Streaming Subscriptions Add Up

Subscribing to multiple streaming services might seem like a small expense, but these monthly fees quickly accumulate. With the convenience of on-demand entertainment, it’s easy to overlook the total cost. Many sign up for services they rarely use, letting money slip away unnoticed. Often, people forget to cancel free trials, leading to unexpected charges. Evaluating which platforms you truly use can help trim these unnecessary expenses.

Cutting down on subscriptions can save a surprising amount. Reviewing your streaming habits and canceling unused services is a smart financial move. Keep an eye on these recurring costs!

Ordering Takeout and Delivery

Ordering takeout and delivery can be a significant drain on your finances. It’s convenient and saves time, but the costs add up quickly. Frequent takeout orders often include service fees, delivery charges, and tips, making them more expensive than preparing meals at home. Additionally, indulging in sodas and extras can escalate costs further. By cooking at home more often, you can save a substantial amount of money.

Cutting back on ordering in can significantly reduce your expenses. Plan meals and shop for groceries to keep more money in your wallet.

Bottled Water Purchases

Grabbing a bottled water on the go is a habit that's more costly than it seems. While convenient, these purchases add up quickly, straining your budget. Opting for a reusable water bottle can save you money and reduce environmental impact. Bottled water often costs significantly more than tap, and the expense becomes substantial over time. Consider investing in a quality water filter for home use.

Switching to reusable bottles can be a simple yet effective way to save money. Make the change today and watch your savings grow!

Daily Coffee Purchases

Grabbing a cup of coffee on your way to work might seem like a small expense, but it adds up quickly over time. Many of us indulge in this daily ritual without realizing its impact on our finances. With each purchase, you’re potentially spending hundreds of dollars a year on something that could be made at home for a fraction of the cost. It’s a classic example of convenience over savings. By brewing your own coffee, you can significantly cut down on unnecessary expenses.

Reevaluating this habit could help you save more money for other priorities. Consider trying a cost-effective alternative today.

Leaving Lights On

Forgetting to turn off lights when leaving a room is an everyday habit that many overlook. This small action can lead to significantly higher electricity bills over time. Even energy-efficient bulbs, when left on unnecessarily, contribute to waste. Developing a habit of switching off lights can save money and energy. Consider using timers or smart home devices to automate this process. It's a simple change with big savings.

By being mindful of lighting usage, you can cut down on wasteful expenses. Small adjustments in daily habits ensure you keep more money in your pocket.

Adjusting Thermostat Frequently

Constantly adjusting the thermostat might seem harmless, but it can significantly increase energy bills. Each degree you lower or raise can add up over time, leading to unnecessary expenses. Instead of constant changes, try setting a consistent temperature and dress accordingly for the weather. This stability can help reduce energy usage and keep your home comfortable. Small adjustments in habits can lead to big savings.

By being mindful of thermostat settings, you can maintain comfort while reducing costs. Simple changes in behavior can effectively lower monthly energy expenses.

Leaving the Tap Running

Many of us leave the tap running while washing our hands or brushing our teeth, not realizing how quickly this habit can add up in water bills. It might seem trivial, but those extra minutes with the tap on lead to gallons wasted daily. Reducing water usage not only helps the environment but also keeps money in your pocket. Every small adjustment adds up over time. Think twice before leaving it running.

Cutting down water waste is simple yet effective. Make a habit of turning off the tap when not in use, and watch your savings grow.

Capsule Coffee Convenience

Single-serve coffee makers have become a staple in many kitchens, offering speed and convenience. However, each capsule can cost considerably more than brewing a traditional pot of coffee. The convenience of popping in a pod often overshadows the cumulative expense. Over time, these seemingly small costs can add up, draining your wallet without you realizing it. Switching to a more economical brewing method can save you significant money.

Reconsider your coffee-making habits to curb unnecessary expenses. Opt for bulk coffee purchases and reusable filters to cut costs. You'll enjoy your brew without overspending.

