Investment Fraud

Investment fraud is a very old trick that continues to catch people off guard. Someone offers an opportunity that sounds perfect, with no risk and unusually big returns. These schemes often target retirement savings, playing on the desire for stability and peace of mind. Scammers may arrive with polished charts, official looking paperwork, and confident explanations designed to build trust quickly. They often create a sense of urgency, pushing you to decide before you have time to think or ask questions. That pressure is the real warning sign. Legitimate investments always involve some level of risk and never promise guaranteed profits. If someone insists the deal is safe, exclusive, or time sensitive, it is worth slowing down. Taking time to verify details can protect savings that took decades to build.

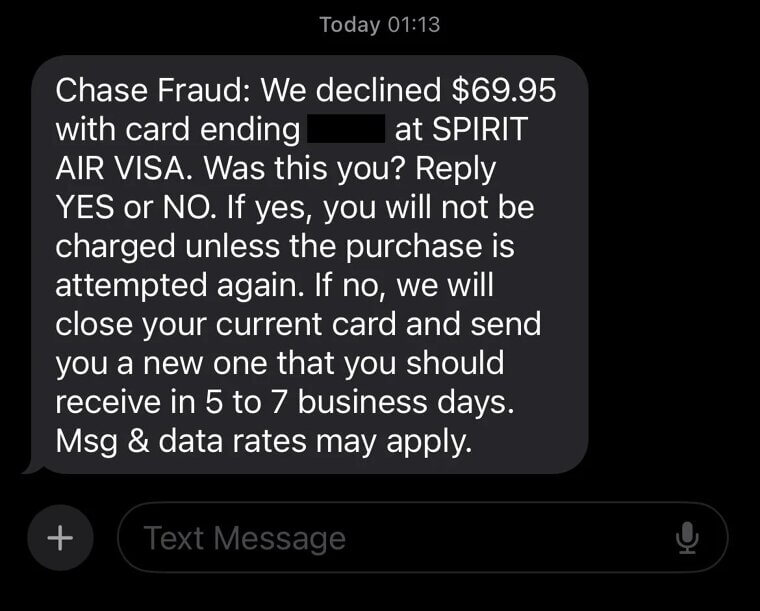

Fake Bank Fraud Alerts

This is one of the oldest tricks in the scammers’ playbook. The victim gets a text or email saying their bank has spotted a problem. It sounds serious and urgent, of course, and they want you to click a link or call a number right away. Once you do, they ask for login details.

