These Daily Purchases Are Money Drains to Be Aware of

Money is hard to come by - (you have to actually work for it, for starters) - and once you’ve got it, it’s all too easy to lose. From morning cups of coffee to the gasoline in your tank, there are several everyday purchases that could be costing you much more than just money, but financial peace of mind, too.

Daily Coffee Runs

Like the people writing this, your morning probably cannot properly start until you’ve had a cup of coffee in you. However, while you may be tempted to stop at your local Starbucks on your way to work, we recommend making your coffee and enjoying it at home - you could be spending up to $1,300 annually on coffee alone.

Bottled Water

Let’s face it, water really shouldn’t be something we have to pay for, ever, but such is the society that we live in. However, while you can purchase bottled water every day, your wallet would be much happier if you invested in some reusable ones instead, and maybe a filter as well.

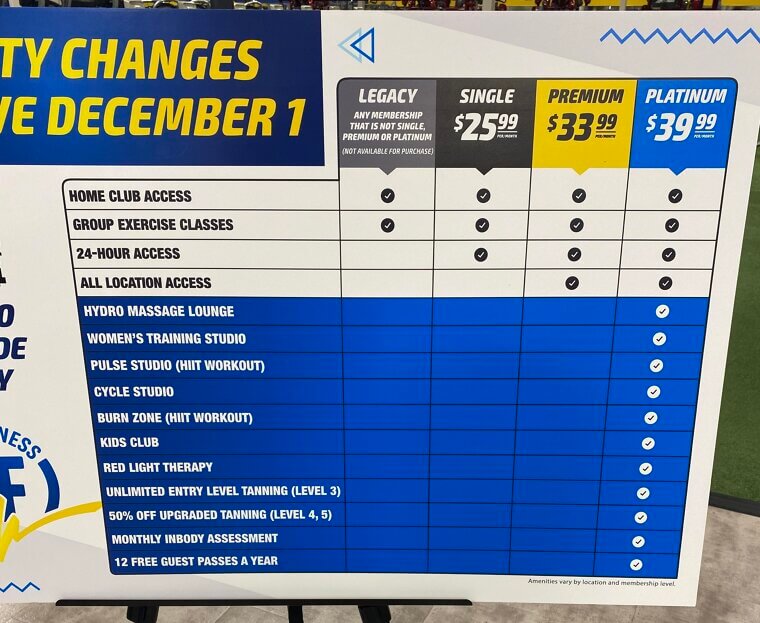

Unused Subscriptions

Remember that time when you were adamant about getting into shape and opened up an account at your local gym on a whim? Yeah, us too, and if you’re like us, you probably never made much use of it after the first few weeks. We know how awkward it can be to cancel your membership, but trust us, you’ll be doing your financials a favor.

Impulse Buys

An impulse buy doesn’t have to be anything big or expensive like a brand new pair of shoes - it could be something as small as a sweet treat that you tell yourself you really deserve. While that may be the case, you also deserve to have some financial security, so cut the impulse buys wherever you can.

Takeouts

Depending on your lifestyle, eating out or going to the drive-thru may very well be an almost daily habit. Of course, you don’t need us to tell you how much they’re tearing into your finances - you’ve seen the receipts yourself!

ATM and Bank Fees

Unless you’re living completely off the grid or prefer to store your money inside your mattress, you probably have a bank account, maybe even several. While convenient, visiting the ATM every day can quickly lead to some truly ludicrous bank fees.

Credit Card Interest

While not necessarily an “everyday purchase”, you may very well make use of your credit card almost every day! Just be sure to always pay off your purchases come month-end - carrying debt can cost you around $1000 per year.

Extended Warranties

When purchasing a piece of hardware, don’t be swayed by the charming salesperson assisting you. Most of the time, you really don’t need an extended warranty of any sort. They cost more, and they’re often worth even less since you likely won’t be making use of them anytime soon.

Dry Cleaning

Depending on the sort of clothes you wear, you may very well have no choice but to visit the dry cleaners fairly regularly. Keep in mind, however, that frequent visits can often cost thousands annually. It’s more frugal to save up for your own machine in the long run.

Laundry

While we’re on the subject of laundry, your washing habits can also cost you far more than they really should. Frequent use of hot water and constant use of a dryer can jack up your energy costs and potentially cut deeply into your finances. It’s cheaper to just air-dry all of your clothes.

Paper Towels

Paper towels may not be an everyday purchase for you, but depending on how frequently you make use of them, they very well could be. Buying reusable cloths is far cheaper in the long run, even if they can get a bit rancid from time to time.

Liquid Soap

Please don’t be alarmed - we are by no means suggesting that you cut out soap as part of your groceries or daily purchases. What we are suggesting is that you cut out liquid soap, which typically costs almost double the price of a regular old bar of soap.

Premium Phone Plans

Let’s face it, buying the brand new iPhone was probably hard enough on your finances as they were, but opting for the premium plan as well? Absolute murder. With WiFi being available pretty much everywhere you go, there’s often no need at all to opt in for a data plan, no matter how many premium features your service provider promises you.