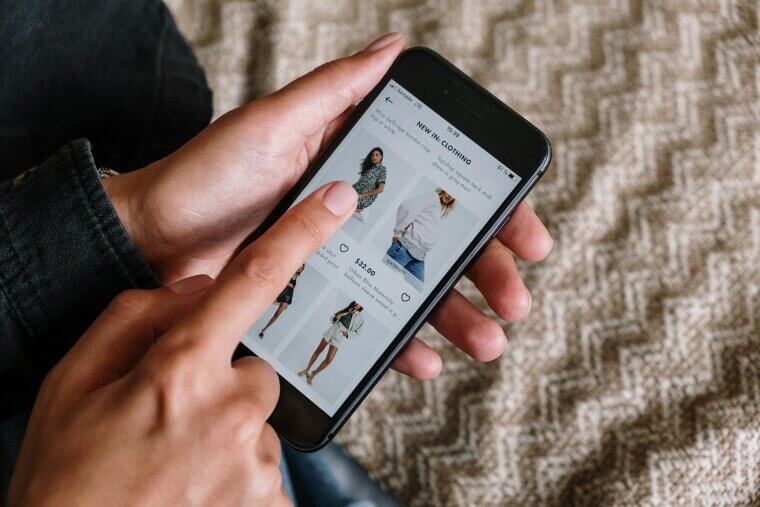

Online Shopping Splurges

Scrolling through online stores can be a soothing activity, but it often leads to unplanned purchases. Those seemingly small buys add up quickly, impacting your budget more than you'd expect. The convenience of shopping from your phone makes it easy to overlook the total cost. Notifications about sales and discounts entice you to spend more. It's important to set limits to avoid overspending.

By recognizing the impact of online shopping, you can make more mindful choices. Setting spending limits helps maintain control and reduces unnecessary expenses.

Ordering Takeout at Work

Grabbing a quick takeout meal at work seems convenient, but it can silently drain your finances. The allure of ready-made food saves time but adds up quickly in cost. Over time, these seemingly small expenses can lead to a significant dent in your budget. Preparing meals at home and bringing them to work is a practical alternative. It not only saves money but also allows for healthier, personalized options.

Cutting back on takeout can significantly bolster your savings. A few changes in daily habits can keep more cash in your pocket.

Leaving the Fridge Open

Leaving the refrigerator door open while deciding what to eat is more costly than it seems. This habit leads to energy waste as the fridge works harder to maintain its cool temperature. Every extra second the door stays open adds to your electricity bill over time. Additionally, it can compromise food quality, leading to more frequent grocery trips. Small changes in behavior can help save money and energy.

To cut down costs, always decide what you need before opening the fridge. Simple habits like this can keep your wallet and the environment happy.

Convenience Store Impulse Buys

Stopping by convenience stores for quick snacks or drinks might seem harmless, but these frequent purchases add up quickly. The allure of convenience often leads to impulse buying, tempting you with items you don't necessarily need. Whether it's grabbing a soda, candy, or magazine, these small expenses can accumulate over time. By planning ahead and sticking to a grocery list, you can avoid the trap of overspending. Curbing these habits helps save money.

Next time you stop by for a quick purchase, think twice about what you really need. Small changes can lead to big savings over time.

Leaving Lights On

Forgetting to turn off lights is a small habit that can lead to big energy bills over time. Those extra costs add up, especially if multiple lights are left on in various rooms. It’s a common oversight in our busy lives, yet simply switching off the lights when leaving a room can make a noticeable difference. Additionally, using energy-efficient bulbs can help cut down on unnecessary expenses. Being mindful of this habit can keep costs down.

Taking a moment to switch off lights can lead to significant savings. Small changes in daily routines can make a big difference in your utility bills.

Printed Newspaper Subscriptions

Subscribing to printed newspapers might seem like a nostalgic habit, but it can quickly add up in cost. With digital alternatives readily available, the expense of print subscriptions often goes unnoticed. Many people are drawn to the tactile experience of flipping through pages, but this preference comes at a price. Additionally, print newspapers can clutter your space, creating more hassle than value. Considering digital subscriptions can save both money and space.

Switching to digital alternatives can significantly reduce costs and clutter. Embrace the convenience and savings by opting for online news. Make a small change for a big impact.

Overbuying Toilet Paper

Have you ever found yourself buying more toilet paper than you need? It's a common trap that many of us fall into, thinking we're saving money by purchasing in bulk. However, overbuying can lead to unnecessary spending and wasted storage space. You might even forget about the extra rolls stashed away, leading to buying even more. By being mindful of your actual usage, you can avoid flushing money down the drain.

Rethink your purchasing habits and consider buying only what you need. Being conscious of how much you use can lead to significant savings.

Running the Dishwasher Half-Full

Running the dishwasher when it's not full is a habit many of us have, but it can lead to unnecessary expenses. Each cycle uses water and electricity, and over time, these costs add up. By waiting until the dishwasher is fully loaded, you can reduce the number of washes and save money. It’s a simple adjustment in routine that can significantly lower utility bills. Small changes can make a big difference.