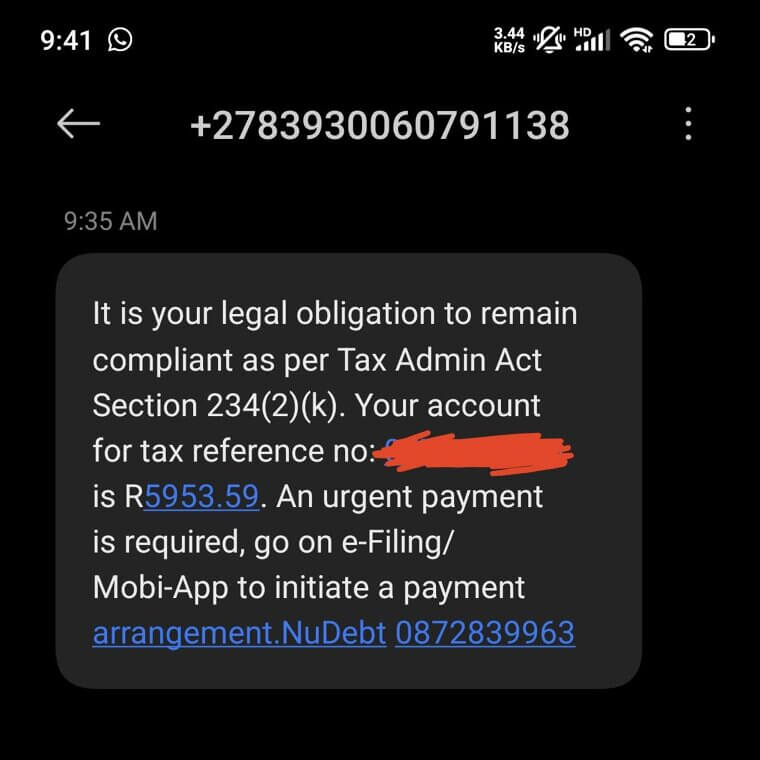

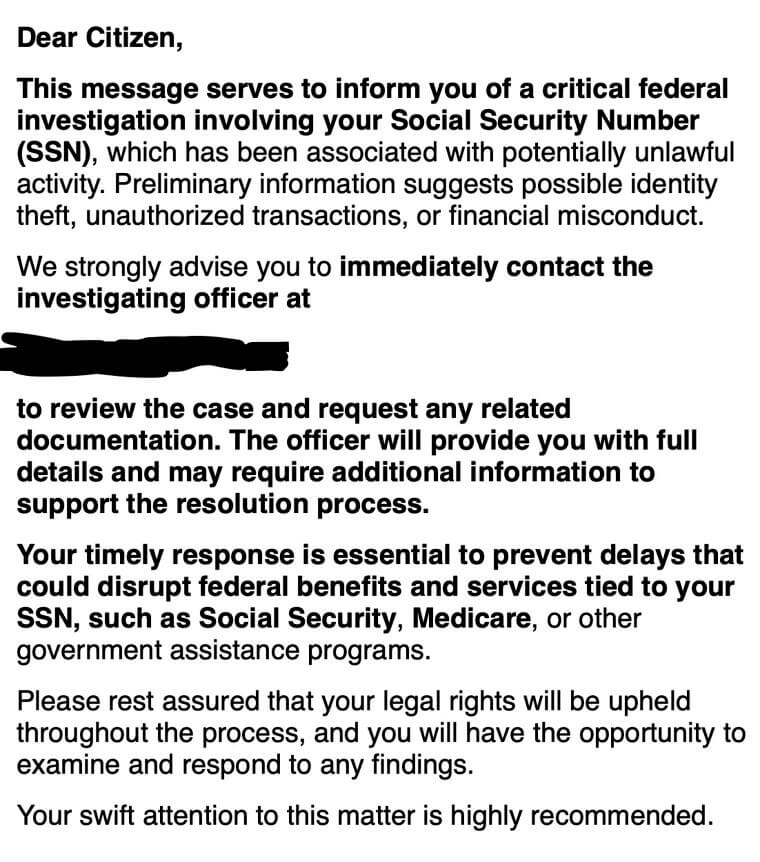

Impersonation Scams

Someone calls or texts claiming they’re from Social Security, the IRS, or Medicare. They sound official and a little scary. They say you owe money or broke a rule. Then they demand payment right now, often in gift cards or wire transfers. That’s the giveaway. Real government offices never collect money this way.

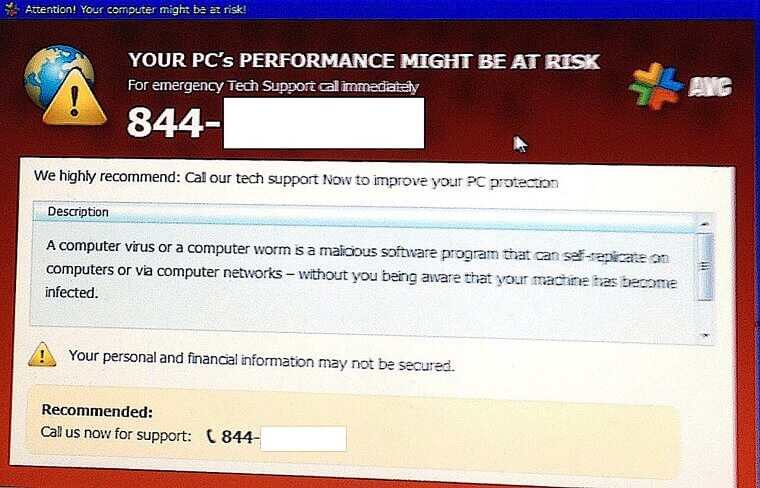

“Tech Support” Scams

Out of nowhere, someone calls saying your computer has a virus. They claim to work for Microsoft or Apple. They talk fast and sound helpful. Then they ask for remote access. Once they’re in, they steal passwords and bank info. Real tech companies don’t make surprise calls like this.

Sweepstakes and Lottery Scams

Someone tells you that you won a prize. It sounds exciting and official. Then comes the catch. They say you must pay taxes or fees first. That’s the scam. Real prizes don’t ask for upfront money. Once you send payment, the prize disappears along with the scammer.

AI Voice Cloning Scams

This one is relatively new and extra sneaky. Scammers use AI to copy voices. It really sounds like your child or grandchild. They call asking for urgent help or money. Panic kicks in fast. That’s the goal. Always pause, hang up, and call your loved one yourself to double-check.

