Not Adjusting Lifestyle Early Enough

Many people maintain the same level of lifestyle they had while working when they retire. They often realize too late that they can't afford to continue living the same way. Some wish they had practiced living on a reduced budget years before retiring. That early adjustment would have made the transition smoother and taken away a lot of stress.

Underestimating Home Maintenance Costs

People don’t often realize how expensive a house can be once everything starts aging at the same time. Roof repairs, plumbing surprises, and appliance replacements can hit fast. Many retirees learned the hard way. They now wish they had planned ahead and budgeted appropriately rather than just assuming their houses would behave simply because they loved them.

Delaying Conversations About Financial Priorities

Some older adults admit they waited too long to talk openly with their spouse or family about how money should be handled in retirement. A lack of open communication leads to confusion regarding how to budget. They soon realized that having had a genuine discussion much earlier would have helped them avoid numerous conflicts and misunderstandings while ensuring that everybody was on the same page.

Relying Too Heavily on Credit Cards

Plenty of retirees regret leaning on credit cards during their working years because those balances eventually catch up. High interest makes everything more expensive, and some people enter retirement still paying off old purchases. They wish they had built up an emergency fund instead of letting credit fill the gap during tough moments.

Forgetting to Plan for Rising Insurance Costs

Many retirees say they were shocked at how much insurance creeps up over time. Health, home, and car coverage rarely get cheaper, and those increases can squeeze a fixed income. Looking back, they wish they had built those rising costs into their long-term budget instead of assuming things would stay roughly the same.

Taking on Loans Too Close to Retirement

A lot of older adults regret buying cars, updating homes, or financing big purchases right before retiring. Those payments feel manageable while they still have a steady income, but they quickly become stressful once the paychecks stop.

Cashing Out Retirement Savings Too Soon

Some retirees admit they dipped into their retirement accounts during their working years to pay for vacations, remodeling homes, and addressing financial emergencies. They considered it a minor decision at the time because they didn’t understand how much growth they’d be losing. Many wish they had been more protective of those funds because compounding would have created larger cushions for retirement.

Overestimating How Long Money Would Last

It is surprisingly easy to assume savings will stretch forever, especially if you have not retired before. Many older adults regret not being more realistic about longevity and healthcare costs. If they had created a more conservative spending plan early on, their savings would have been able to keep up with a longer life.

Not Shopping Around for Better Deals

Some retirees realize they stuck with the same banks, utility companies, and insurance providers out of habit. Over time, that loyalty cost them money. They look back wishing they had compared prices more often because small savings across several bills can make a big difference once you are living on a fixed income.

Ignoring Small Lifestyle Upgrades That Drain Money

A lot of retirees admit they kept little habits that slowly chipped away at their budget. It might be eating out too often, keeping every streaming service, or sticking with pricier brands out of routine. None of it feels big in the moment, but over a year, it adds up.

Supporting Adult Children Without Firm Boundaries

Many older adults love helping their kids, but some regret not setting limits. Offering financial help is fine, but doing it too often can strain retirement savings fast. Looking back, many wish they had been more open about what they could realistically afford. They also say that kids usually understand once you explain the situation honestly.

Misjudging How Much Travel Really Costs

Retirees often dream about seeing new places, but the cost of travel surprises many of them. Flights, hotels, meals, and miscellaneous costs can add up very fast. In hindsight, many retirees wish they had developed a defined budget for travel rather than assuming they would be able to figure out how to cover those expenses on the go. A defined budget would have helped them enjoy trips without stressing about overspending later.

Holding Onto a House That Is Too Expensive

Many retirees choose to live in larger homes longer than they should. Some do this because they are emotionally attached, while others like the fact that it feels familiar. Many end up regretting waiting to downsize. The mortgage, taxes, utilities, and upkeep can be overwhelming on a fixed income. They often say that had they downsized sooner, they would have freed up cash, and daily life would have been easier and more manageable.

Not Preparing for Long-Term Healthcare Needs

Many older adults do not spend enough time considering their future health care needs. Some of the things they need assistance with can be costly, such as assisted living, in-home help, or medical equipment. Many retirees wish they had thought about insurance, saving strategies, or family plans much earlier.

Letting Inflation Sneak up on Them

Many retirees admit they simply didn’t plan for how quickly prices climb over the years. Groceries, utilities, and everyday basics slowly rise, and it hits harder when income is fixed. Looking back, they say they wish they had built in more wiggle room instead of assuming costs would stay steady. Inflation quietly eats savings if you are not ready.

