Stressed About What Retirement Is Going to Cost You?

When you retire, it’s common to be stressed about bills. You might be on a lower income all of a sudden, and have to juggle that with your outgoings. What might help is a list of things you’re likely to spend less money, and a list of things you’re still spending plenty on. We’ve made that list to help you through this transitionary time in your life.

SPEND LESS ON: Transportation

If you’re no longer working, then you no longer have to drive your car to work. So long, high gas costs! It’s thought that adults of retirement age spend $8,172 on transportation costs, down from $13,865 for adults under 65.

SPEND MORE ON: Healthcare

There’s no getting around it: healthcare in the United States is expensive, especially if you’re disabled. As you age, medical needs increase – everything from prescriptions to doctor visits to operations will set you back, in some cases considerably.

SPEND LESS ON: Clothing

Most people go all out for clothing when it comes to work, and stick with just a few tried and tested pieces for non-work events. So no more work equals a much smaller amount of money being spent on clothes. The average clothes budget for a retired adult is only $1,130 – but you can still get some very nice clothes with that.

SPEND MORE ON: Prescription Drugs

Prescription drugs are another aspect of healthcare that costs a lot of money. Many retirees require daily medications for conditions like high blood pressure, cholesterol, or diabetes, and they find themselves with an annual bill of thousands of dollars for those things.

SPEND LESS ON: Food

You’d expect to spend the same amount on food whether you were retired or not, but no, the food bills actually go down when you retire. This is because retirees have more time to spend in the grocery store looking for bargains and comparing prices!

SPEND MORE ON: Home Repairs

Retirees generally spend more time at home, and more time in the home means more wear and tear on it. Elderly folks often can’t fix problems with the house themselves, so they have to call someone in to do it, and that sets them back by quite a lot.

SPEND LESS ON: Entertainment

Retirees are just able to make their own entertainment. Instead of spending a lot of money on video games or Netflix, they’re happy to take a brisk walk outside or sit on the couch with a good book. Even cinema trips are usually few and far between. Generally, retired people are spending a mere $2,672 a year on entertainment, saving the money for other things.

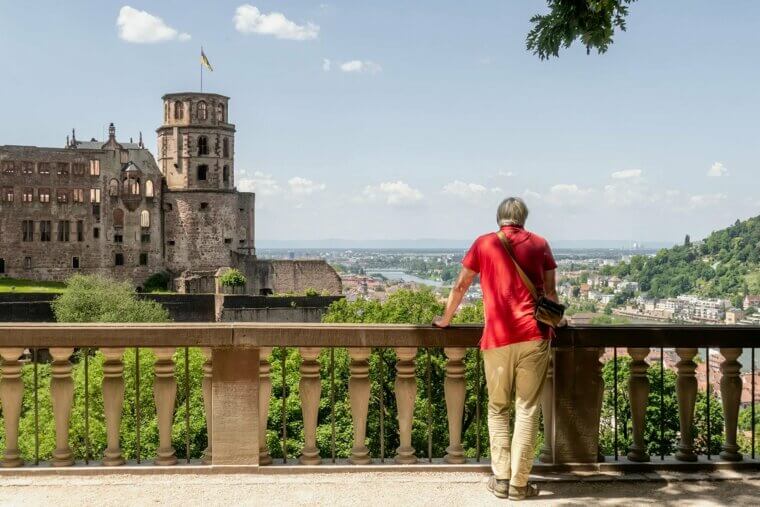

SPEND MORE ON: Travel

Many people dream of travelling the world after they retire, so when work is finally done they go all out to achieve their goals. However, this means spending a lot of money. Hotels, flights, travel insurance – it all adds up to a lot of money over the years.

SPEND LESS ON: Mortgages

According to research, most adults will have paid off their mortgage by the time they retire and won’t have to worry about it. Apparently only 34% of homeowners over the age of 65 had a mortgage in 2022 – not bad.

SPEND MORE ON: Hobbies and Leisure

Being retired means more time to pursue hobbies! Unfortunately, hobbies can get expensive. Even something simple like painting costs a lot of money every year, and if you’re trying out something that requires a lot of equipment, like skiing or photography, the costs can soon rise.

SPEND LESS ON: Education

Some people choose to take classes in their retirement, but not many. And for the ones that do, they often find that local colleges offer free classes to people over the age of 65. The average retiree spends only $373 on education every year.

SPEND MORE ON: Utilities

Being home more often means higher use of electricity, gas, and water - especially in extreme weather, which the United States is unfortunately very prone to. Energy bills are rising in the country and they don’t show any signs of dropping anytime soon.

