Ignoring Their Debt Until It Feels Overwhelming

People often avoid looking at their debt because it feels uncomfortable. Planners say this only makes things worse. Interest continues accumulating on the debt total, and eventually, it seems unmanageable. Even a simple payment plan helps. Facing the numbers is the scary part, but once you do, everything becomes easier to manage.

Ignoring Where Their Money Actually Goes

Many people think they have a good understanding of their spending habits, but they are often surprised when they start tracking their purchases. Little purchases can add up quickly, usually quicker than anyone expects. Financial planners say this is the most common mistake. If you do not know where your money is going, it is impossible to effectively manage your finances.

Treating Credit Cards Like Free Money

Credit cards feel harmless until the bill shows up, and suddenly everything feels tight. Financial planners see this all the time. People often use their credit cards without thinking, and later start panicking when they see their credit card bill. The issue is not the credit card; the issue is how many people buy before budgeting. That cycle creates long-term headaches that are totally avoidable.

Not Having an Emergency Fund

Life throws surprises at everyone. A flat tire, a medical bill, a broken appliance. Planners say many clients rely on credit cards instead of savings. That turns a simple problem into long-term debt. Even a small emergency fund can reduce stress. It is not about saving thousands overnight. It is about building a cushion slowly and consistently.

Underestimating Subscription Costs

People love subscriptions because they seem cheap, but planners say this is a sneaky budget killer. Ten dollars here, fifteen there, a few forgotten renewals, and suddenly a big chunk of money disappears every month. Most clients do not even notice until someone points it out. A quick audit usually frees up more cash than expected.

Forgetting to Adjust Their Budget When Life Changes

A budget should change with your life. New job, new rent, new bills. Planners say clients often keep using an old budget that no longer makes sense. That creates stress because the numbers never quite line up. Updating the plan takes a few minutes, but it can make everything feel easier and way more organized.

Guessing Their Monthly Spending Instead of Checking

A lot of people just guess what they spend each month, and planners say those guesses are almost always wrong. Most folks underestimate by hundreds. When the real numbers show up, they are shocked. It is not about being perfect. It is about being honest with yourself so your budget stops feeling like a mystery you can never solve.

Shopping When They Are Stressed or Bored

Planners see this constantly. People buy things to feel better, then feel worse when the bill comes. It is not that anyone sets out to overspend. It just sneaks up during a long week or a bad day. A little awareness helps. Even waiting fifteen minutes before hitting “buy now” can stop a lot of regret.

Forgetting About Annual or Irregular Bills

Things like car insurance, school fees, or home repairs always catch people off guard. Planners say these surprise expenses wreck more budgets than daily spending ever does. When you forget to plan for them, they feel like emergencies. Setting aside a small amount each month makes those big bills feel totally normal instead of stressful.

Trying to Cut Everything at Once

Some people get motivated and try to overhaul their entire budget in a single week. Planners say that always backfires. It is like going on a super strict diet. You burn out fast. Small cuts are easier to stick with and make a bigger impact over time. Consistency always beats dramatic, short-lived effort.

Assuming a Higher Income Will Fix Everything

Financial planners hear this all the time. People think a raise or a better job will magically solve their money problems. But if spending habits do not change, income increases disappear fast. It is not about making more. It is about managing what you already have. A solid plan beats wishful thinking every single time.

Not Checking Prices Before Shopping

Planners say a lot of people walk into a store or shop online without comparing prices. It sounds small, but those little differences add up over a year. Even checking two websites before buying something can save real money. It is not about being cheap. It is about being smart with the cash you already work hard for.

Letting Lifestyle Creep Take Over

Many people start upgrading everything once they start earning more. And most don't even realize it. They eat better meals, wear nicer clothes, and go on more trips. The raises disappear before they hit savings. There is nothing wrong with enjoying life, but doing it intentionally makes a big difference. Otherwise, your expenses will continue to rise at a higher rate than your income, creating significant financial stress.

Forgetting to Save for Fun Stuff

This is a common mistake many planners see. People think that budgeting is only about paying bills and meeting obligations. As a result, they often splurge on things because they feel they have been deprived. When you actually plan for fun spending, you can spend guilt-free. It makes the whole budget feel lighter and way easier to stick to.

Not Reviewing Their Budget Regularly

Budgeting is not a one-time event. It is an evolving process. Changes occur often, like higher costs and shifting priorities. Planners say that until a crisis occurs, people rarely review their budgets. You can prevent small discrepancies from turning into major issues by scheduling a brief monthly review. It takes you about ten minutes, but it's a good way of keeping your finances in the best shape possible.

Relying Too Much on Sales

Many people convince themselves they are saving money just because something is on sale. However, planners believe that if you did not intend to purchase the item in the first place, you did not save any money. You spent even more. Sales are great when they fit your budget. When they don’t, they quietly drain your wallet.

Not Setting Clear Money Goals

Many people say they want to “save more,” but they never state exactly how much “more” is. This is an issue constantly seen by planners, who say that without any long-term goals, it’s easy to get distracted and lose motivation. Having a small goal, like saving for a vacation or a new phone, provides a purpose for budgeting instead of feeling like a hassle.

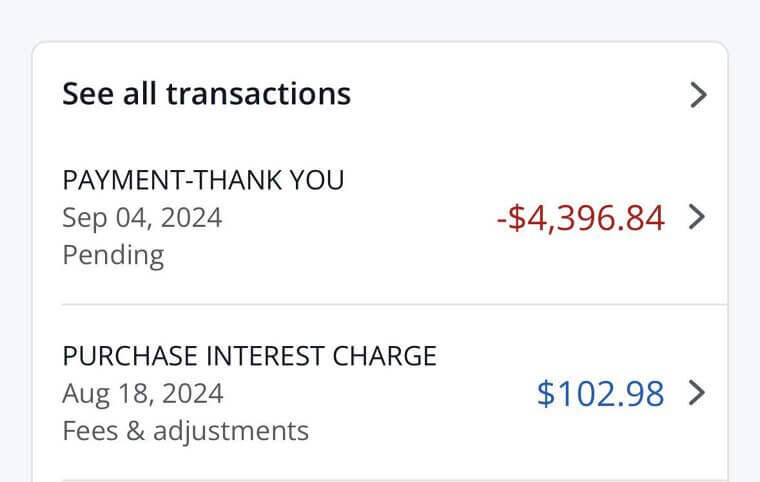

Ignoring Small Interest Charges

Although those small amounts charged as interest on credit cards seem insignificant, planners say they add up quickly over time. A few dollars this month, a few more next month. Before you know it, hundreds disappear over the year. Finding ways to eliminate or reduce interest on credit cards will create additional revenue for your budget. It is one of the easiest financial wins out there.

Forgetting to Automate Their Savings

Many financial advisors suggest using an automated system for saving. The main reason for this is that individuals who have to transfer money manually tend to forget to send it. When savings are automated, it eliminates temptation and effort. Many clients are amazed at the amount saved just by using an automatic system. It feels like paying yourself first, and it makes saving feel painless.

Not Asking for Help When They Need It

According to financial planners, not seeking help can lead to years of being stuck in bad habits. Asking for help early can save you a great deal of money, stress, and time. It does not have to be a full financial overhaul. Sometimes, a single conversation can help get you on the right track to a better financial future.