Consider the impact of small daily decisions. Adjusting habits like maximizing dishwasher loads can help you save money effortlessly. Every little bit counts toward reducing your monthly bills.

Frozen Vegetables Convenience Trap

Opting for frozen vegetables might seem like a time-saver, but it’s a sneaky way to waste money. While they offer convenience, the cost per serving is often higher than fresh produce. Additionally, frozen veggies may lack the flavor and nutrients of fresh ones, making them less satisfying. Over time, relying on these can add up, draining your grocery budget significantly. Consider buying fresh, seasonal produce to save money.

Choosing fresh vegetables over frozen not only cuts costs but enhances flavor. Being mindful of these everyday habits can save money. Small changes lead to big savings.

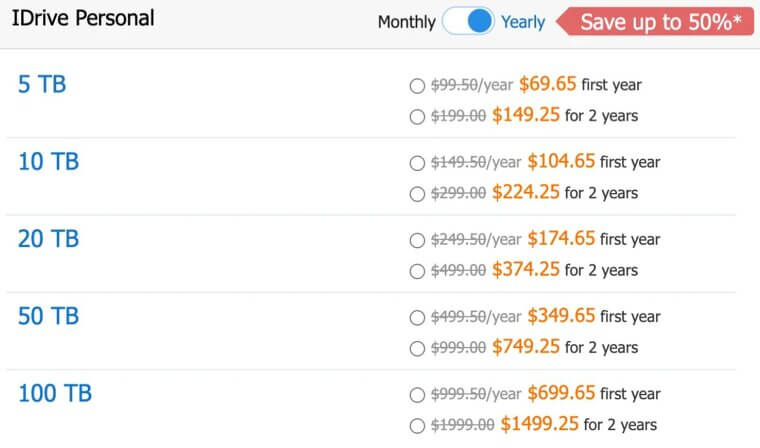

Online Storage Subscription Costs

Subscribing to online storage plans often leads us to overestimate our needs, resulting in unnecessary expenses. Many choose plans with more space than required, simply for peace of mind or future-proofing. This habit can be costly, as you might be paying for storage you never actually use. Evaluating your real storage needs and adjusting your plan accordingly can help avoid wasting money. It's a simple step towards better financial management.

Being mindful of your actual usage can help you choose a more cost-effective plan. Don't let the allure of extra space drain your wallet unnecessarily.

Dining Out for Drinks

Enjoying drinks out with friends can quickly become a costly habit. Each cocktail or mixed drink at bars and restaurants tends to be marked up significantly compared to making the same at home. While the social experience is enjoyable, it’s easy to lose track of spending when buying rounds for the group. This can add up substantially over time, putting a noticeable dent in your budget. Keeping an eye on this expense can save money.

Consider moderating your outings to occasional treats rather than routine splurges. This way, you can enjoy social gatherings without overspending. Remember, moderation is key!

Automatic Car Wash Expenses

Regular visits to automatic car washes might seem like a minor expense, but they can significantly add up over time. Each wash takes a toll on your budget, especially if it's a frequent routine. While convenient, these services often come with hidden costs, including environmental fees and tips. Opting for a DIY wash at home can save a chunk of money annually. Plus, it gives you more control over the products used.

Consider washing your car at home to cut down on these unnecessary expenses. It's a simple change that can accumulate significant savings over time.

Leaving Chargers Plugged In

One everyday habit that quietly drains your wallet is leaving chargers plugged in when not in use. These devices continue to draw electricity, a phenomenon known as "phantom power." Over time, this small but constant energy usage can inflate your electricity bills. Many people overlook this waste, assuming such a minor action couldn't have a significant impact. However, collectively, it adds up, costing more than anticipated. Be mindful, unplug when not needed.

To save money, unplug chargers and devices when they're not in use. This simple action can prevent unnecessary energy usage and reduce your electricity bills.

Frozen Meals Add Up

Relying on frozen meals might seem like a convenient solution, but their cost can add up over time. While they offer quick preparation and portion control, the price per meal is often higher than cooking from scratch. These pre-packaged foods may also lack the nutritional value of fresh ingredients. By planning and preparing meals in advance, you can save money and improve your diet. Consider alternatives to cut costs.

Switch to cooking fresh to save money and boost your health. Preparing meals at home can be more cost-effective and nutritious than relying on ready-made options.