Phishing Messages

These emails look very real. Logos, colors, and wording all seem right. They warn you about account problems and ask you to click a link. That link leads to a fake site. Once you type in details, scammers grab them. Always go straight to your bank’s website instead.

The Grandparent Scam

The caller says they’re your grandchild. They sound upset and rushed. They claim they’re in trouble and need money fast. They beg you not to tell anyone. That’s how scammers work. They push emotions hard. Always hang up and call your family directly before sending a cent.

Phone Banking Scams

Scammers call pretending to be from your bank. They sound confident and professional. They say your money is in danger and must be moved quickly. They push hard. Real banks don’t ask for transfers over the phone. If a call feels rushed or scary, hang up right away.

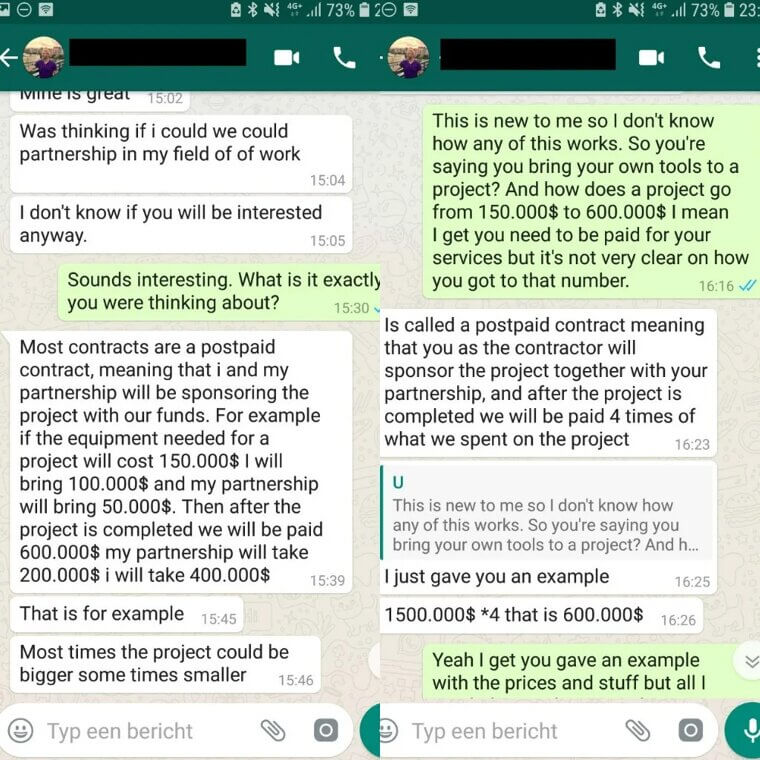

Romance Scams

These scammers take their time by building trust with their intended victim online. They listen, “love bomb,” and seem caring. Over time, they ask for money. There’s always a reason. Emergencies, travel issues, or business problems. They also avoid meeting in person, which should be a big red flag! Real relationships don’t depend on secret money transfers.

Charity Donation Scams

Scammers often strike after disasters. They tell emotional stories and ask for donations right away. They pressure you to act fast. That’s not how real charities work. Legit charities welcome questions and give proof. Always take time to check before donating. Kindness shouldn’t come with pressure.