SPEND LESS ON: Alcohol and Tobacco

Alcohol and tobacco are increasingly becoming playthings of the young, not the old. Retirees know how dangerous to the body those things are, and are rejecting them. According to research, the average retiree spends $469 on alcohol and $261 on tobacco per year.

SPEND MORE ON: Insurance

It used to be said that there were only three certain things in life: birth, death, and taxes. Now there’s a fourth one – insurance. Health, dental, long-term care, life, and even home insurance premiums often go up with age. Retirees pay more to keep the same coverage.

SPEND LESS ON: Pets

Pets are expensive, and retirees know it. And to be honest, grief plays a role here. When a pet a person has known for a large portion of their life passes away, they just don’t want to get another one, and so remain pet-less into retirement.

SPEND MORE ON: Property Taxes

Even if you’ve paid off your mortgage, your home doesn’t stop costing you money. Retirees on fixed incomes may struggle with property tax increases, especially in areas with no senior exemptions or tax freezes.

SPEND LESS ON: Taxes

Taxes are simply lower for retirees than they are for young people, thanks to systems like Social Security and some states waiving property taxes for the elderly. By the time you reach 75 years old, you could be spending as little as $2,408 per year on taxes.

SPEND MORE ON: Donations

As people grow older, they want to give back to the community more, and that includes donating money to good causes. Some people find themselves going over the top and donating a little too much money to charity, though, leaving less to spend on nice things.

SPEND LESS ON: Dining Out

Retirees usually cook more at home since they have more time. That means fewer quick lunches near the office or expensive dinners after long workdays. Instead, they grocery shop, and many people stick to a strict grocery budget.

SPEND MORE ON: Gifts

Retired people who are doing well often want to surprise the people in their life with grand gifts. Some even go so far as to buy houses or cars (or both) for their loved ones. But they need to watch out and not give so many gifts that they end up struggling themselves.

SPEND LESS ON: Children

It’s true that some retirees have to support their adult children. But generally, retirees are empty nesters, and they no longer have to spend money on school supplies, extracurricular activities, tuition and so on.

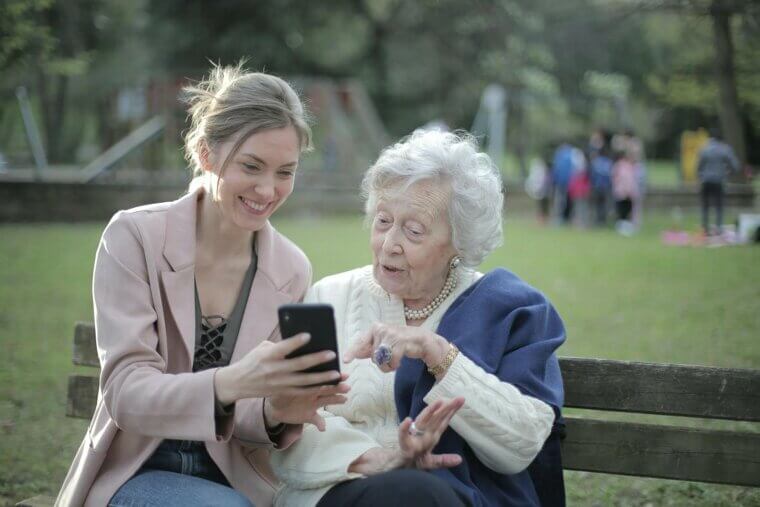

SPEND MORE ON: Technology

Staying connected to family and managing finances now requires internet, smartphones, and sometimes new devices – and all those things can be difficult to navigate for a retired person. Some of them end up paying more than they should for internet because they don’t know how to find the best deals.

SPEND LESS ON: Life and Disability Insurance

Many elderly people drop life and disability insurance policies once they retire, especially once the mortgage is paid off and all the children are self-sufficient. These policies are less necessary without income to protect.

SPEND MORE ON: Dental Care

Unfortunately, your teeth get worse as you get older, and that spells trouble. Medicare doesn’t cover routine dental visits, cleanings, crowns, or dentures, so retirees often pay out of pocket and it costs them a lot of money.

SPEND LESS ON: Gym Memberships

A lot of gyms don’t really cater to the elderly and retired, preferring instead to court a young clientele. So generally speaking, retirees don’t spend a lot of money on gym memberships, and choose to get their exercise in from the comfort of their own home.