Convenience Store Purchases

Convenience stores are nothing if not, well, convenient. You probably have one that you frequent almost every day. However, what’s less convenient is their tendency to add a markup to every single item in their store. We know, we hate supporting big chains, too, but they’re usually so much more reasonable with their prices.

Soft Drinks

Nothing beats a cup of Coke with a Big Mac, right? Well, maybe one thing: the money you’d save if you didn’t order a drink every time you ate out or got a takeaway. These often cost almost half of the meal itself, and if you’ve followed our advice so far, then you know you’ve got water at home!

New Models

No, we aren’t suggesting that our readers purchase the winners of America’s Next Top Model. We mean the iPhones, the Xboxes, and the TVs. Whenever a new model is released, there’s often pressure to get your hands on it immediately. But if we’re being real here, your old model probably still works just as well as it did when you got it.

Subscription Boxes

This one is fairly niche and isn’t prevalent all over the world, but with the rise of services like HelloFresh, which deliver goods straight to your door, there are more than a few people who subscribe to these sorts of goodie boxes. Take our advice: don’t. While their main content may seem totally worth the price, they often contain all sorts of unnecessary goodies to justify their totally ludicrous prices.

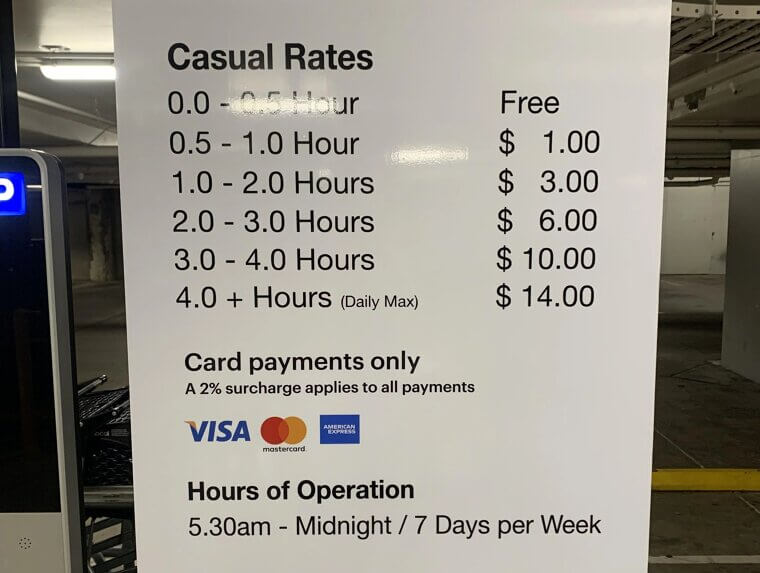

Parking Fees

This one’s almost unavoidable if you’re a daily driver. Wherever you go throughout your day, there are bound to be one or two places that insist on charging you for the “privilege” of parking on their premises. While these amounts may seem small, they can quickly add up. We recommend parking off-premises wherever possible.

Birthday Gifts

Birthday gifts aren’t everyday purchases, but they do have a tendency to crop up at all the worst times. We’re not saying you shouldn’t get your nephew that toy he really wanted - we’re just saying that you need to budget for it way in advance.

Petcare Products

Owning a pet can be one of the most wonderful experiences in the world, like having a furry family member that loves everything you do. However, they’re also expensive to own and require tight budgeting skills to keep them around. In short, you really shouldn’t be buying them a new pack of treats every day. And not just for your budget, but for your pet’s health as well!

Hair and Beauty Products

We all love it when our hair is smooth and soft, or when our faces are pretty and sparkling, but buying a new bottle of conditioner or lipstick every other day can and will dig into your budget more than you’d want it to.

Miscellaneous Purchases

There are a few products that we could file under “Miscellany”, things like batteries or wrapping paper, the sort of things that are super common, but which often don’t get accounted for when you’re drawing up your monthly budget.

Postage

Unless you’re a frequent and enthusiastic letter-writer, you probably won’t need to pay for postage every day. Chances are, however, that you will inevitably pay for it one time or another, and when you do, you’ll want to have thought about it in advance if you want to keep your budget intact.

Energy-Intensive Appliances

Getting rid of your refrigerator, microwave, or washing machine will probably do more harm to your budget in the long run. That being said, we recommend unplugging or making use of the energy-saving features on your appliances if you want to conserve your budget as much as possible.