Too Many Pet Toys Waste Money

While it’s tempting to spoil our furry friends with toys, buying excess pet toys is a common money-wasting habit. Many toys go unused, quickly forgotten by pets, or destroyed in minutes. This means frequent replacements and unnecessary expenses. Instead, rotating a few favorite toys can keep your pet entertained without breaking the bank. Recognizing this spending habit can help manage costs and reduce clutter.

Consider budgeting and prioritizing quality over quantity when it comes to pet toys. Focusing on essentials saves money and keeps your pet happy.

Watering Lawns Excessively

Overwatering your lawn might seem harmless, but it's a common habit that wastes a surprising amount of money. Many people set their sprinklers on automatic timers without considering the actual water needs of their grass. This leads to unnecessary water usage, especially during rainy seasons. Ignoring efficient watering practices not only inflates your water bill but also contributes to resource wastage. Adjusting your watering habits can significantly cut costs.

Being mindful of your lawn care routine can save you money and help the environment. Consider investing in smart sprinkler systems or simply adjusting your current practices to reduce waste.

Bike Sharing: Hidden Costs

Riding a shared bike seems like a cost-effective and eco-friendly choice. However, frequent usage fees can quickly add up, especially if you exceed the time limits. Many people overlook the impact of these small charges on their monthly budget. Additionally, some services require a subscription fee, increasing the overall expense. While convenient for short trips, relying heavily on bike-sharing can quietly drain your finances over time.

Consider how often you use shared bikes and explore alternatives. Small changes can lead to significant savings and help keep your budget in check.

Holiday Impulse Buys

During the festive season, it's easy to get caught up in the excitement of holiday shopping. Many people find themselves purchasing ornaments and decorations on a whim, often without considering the cost. These small, frequent purchases can add up quickly, draining your holiday budget faster than you realize. By planning ahead and setting spending limits, you can avoid overspending on items that may not be necessary. Be mindful and spend wisely.

Remember, sticking to a budget and resisting impulse buys can keep your finances in check during the holidays.

Bulk Buying Temptations

Shopping at wholesale stores can lead to unintended spending. The allure of buying in bulk often results in purchasing more than necessary. While discounts seem appealing, the costs can add up quickly. Items bought in excess may expire before use, leading to waste. Additionally, impulse buys are common in these environments, further draining your budget. It's easy to overlook how these habits contribute to financial leakage.

Be mindful of your buying habits and stick to a list. This helps avoid unnecessary expenditures and maximizes the value of your purchases.

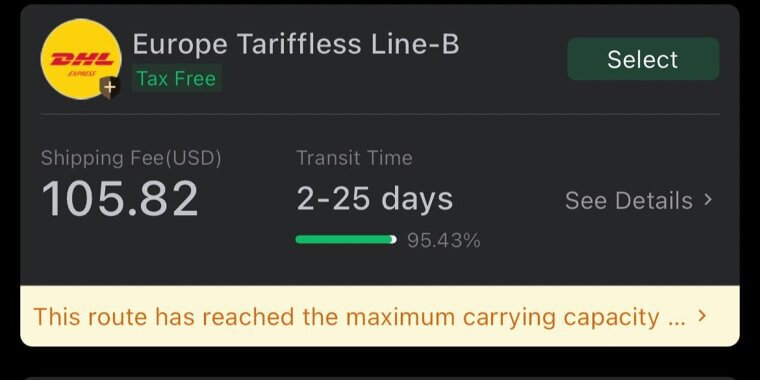

Online Shopping Shipping Costs

Paying high shipping fees is a common money-wasting habit many overlook. When placing online orders, it's tempting to choose express delivery for convenience. However, these fees can significantly inflate your total spending. Often, opting for standard shipping can save money without sacrificing much time. It's essential to consider whether the convenience of faster delivery is worth the additional cost. Being mindful of shipping options can help keep your budget on track.

Choosing slower shipping methods can save money in the long run. It's crucial to weigh the necessity against the extra cost, helping to stretch your budget further.

Gym Memberships Gone Unused

Many people sign up for gym memberships with the best intentions, hoping to improve their health and fitness. However, life gets busy, and those visits can become infrequent or nonexistent. Despite this, monthly fees still come out of your account, quietly draining your finances. Over time, these unused memberships can add up significantly, costing you hundreds without delivering any benefit. It’s essential to evaluate if you’re truly getting your money’s worth.

Taking a closer look at your gym usage can help you decide if it’s a worthwhile investment. Canceling or downgrading could save you money.

