Premium Gas

Regular, premium, ultra-premium, but what's the difference? According to experts, not a lot. Premium Gas is designed to prevent engine knocking in sports cars, so unless you're driving one of those, you're paying extra for zero mileage or performance benefits. Stick to regular gas and you'll be shocked at how much you save.

Work Lunches

There's a reason our parents also said “we've got food at home”! Buying lunch from your cafeteria or a store every day quickly adds up, with some people spending $30 or more in one week. Financial planners recommend buying cheaper ingredients and making your own lunches to save cash and avoid impulse purchases.

Magazines

Whether you get them through a subscription or pick them up at the store, magazines are a small but significant leech on your finances. They're fairly cheap, but most people only flick through them once or twice before throwing them away. Why waste money when you can search up the articles you want to read online for free instead?

Bottled Water

Financial planners and environmentalists are in agreement on bottled water: it's not necessary! Buying single-use bottles over and over is a waste of money that will soon add up to the cost of buying a water filter to refresh your tap water instead. Bottled water is wasteful in several ways and prices will keep steadily rising, too.

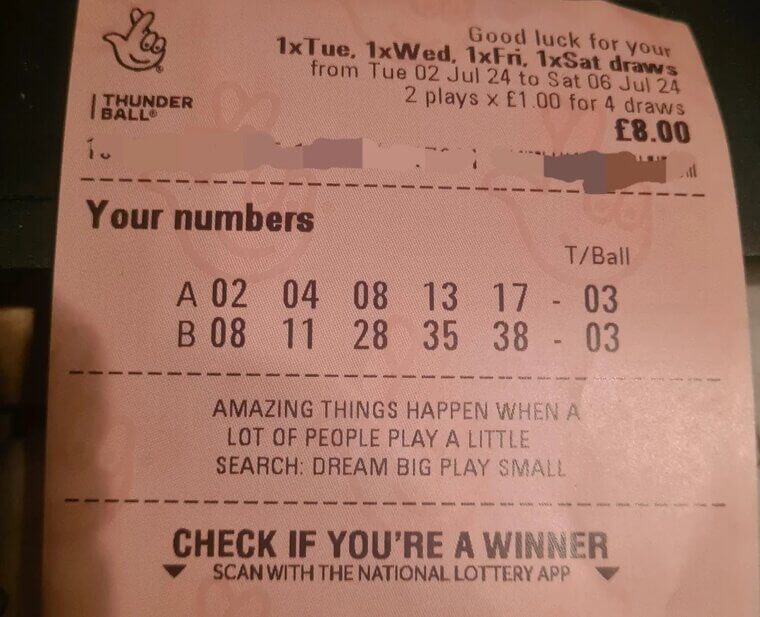

Lottery Tickets

We all know that feeling: just one more ticket and I'll win the jackpot. But how often does it happen? Many people spend tens or even hundreds of dollars on tickets only to win nothing and be left out of pocket. Financial planners note the catch-22 of continuously spending until you've got no spare change left.

Takeout Coffee

Takeout coffee regularly comes up in these discussions, and while giving it up won't make you a millionaire, it will still save you more disposable income. Coffee machines can be expensive, but you'll save much more over your lifetime making coffee at home than spending up to $5 on just one drink from a coffee shop.

Name-Brand Groceries

Sometimes, name-brand groceries do taste better, but buying everything branded can send your grocery bill skyrocketing into the hundreds. Financial planners even name food as one of the biggest expenses we have. Luckily, store-brand groceries often don't look or taste much different, and you'll have much more money left in your budget to spend on other necessities.

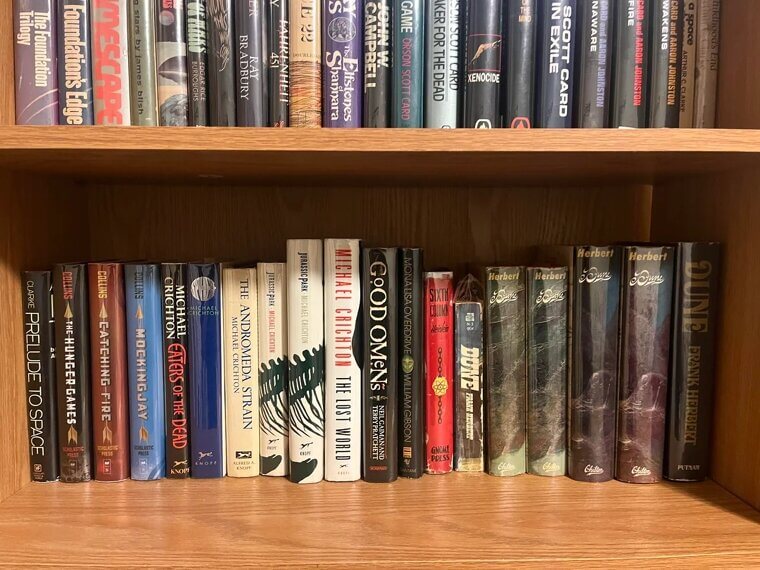

New Books

Books are great to own, but new books can cost between $8 and $10 each. Even the biggest bookworms need to cut down those costs if they want to save money, and there are some cheap solutions. Secondhand books generally cost at least half of what new ones do, or skip paying at all and borrow from your local library!

