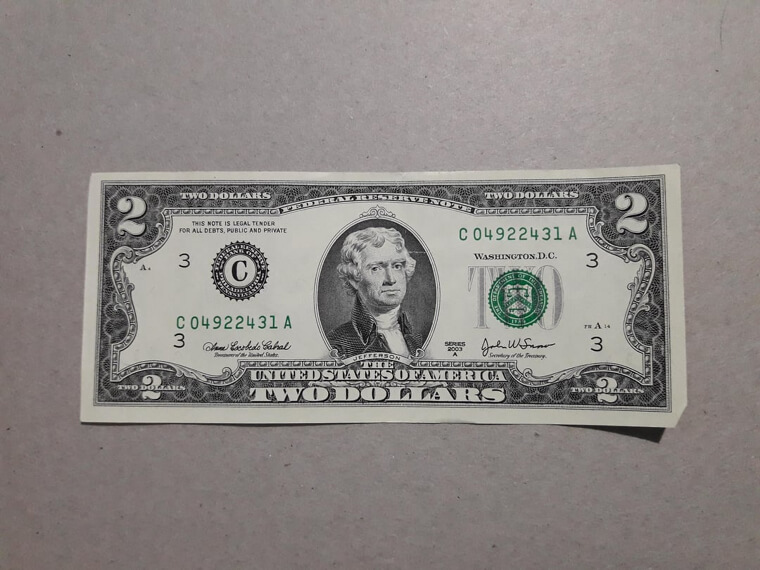

The Disruption of Standard Cash Inventory and Flow

The request for a specific, non-standard denomination like the two-dollar bill disrupts the branch's carefully organized system for cash management. Banks manage their cash drawers, vaults, and ATM reserves based on the most common denominations: ones, fives, tens, twenties, and occasionally fifties or hundreds. When a customer asks for a large quantity of two-dollar bills, the teller cannot simply retrieve them from their standard drawer; they must often leave their station to access the reserve vault, sometimes requiring a supervisor's key or sign-off. This action immediately pulls one employee away from serving the main line, increasing customer wait times and decreasing overall branch efficiency. Furthermore, two-dollar bills are not routinely cycled through the branch's automated counting or sorting machines, meaning they must be manually counted and logged, consuming additional time and creating potential for human error in the daily reconciliation process. The bank operates on maximizing efficiency for standard transactions, and this request forces a manual override of that system, costing the bank time and, indirectly, customer satisfaction.

Immediate Security and Counterfeit Risk

Handling and dispensing niche currency like the two-dollar bill introduces an unnecessary element of security risk for the teller. Standard bills are verified by counting machines, security pens, and the tellers’ quick, practiced eye during high-volume transactions. Since two-dollar bills are rarely seen, tellers, especially newer associates, are not as quick to spot counterfeits. When a customer demands a specific, often large, quantity of an unusual bill, it forces the teller to verify its authenticity manually, which is a slow and error-prone process when the line is long. The bank's security protocols prioritize speed for common currency exchange to minimize exposure. Introducing an unfamiliar currency type breaks this routine. The time spent manually verifying or retrieving the bills also makes the teller more vulnerable during the transaction, as their attention is diverted from their surroundings and the security cameras may not perfectly capture the unusual transaction. It puts undue pressure on the associate to confirm legitimacy for a novelty item.

Training Gaps and Teller Annoyance

For entry-level or newly trained banking associates, handling requests for two-dollar bills presents an immediate challenge they are often ill-equipped to manage. Modern teller training focuses heavily on digital systems, compliance, and processing standard transactions efficiently. The rare request for two-dollar bills falls outside the core competency required for fast service. New tellers may not know where the bills are stored, the correct procedure for logging the transaction in the system (which may default to only standard bills), or the proper protocol for checking authenticity. This leads to embarrassment, procedural delays, and the need to call a seasoned supervisor for assistance, which compounds the efficiency issues mentioned earlier. While older, established tellers might treat it as a routine side task, for many modern banking staff, it is an avoidable friction point. The request forces a departure from automated and digital processes back into manual, high-effort customer service that slows down the entire branch's workflow and creates unnecessary stress for the employee.

Slowing Down the Line and Harming Other Customers

The most tangible negative consequence of asking for two-dollar bills is the impact it has on the other customers waiting in line. A simple withdrawal of twenty-dollar bills takes seconds. A request for fifty two-dollar bills can easily extend the transaction time by several minutes, particularly if the teller needs to locate the bills, manually count them, and log the unusual currency movement. This delay affects everyone behind that customer, leading to frustration and resentment that are directed toward both the teller and the institution. In the era of instant digital transactions and quick ATM service, customers expect branch transactions to be equally swift. This niche request is perceived by others as an unnecessary imposition and a waste of collective time. Banking executives aim to minimize in-branch traffic for standard transactions, pushing customers toward digital self-service. Any activity that drags out the in-branch experience works directly against the bank's operational goals and negatively impacts customer satisfaction ratings.

Reinforcing Anti-Modern Banking Habits

The continued demand for niche currency like the two-dollar bill reinforces outdated, manual banking habits in an increasingly automated world. The entire financial industry is shifting toward digital transactions, complex advisory services, and self-service through smart ATMs. The branch associate's role is evolving from a simple cash handler to a financial problem solver and product specialist. Requests for novelty currency distract from this critical shift. It signifies a resistance to modern convenience and efficiency. If customers continue to demand transactions that require significant manual effort and time, it hinders the bank's ability to evolve the branch experience into a more valuable, advisory setting. This unnecessary transaction takes up the human element that should be reserved for complex issues like setting up a trust, discussing a loan, or resolving fraud, rather than simply dispensing novelty paper money.

The Bottom Line: Save the Two-Dollar Bills for Collectors, Not Daily Banking

While the two-dollar bill remains legal tender and holds a certain nostalgic charm for gift-giving or collecting, making it a routine part of your banking visits is a habit that belongs in the past. The modern banking ecosystem is built entirely on speed, efficiency, and digital security, meaning that forcing a manual, irregular transaction creates friction that affects everyone involved. By sticking to standard denominations or embracing digital payment methods, you demonstrate respect for the teller's time and consideration for the customers waiting behind you. If you truly desire these unique bills for a special occasion, consider ordering them in bulk online or simply keeping the ones you happen to receive in circulation. Ultimately, the branch is a place for essential financial business, not a hobby shop for novelty currency. Retiring this outdated request helps keep the lines moving and allows banking associates to focus on what really matters: protecting and growing your finances in an increasingly complex digital world.