Vending Machine Purchases Waste Money

Vending machines offer convenience but can quickly drain your wallet. Each purchase might seem minor, yet these costs add up over time. The convenience fee you pay for a snack or drink could be better spent elsewhere. Plus, the allure of vending machine snacks often leads to impulse buys. By being mindful of these small expenses, you can significantly reduce unnecessary spending and save more money.

Opt for smarter spending by planning your snacks in advance. Preparing snacks at home can save money and reduce unhealthy impulse buys.

Smoothie Splurges That Add Up

Buying smoothies from trendy cafes can quickly drain your wallet. These delicious concoctions, often marketed as healthy treats, can cost significantly more than homemade versions. While convenient, purchasing them regularly can lead to surprisingly high monthly expenses. The allure of exotic ingredients and fancy packaging makes it easy to overlook their impact on your budget. Making your own smoothies at home can be a tasty and cost-effective alternative.

By switching to homemade smoothies, you’ll save money and enjoy fresher ingredients. It’s a simple change that can lead to significant savings over time.

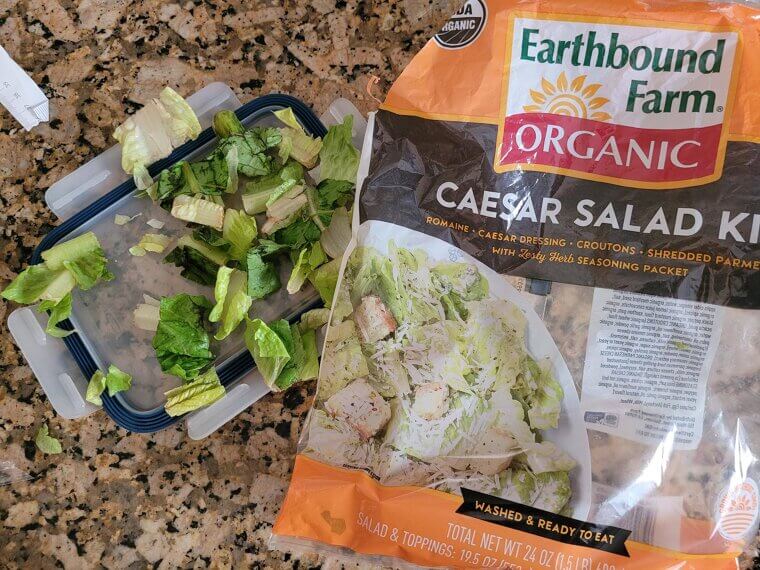

Pre-Packaged Salad Kits Waste Money

Pre-packaged salad kits are a convenient choice but often lead to unnecessary spending. While they save time, the cost per serving is significantly higher than buying fresh ingredients separately. These kits can also result in food waste if not used promptly, as the greens wilt quickly. By assembling your salads from scratch, you not only save money but also enjoy fresher, more customizable meals. Investing a bit of time pays off.

Consider preparing your own salads to reduce costs. It’s a simple change that can lead to substantial savings and less food waste over time.

Scented Candles Burn Cash

Scented candles can be a delightful addition to any home, filling the air with pleasant aromas. However, their allure often leads to overspending. The habit of purchasing multiple candles for different moods or occasions can quickly add up. Many people overlook how fast these small purchases accumulate over time. While they offer temporary joy, the financial impact lingers longer than their scent. Reevaluating this habit can save money.

Consider cutting back on candle purchases to boost your savings. Opt for more budget-friendly alternatives to maintain ambiance without draining your finances.

Luggage Wrapping Costs Money

Wrapping your luggage at the airport might seem like a smart way to protect your belongings, but it’s also a sneaky expense. While it promises safety from scuffs and unauthorized access, the cost adds up quickly, especially if you travel often. In most cases, the wrapping is unnecessary, as your suitcase is durable enough for the journey. Instead, consider investing in a good lock or more resilient luggage.

By avoiding this extra expense, you can save money for more meaningful travel experiences. Small changes in your travel habits can lead to considerable savings in the long run.

Disposable Razors Drain Cash

One everyday habit that quietly empties your wallet is purchasing disposable razors. These items might seem inexpensive, but their cost accumulates quickly over time. Many people opt for disposable razors for convenience, overlooking the fact that buying them repeatedly is far more costly than investing in reusable options. Moreover, the quality of disposable razors often leads to more frequent replacements. Recognizing this can steer you towards more cost-effective shaving solutions.

Opt for reusable razors to save money and reduce waste. Making this small change can lead to significant long-term savings while also benefiting the environment.