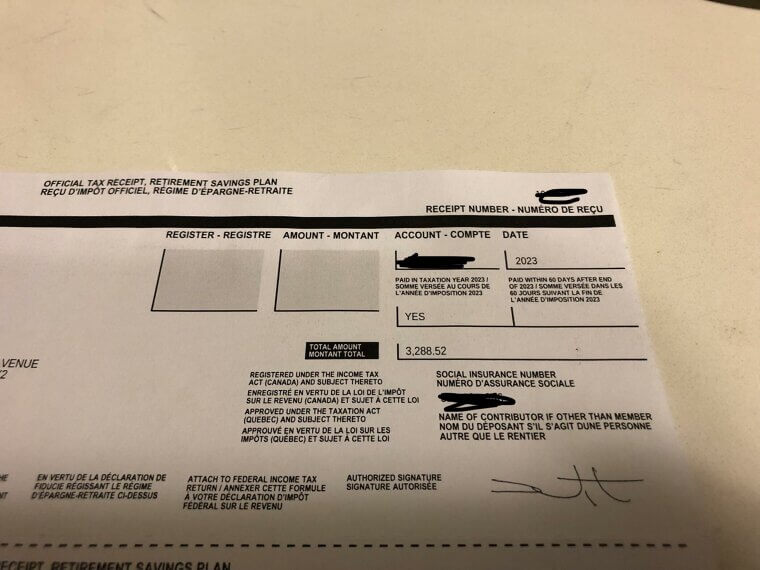

Retirement Taxes

While it may seem like we’re ending this list on an obvious expense, retirement taxes can actually be far higher than you expect. There are state laws regarding tax exemptions, but pensions and other forms of retirement income are still taxed at various state and national levels.