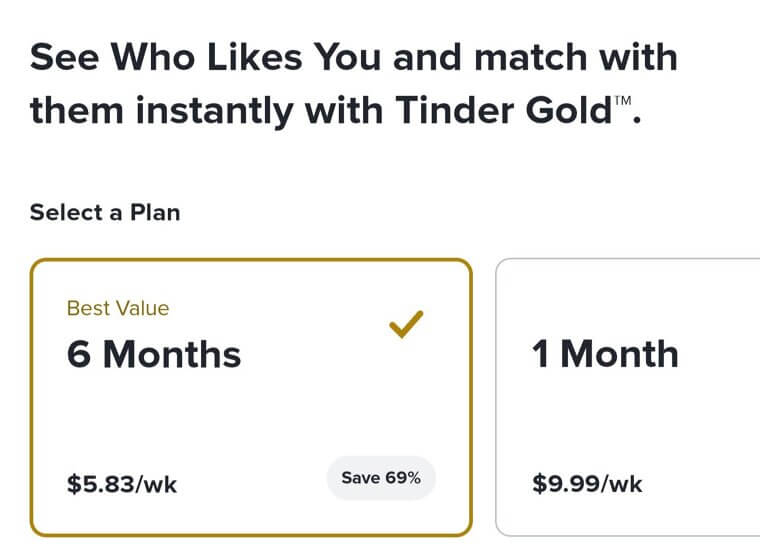

Ignoring Small Recurring Expenses

Many older adults look back and realize they’d spent a huge amount of money while paying small amounts each month. Streaming subscriptions, memberships, and random fees slowly drain your budget without you noticing. By the time they retire, many people wish they had tracked their small expenses and started creating a larger financial safety net sooner.

Not Taking Advantage of Senior Discounts

Although it may seem trivial, a large percentage of retirees usually regret not taking advantage of discounts sooner. Many passed up on using these discounts because they did not want to feel old. However, they’ve come to appreciate how every little discount can help them save additional funds during retirement.

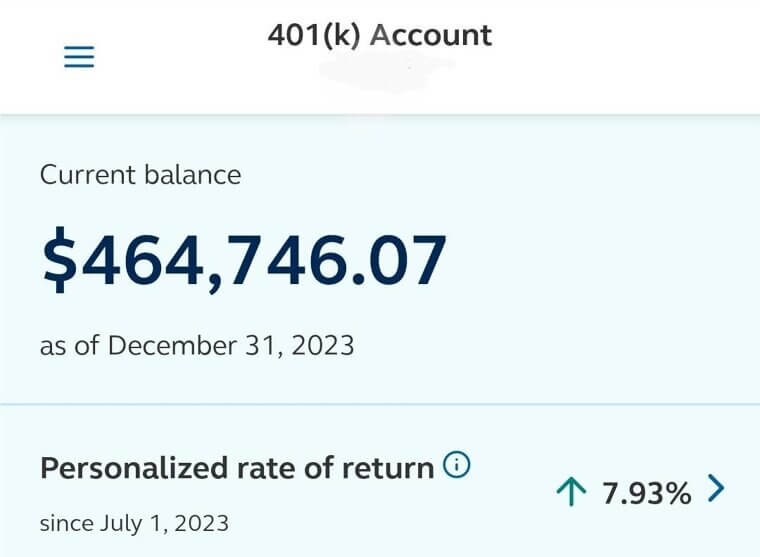

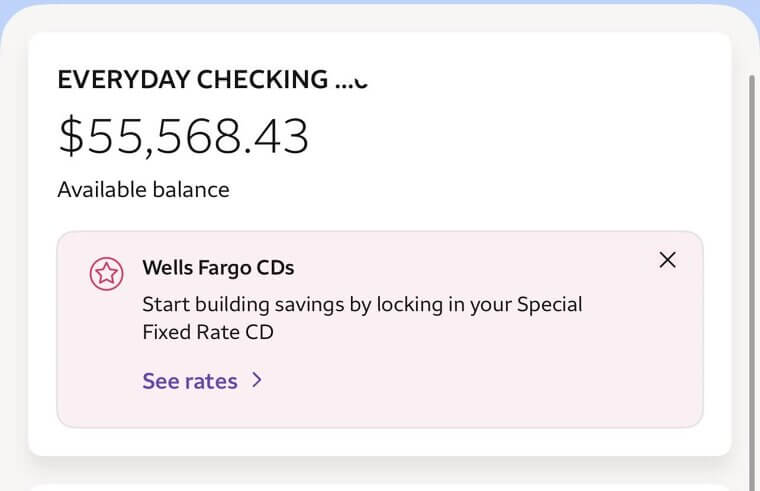

Keeping Too Much Money in Low-Interest Accounts

A lot of older adults admit they felt safer leaving everything in basic savings accounts. Over time, they realized their money was barely growing. Many look back, wishing they had been open to safer investment options that still offered better returns. Even modest growth would have made a noticeable difference during retirement.

Failing to Review Their Budget Regularly

Some retirees created a budget once and never revisited it, which led to surprises later. Life changes, needs shift, and costs increase. Without updates, the budget stops working. A quick review could have helped some retirees stay on track with far less stress.

Underestimating the Emotional Side of Spending

Several retirees admit they spent money to stay busy, feel good, or fill time after leaving work. It is understandable, but those emotional purchases can snowball. Looking back, they wish they had recognized the pattern sooner and found healthier, cheaper ways to stay engaged.