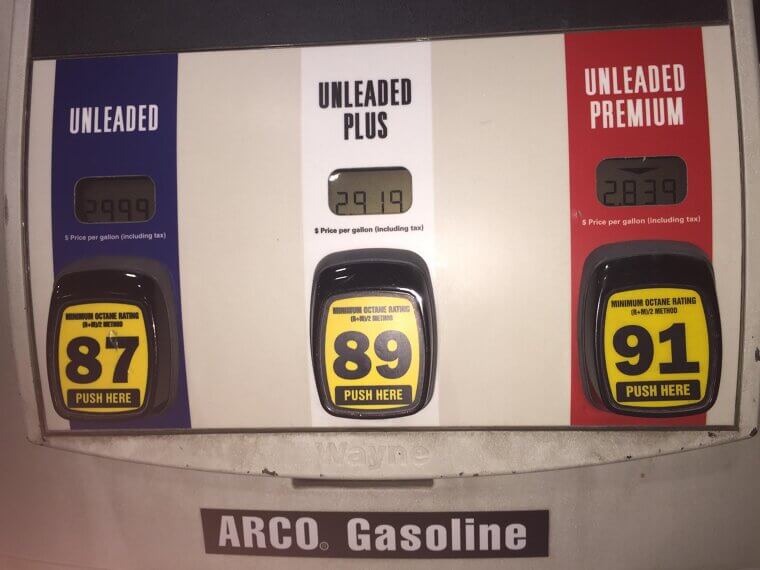

Fancy Gas

The very concept of “premium” gasoline is absurd in and of itself, but many people regularly opt for the stuff every day, even when regular gas will serve them just fine. It’s cheaper, and much kinder to your wallet.

Pre-Packaged Foods

Buying pre-packaged foods daily is like buying takeout every day, but make it diet. It’s still expensive, and it doesn’t last long. Buying in bulk is often cheaper in the long run.

Phone Charging

Even the manufacturer recommends that you take your phone off charge as soon as the battery is full! Leaving your phone plugged in for extended periods of time can really jack up your energy bills.

Home Maintenance

You probably don’t need to give the technician a call to service your refrigerator every day anyway, but chances are you’re not taking proper care of your appliances. While it may not be an everyday cost, not taking care of them can and will come to bite your finances in the future.

Utility Add-Ons

Remember cable? We sure do. These days, with the prevalence of streaming services like Netflix or Hulu, you probably won’t get much use out of your premium cable plan. Ditch the unnecessary utility add-ons and enjoy some healthier finances.

Demanding Social Life

We know how difficult it can be to keep everybody in your life happy, but it’s important that you prioritize your own well-being first - and that means keeping your finances in check, even if you have to miss out on the weekly get-together at the club from time to time.

Insurance Costs

Insurance is important, and being covered - be it for medical reasons or your vehicle - gives you a little peace of mind. It’s important to review, however, just how much that peace of mind is costing you. Next time your plan comes up for renewal, make sure you shop around to see if another provider can offer you a better deal.

Coupons and Gift Cards

This next entry isn’t so much something you do, but rather something you don’t do. Simply put, if you’re not making use of the coupons and gift cards you receive, you’re ultimately shooting your finances in the foot.

Pampering Sessions

You probably don’t visit the spa or salon every day, but once a week? Every two weeks, maybe? That’s definitely a possibility, and it’s one that can eat into your budget without remorse.

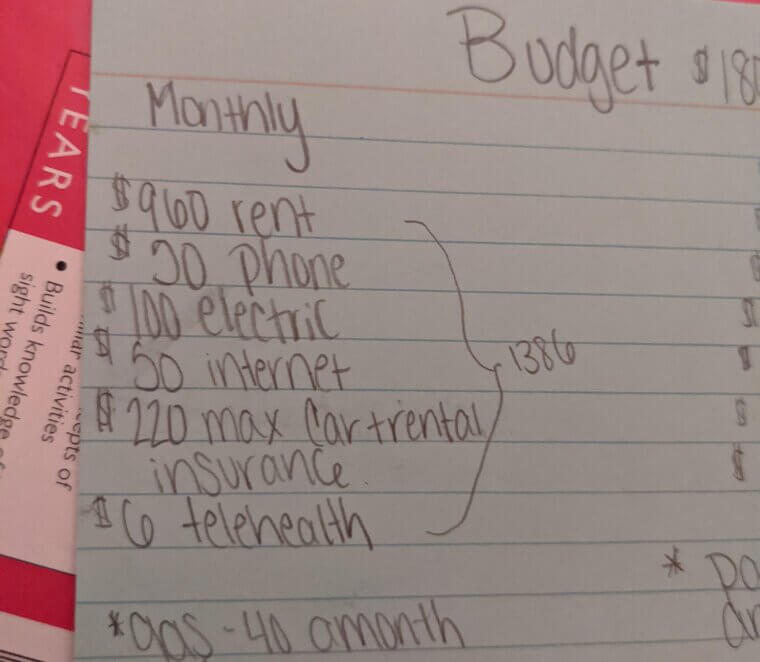

Lack of Financial Savviness

Financial savviness isn’t something that’s strictly taught in schools, but it should be. Our last entry may not be an everyday purchase, but it is an everyday cost, one that has probably lost you more money than you’d care to admit. Pay attention to your budget and where your money goes, and you may surprise yourself with how much you could have been saving all this time.