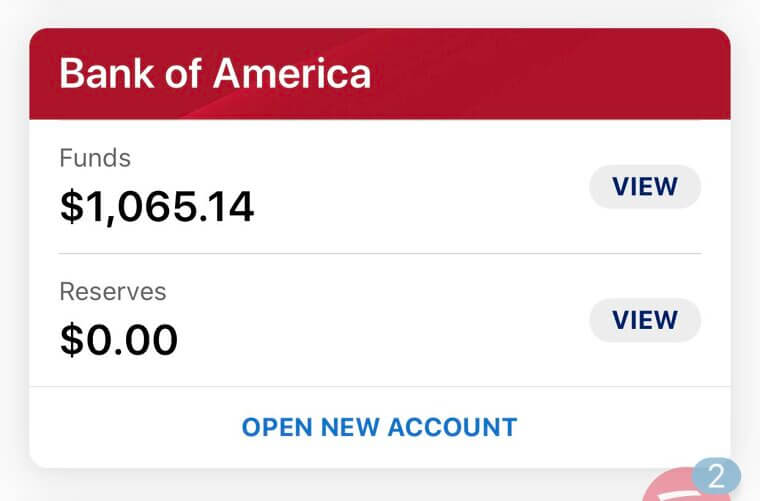

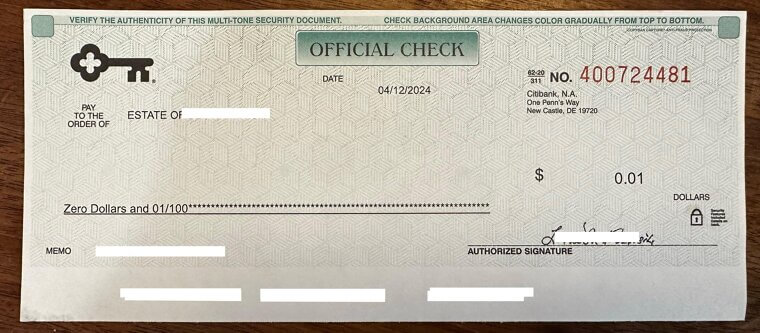

Check Overpayment Scams

Someone sends you a check for too much money. They say it was a mistake and ask you to send back the extra. The check looks real at first. Later, it bounces. Your refund was real money. Banks take it back. You end up losing what you sent, and they laugh all the way to the bank.

Enrollment Scams

Scammers offer help with Medicare plans. They promise better coverage or refunds. They ask for bank details or Social Security numbers. They sound friendly and helpful. Real Medicare doesn’t call asking for personal info, so this is one of those scams that hits hard. Sharing details can lead to stolen benefits and serious identity problems.

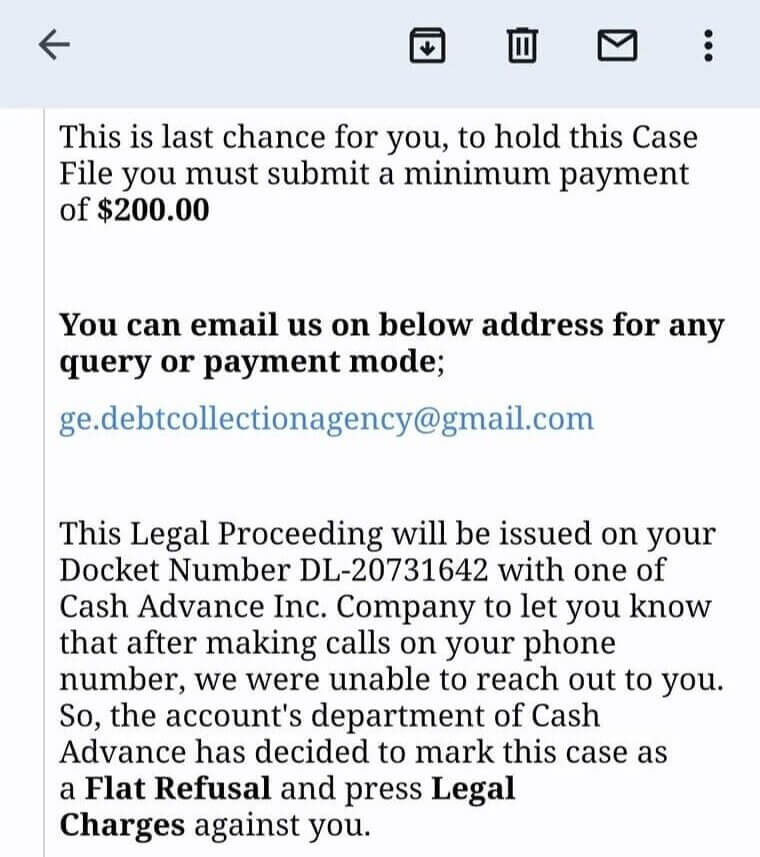

Fake Debt Collection

These callers say you owe money and must pay immediately. They threaten lawsuits or arrest, which scares a lot of seniors into complying. They demand gift cards or wires. Real debt collectors don’t work like this. They send written notices and give time to respond. Scammers rely on fear. Calm questions usually make them disappear.

ATM Skimming

ATM skimming is happening way more than it should. But how does it happen? Scammers attach small devices to ATMs. These devices steal card details quietly. Everything seems normal at first. Later, money starts disappearing. Always check the card slot before using it. Cover your PIN. Using ATMs inside banks adds an extra layer of safety.

Fake Banking Websites

Fake banking websites look almost perfect. One wrong click takes you there. You enter your login details, thinking it’s safe. Scammers capture everything. Always type your bank’s address yourself. Avoid clicking banking links in emails or texts, no matter how real they look - it’s usually a scam that sees you losing your money in the worst way possible.