Car Accessories

Whether they're cute or stylish, car accessories are a fun but wholly unnecessary automotive addition that can cost a pretty penny. Financial planners recommend saving that money for unexpected repairs, yearly services, or gas, keeping your car as cheap and well-maintained as possible. Anything extra is a bonus.

Meal Kits

Meal kits were a great invention for people who didn't have much time to cook, but subscriptions are more expensive now and the boxes don't provide enough ingredients to truly get your money's worth. It's far more financially sensible to bulk-buy affordable ingredients and meal plan to get plenty of lunches and dinners out of your purchase.

Designer Clothing

One or two designer pieces is fine, but an entire designer wardrobe will quickly wreck your finances. Status-symbol outfits have inflated prices, and for the cost of one piece, you could buy several others from lesser-known brands. Designer clothing should be treated as a luxury if you need to save money.

Gift Wrap

Unfortunately, we can't cut every single-use item from our budgets, but we can definitely stop buying so much gift wrap. Especially at this time of year, financial planners recommend ditching gift wrap for reusable fabrics or jars that will help to save some extra cash for more worthwhile purchases or emergencies.

Paper Towels

How many paper towels do you use in a week? The roll may be cheap enough upfront, but you'd be surprised how much you spend on them every year. Buying fabric cloths that can be washed and reused is much cheaper in the long run, and you'll find that they're more absorbent too. Cut paper towels from your budget now.

High-End Makeup

Makeup is something else that many people spend a lot more on each year than they realize. This isn't generally an issue with drugstore products, but high-end brands like Chanel and Dior are extremely expensive. There are plenty of good drugstore makeups that do the job without cutting into your grocery or utility budgets.

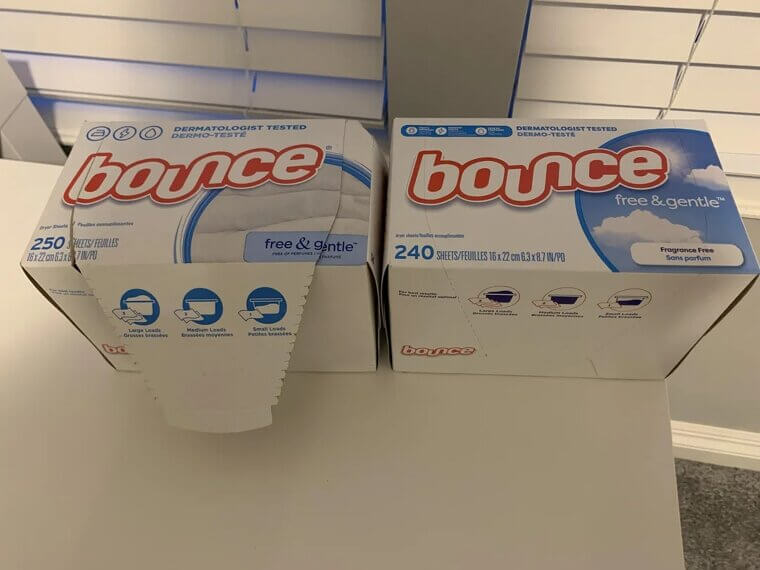

Dryer Sheets

Not only are they single-use, so purchased more often, and constantly rising in price, but dryer sheets also cause build-up in your machine that could require costly repairs down the line. To stay on the safe and financially-smart side, ditch dryer sheets and put that money elsewhere in your budget.

Alcohol

Unless you never drink, alcohol is something that we all spend money on in some capacity. The rising costs of drinks in bars and bottles in stores is both irritating and terrible for those who want to save money. If things are tight, cutting out alcohol could provide financial relief at a time when you really need it.

Fabric Softener

It's one of the biggest victims of recent shrinkflation, but fabric softener is committing money-related crimes of its own. It’s generally pricier than other laundry products, such as powder, and aside from a nice, fresh smell, it doesn't add a lot to the load. Cut it out now and save that money for something else.

Frozen Meals

Frozen foods are usually a good way to save some money, but entire frozen meals aren't that beneficial. They cost more, but only provide one dinner, whereas bulk-bought frozen ingredients can be used over weeks or months to create multiple meals. Stop paying extra for convenience.

Soda

Soda is a grocery staple for many people, but do you know how much you actually spend on it? Bulk packs of branded soda can be $10 or more, which quickly adds up if you consume a lot of it. It takes a chunk out of your grocery budget that could be spent on actual food, so financial planners recommend dropping it.