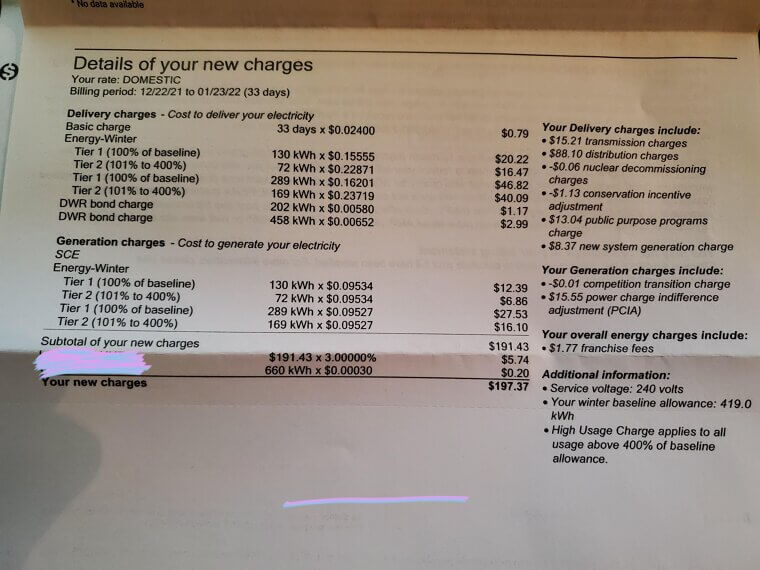

Utility Bill Scams

Scammers claim you missed a utility payment. They threaten to shut off power or water. They demand immediate payment, again through gift cards or apps - see the pattern? Real utility companies send notices first. They don’t rush you like this. Call your provider directly to check before paying.

Fake Insurance Offers

These scams sound amazing at first. Super low prices. Great coverage. No hassle. That’s how they hook people. They ask for payment upfront and promise paperwork later. Then they disappear. No policy ever existed. Real insurance agents explain details clearly, answer questions, and never rush you. Pressure and urgency are big warning signs.

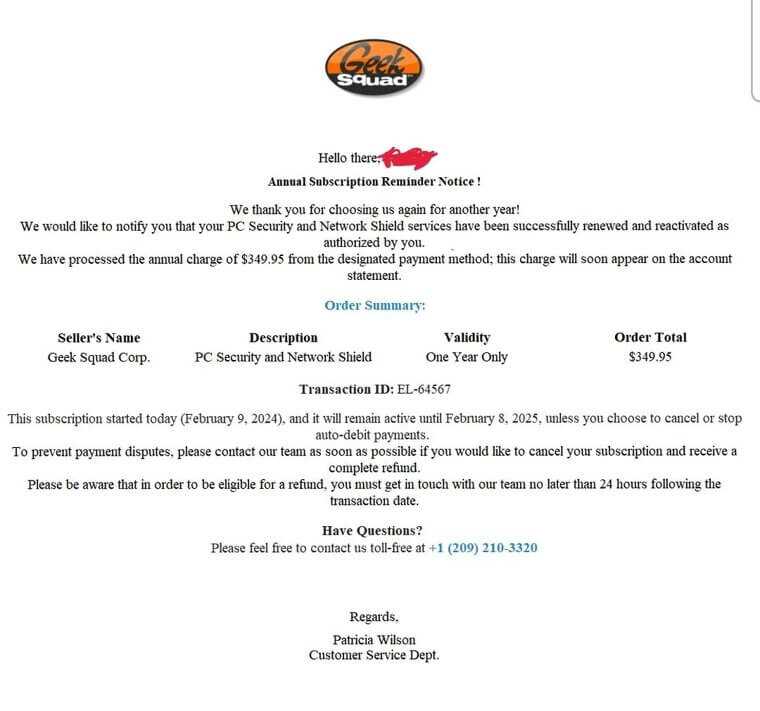

Renewal Scams

You get an email or call saying a subscription is about to expire. It feels urgent and stressful. You’re told to pay now to avoid charges or loss of service. Many times, you never even signed up. The fees seem small, but they repeat monthly and add up quickly. Always check your bank statements. Real companies make cancellations easy.

Crisis Money Scams

This scam hits hard emotionally. Scammers claim a loved one is hurt, arrested, or stranded somewhere. They sound frantic and convincing. They demand money immediately and insist you keep it secret. That pressure clouds judgment. Always stop and take a breath. Call another family member or the person directly before sending any money.